National Research (NASDAQ:NRC) Has Affirmed Its Dividend Of $0.12

National Research Corporation's (NASDAQ:NRC) investors are due to receive a payment of $0.12 per share on 12th of January. Including this payment, the dividend yield on the stock will be 1.2%, which is a modest boost for shareholders' returns.

Check out our latest analysis for National Research

National Research Doesn't Earn Enough To Cover Its Payments

It would be nice for the yield to be higher, but we should also check if higher levels of dividend payment would be sustainable. Based on the last payment, National Research was quite comfortably earning enough to cover the dividend. This means that a large portion of its earnings are being retained to grow the business.

Over the next year, EPS could expand by 1.3% if the company continues along the path it has been on recently. Assuming the dividend continues along recent trends, we think the payout ratio could reach 141%, which probably can't continue without starting to put some pressure on the balance sheet.

National Research's Dividend Has Lacked Consistency

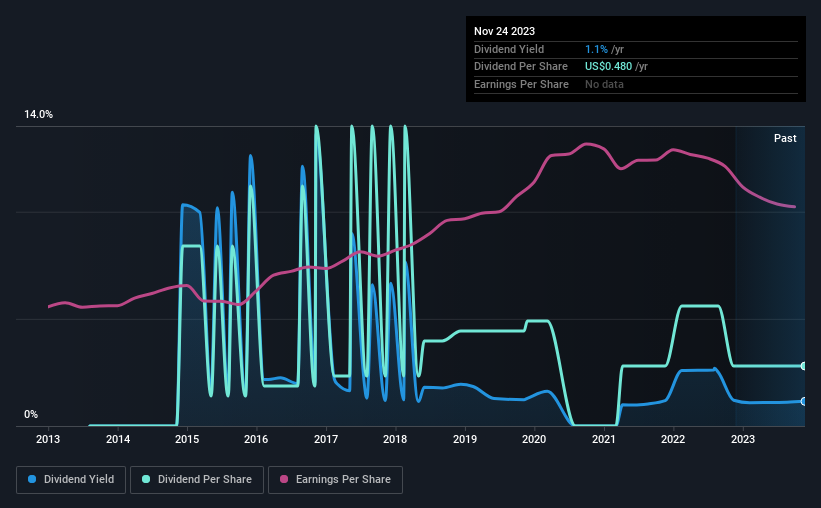

Looking back, National Research's dividend hasn't been particularly consistent. Due to this, we are a little bit cautious about the dividend consistency over a full economic cycle. Since 2014, the annual payment back then was $1.44, compared to the most recent full-year payment of $0.48. The dividend has fallen 67% over that period. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

The Dividend's Growth Prospects Are Limited

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Although it's important to note that National Research's earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time. Growth of 1.3% per annum is not particularly high, which might explain why the company is paying out a higher proportion of earnings. This could mean the dividend doesn't have the growth potential we look for going into the future.

In Summary

Overall, a consistent dividend is a good thing, and we think that National Research has the ability to continue this into the future. The payout ratio looks good, but unfortunately the company's dividend track record isn't stellar. This looks like it could be a good dividend stock going forward, but we would note that the payout ratio has been at higher levels in the past so it could happen again.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Are management backing themselves to deliver performance? Check their shareholdings in National Research in our latest insider ownership analysis. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.