National Vision (EYE) Hurt by Business Closure, Macro Woe

National Vision's EYE impending termination of its Legacy business might dent growth. High dependence on a limited number of vendors and a tough competitive landscape are other threats. The stock carries a Zacks Rank #4 (Sell) currently.

National Vision, in July 2023, announced that its long-term partnership with Walmart is going to be terminated on Feb 23, 2024. In connection with the termination of the Walmart contract, the company recorded $60.1 million related to Legacy segment goodwill, $9.1 million related to the Walmart contract and relationship intangible asset, and $10.2 million related to property and equipment at Walmart stores and the company’s AC Lens business in the third quarter of 2023.

National Vision noted that this impending termination may significantly impact the company’s business. The transition period, including Walmart’s solicitation period under the agreements, may cause disruption to the business, including a reduction in sales, productivity and focus, and may make it harder to retain associates and optometrists. These, in turn, could adversely impact the company’s financial condition and results of operation.

Further, rising inflation is resulting in increased costs and expenses pressure for National Vision. The company anticipates the pressure from increases in raw materials prices to have an impact on its costs applicable to revenues in 2023. Wage investments as a result of inflation and an increasingly competitive recruiting market for vision care professionals due to the pandemic and related effects have had and may continue to have, an impact on the company’s profitability.

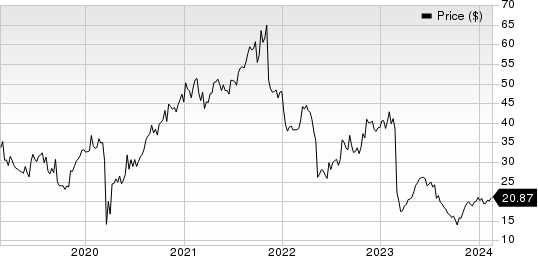

National Vision Holdings, Inc. Price

National Vision Holdings, Inc. price | National Vision Holdings, Inc. Quote

In this regard, targeted wage investments, including increases in compensation for optometrists and associates, as well as flexibility initiatives, impacted costs and selling, general and administrative expenses in 2023. The company anticipates wage pressure in certain markets to continue. The company also apprehended that wage investment pressure and increases in raw materials prices in 2023 may not be fully offset by leverage from revenue growth, productivity efficiency and various pricing actions.

National Vision operates in a highly competitive optical retail industry. The companies within the industry generally compete based on recognition of the brand name, price, convenience, selection, service and product quality. National Vision competes with national retailers like LensCrafters, Pearle Vision and Visionworks in the broader optical retail industry. Competition exists in physical retail locations along with e-commerce platforms. The company also faces a competitive threat from online sellers of contact lenses and eyewear. A number of firms, like Warby Parker and Zenni Optical, are focused on selling eyeglasses in the online market.

On a positive note, National Vision’s four subsegments within Owned and Host are consistently gaining market share, banking on several growth drivers. These include diminishing eyesight with increasing age, causing new customers to buy corrective eyewear, and a steady and consistent replacement cycle, as customers replace or purchase new eyewear for a variety of reasons, including changes in prescriptions, fashion trends and necessity.

America's Best and Eyeglass World are particularly driving revenues. National Vision is expanding sales through the continued rollout of its remote medicine technology. National Vision is also deploying remote medicine technology in tandem with electronic health record technology to drive expanded capacity, improve in-store efficiencies and improve the patient experience. The combination of these initiatives is resulting in added exam capacity in sales that the company would not have had otherwise.

Further, National Vision plans to continue executing core growth initiatives and further investing in strengthening competitive advantages. In terms of store expansion, the company continues to see a sizable new opportunity with growth for many years to come. Despite many supply chain obstacles, during the third quarter, National Vision opened 21 new stores and is on track to open nearly 65 to 70 new stores in 2023. The company noted that the new stores opened over the past 12 months are continuing to perform well and in line with the company’s expectations.

Key Picks

Some better-ranked stocks in the broader medical space are Cardinal Health CAH, Stryker SYK and DaVita DVA. While Cardinal Health and Stryker carry a Zacks Rank #2 (Buy) each, DaVita presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Cardinal Health’s stock has increased 32.6% in the past year. Earnings estimates for Cardinal Health have risen from $6.90 to $7.17 for fiscal 2024 and from $7.73 to $7.94 for fiscal 2025 in the past 30 days.

CAH’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 15.6%. In the last reported quarter, it posted an earnings surprise of 16.7%.

Estimates for Stryker’s 2024 earnings per share have increased from $11.54 to $11.84 in the past 30 days. Shares of the company have moved 32.8% upward in the past year compared with the industry’s rise of 4.9%.

SYK’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 5.1%. In the last reported quarter, it delivered an average earnings surprise of 5.8%.

Estimates for DaVita’s 2024 earnings per share have moved from $8.46 to $8.86 in the past 30 days. Shares of the company have increased 45.6% in the past year compared with the industry’s 7.9% rise.

DVA’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 35.6%. In the last reported quarter, it delivered an average earnings surprise of 22.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

National Vision Holdings, Inc. (EYE) : Free Stock Analysis Report