National Healthcare Corp (NHC) Reports Notable Earnings Growth for 2023

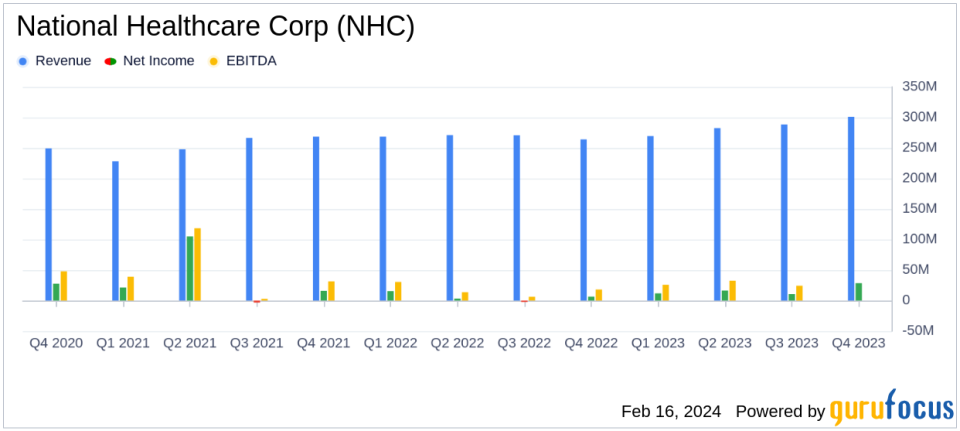

Revenue Growth: Net operating revenues and grant income rose by 5.1% year-over-year to $1.141 billion.

Net Income Surge: GAAP net income attributable to NHC soared to $66.798 million, a 197.5% increase from the previous year.

Earnings Per Share: GAAP diluted earnings per share jumped to $4.34, up from $1.45 in 2022.

Adjusted Earnings: Adjusted net income climbed by 47.2% to $54.934 million, with adjusted diluted earnings per share at $3.55.

Operational Metrics: Same-facility net operating revenues saw an 11.3% increase when excluding ceased operations and government stimulus income.

Balance Sheet Strength: Total assets reached $1.311 billion, with stockholders' equity at $910.480 million.

National Healthcare Corp (NHC) released its 8-K filing on February 16, 2024, detailing its financial performance for the year ended December 31, 2023. The company, a leading provider of long-term care facilities, reported a significant increase in net operating revenues and grant income, which totaled $1,141,544,000, marking a 5.1% rise from the previous year's $1,085,738,000. This growth was even more pronounced in same-facility net operating revenues, which saw an 11.3% increase when adjusting for ceased operations and government stimulus income.

NHC's financial achievements are particularly noteworthy in the context of the healthcare providers and services industry. The company's ability to increase revenue and net income in a challenging healthcare environment underscores its operational efficiency and the demand for its services. The reported GAAP net income attributable to NHC was $66,798,000, a substantial increase from $22,445,000 in the previous year. This remarkable growth in net income is a testament to the company's robust business model and strategic initiatives.

Detailed Financial Performance

On a GAAP basis, diluted earnings per share for the year stood at $4.34, compared to $1.45 in the previous year. Adjusted for non-GAAP items, the net income for the year was $54,934,000, or $3.55 per diluted share, compared to $37,323,000, or $2.42 per diluted share in 2022, representing a 47.2% increase. This adjustment is crucial as it provides a clearer picture of the company's operational performance by excluding the impact of unrealized gains and losses in the marketable equity securities portfolio and other non-GAAP adjustments.

The balance sheet remains strong with total assets of $1,310,796,000 and stockholders' equity of $910,480,000 as of December 31, 2023. Cash, cash equivalents, and marketable securities stood at $223,620,000, indicating a solid liquidity position for NHC.

The company's skilled nursing facilities continue to be a significant contributor to its revenue stream, with Medicare, Managed Care, Medicaid, and Private Pay and Other per diems showing increases in the average skilled nursing per diem rates. Total skilled nursing patient days for the year were 2,364,083, demonstrating the scale of NHC's operations.

"The Company is providing certain non-GAAP financial measures as the Company believes that these figures are helpful in allowing investors to more accurately assess the ongoing nature of the Companys operations and measure the Companys performance more consistently across periods."

Such transparency in financial reporting is essential for investors to make informed decisions, and NHC's commitment to providing both GAAP and non-GAAP measures enhances its credibility in the market.

Looking Ahead

While the earnings report is robust, it is important to consider the potential challenges that may arise. Changes in government healthcare funding, regulatory pressures, and the competitive landscape in the healthcare sector could impact future performance. However, NHC's strong financial results for 2023 position it well to navigate these challenges and continue its growth trajectory.

For a detailed understanding of NHC's financials and operations, investors and stakeholders are encouraged to review the full 8-K filing. The company's performance in 2023 sets a positive tone for the year ahead, and it will be important to monitor how NHC adapts to the evolving healthcare environment.

Explore the complete 8-K earnings release (here) from National Healthcare Corp for further details.

This article first appeared on GuruFocus.