National Vision (EYE) Gains From Store Openings Amid Cost Woes

National Vision EYE continues to gain on positive store comps. The company’s strong focus on opening new stores is also encouraging. However, National Vision’s high dependence on a limited number of vendors is a concern. Also, a tough competitive landscape is a threat. The stock carries a Zacks Rank #3 (Hold).

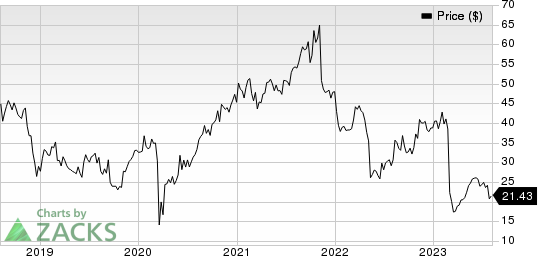

In the past year, National Vision’s shares have outperformed the industry it belongs to. The stock has lost 0.3% compared with the industry’s 18.1% decline.

National Vision reported better-than-expected first-quarter 2023 revenues. Amid an uncertain macro environment, the company delivered positive comparable sales growth in the first quarter, primarily driven by strength in its managed care business. During the reported quarter, the company opened eight new stores and ended the quarter with 1,357 stores. On a year-over-year basis, the company reported a significant decline in its earnings. The contraction of margins as a result of escalating expenses is discouraging too.

During the quarter, National Vision opened four new America's Best and four Eyeglass World stores, and closed five stores. For America's Best and Eyeglass World growth brands combined, unit growth increased 5% from the total store base last year to 1,357 stores.

Further, the company continues to roll out its remote care capabilities, which provide doctors with additional levels of flexibility and expand exam capacity in many areas. Per the company’s first-quarter update, it is on track with expansion into at least an additional 200 remote-enabled stores in 2023.

National Vision Holdings, Inc. Price

National Vision Holdings, Inc. price | National Vision Holdings, Inc. Quote

We note that National Vision plans to continue executing on core growth initiatives and investing in strengthening competitive advantages. In terms of store expansion, the company continues to see a sizable new opportunity with growth for many years to come. Despite many supply chain obstacles, during the first quarter, National Vision opened eight new stores and is on track to open nearly 65 to 70 new stores in 2023. The company noted that the new stores opened over the past 12 months are continuing to perform well and in line with the company’s expectations.

Per National Vision, marketing continues to be a key factor in driving traffic to National Vision’s stores, given the infrequent purchase cycle for eyeglasses. In the current environment of high inflation, the company also noted that it continues to focus on marketing efficiency and is content to be leveraging marketing expenses this year.

In 2023 so far, National Vision has spent $27.7 million on capital expenditures, primarily focused on new store openings and customer-facing technology investments. It remains on track for 2023 capital expenditure in the range of $115 million to $120 million to support key growth initiatives.

The company’s merchandising and distribution teams continue to execute well and are confident that the current inventory levels are sufficient to support continued growth in 2023. Overall, National Vision continues to utilize its strong balance sheet and cash flow to invest in strategic initiatives to enhance customer experience and strengthen its market position.

On the flip side, on a year-over-year basis, the company reported a significant decline in its earnings. The company’s gross margin contracted 45 basis points. Selling, general and administrative expenses rose 9.3%. Adjusted operating margin contracted 158 bps year over year.

The company is facing demand headwinds across its network of stores, given the current macro environment, as well as a supply challenge in a smaller subgroup of stores due to the constraints on eye exam capacity.

National Vision operates in a highly competitive optical retail industry. The companies within the industry generally compete based on recognition of the brand name, price, convenience, selection, service and product quality. National Vision competes with national retailers like LensCrafters, Pearle Vision and Visionworks in the broader optical retail industry. Competition exists in physical retail locations along with e-commerce platforms. The company also faces competitive threat from online sellers of contact lenses and eyewear. A number of firms are focused on selling eyeglasses in the online market like Warby Parker and Zenni Optical.

Key Picks

Some better-ranked stocks in the broader medical space are Zimmer Biomet ZBH, Penumbra PEN and Intuitive Surgical ISRG.

Zimmer Biomet has an earnings yield of 5.64% against the industry’s -3.72%. Zimmer Biomet’s earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and broke even in one, the average surprise being 4.47%. Its shares have gained 11.1% against the industry’s 1.4% decline in the past year.

ZBH carries a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Penumbra, sporting a Zacks Rank #1 at present, has an estimated growth rate of 64.1% for 2024. Penumbra shares have risen 83.7% against the industry’s 0.6% decline over the past year.

PEN’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 94.24%.

Intuitive Surgical, carrying a Zacks Rank #2 at present, has an estimated long-term earnings growth rate of 15.7%, almost in line with the industry. Shares of ISRG have risen 29.6% against the industry’s 0.6% growth over the past year.

ISRG’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, the average surprise being 4.19%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH) : Free Stock Analysis Report

Penumbra, Inc. (PEN) : Free Stock Analysis Report

National Vision Holdings, Inc. (EYE) : Free Stock Analysis Report