National Vision (EYE) Rides on Comps Growth Amid Macro Issues

National Vision EYE continues to gain on solid positive comps. The company’s strong focus on opening new stores is also encouraging. Yet, supply chain challenges continue to dent growth. The stock carries a Zacks Rank #3 (Hold).

National Vision, in the fourth quarter of 2022, successfully rolled out remote medicine and electronic health record capabilities at more than 300 locations and delivered on its objective of opening 80 new stores in 2022. According to the company, it had a strong finish to the quarter, particularly with respect to its managed care sales as the company witnessed a notable improvement in the last week of the year. This period is traditionally a very important time in optics as various annual insurance benefits end.

These trends also helped to support positive comps growth in both the quarter and the year in National Vision’s managed care business, representing an increase in customers with vision insurance. Insured customers are less sensitive to elevated inflationary and macro pressures compared to uninsured customers. In addition, the company continued to see evidence of decline in trade in the fourth quarter from higher income consumers in its stores.

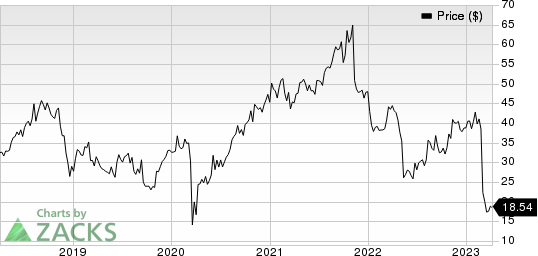

National Vision Holdings, Inc. Price

National Vision Holdings, Inc. price | National Vision Holdings, Inc. Quote

National Vision believes there is an opportunity to build on the improvement in momentum in 2023 through investments in a number of additional initiatives, including increased scheduling options and OD variable compensation program updates. These initiatives were piloted in select markets during the fourth quarter and, given early positive results, a strategic decision was made to expand these programs throughout the company’s America's Best brand in 2023.

Further, the company also continues to roll out its remote care capabilities, which provide doctors with additional levels of flexibility and expand exam capacity in many areas. By the end of 2022, National Vision rolled out remote care capabilities to approximately 300 stores.

On the flip side, National Vision reported dismal fourth-quarter 2022 results, with lower-than-expected revenues. The company reported an adjusted loss in the reported quarter. On a year-over-year basis, the company reported a significant decline in the top- and bottom-line numbers. According to the company, net revenues were negatively impacted by the timing of unearned revenues.

The company is facing demand headwinds across its network of stores, given the current macro environment, as well as a supply challenge in a smaller subgroup of stores due to the constraints on eye exam capacity. Contraction of both margins on escalating expenses is discouraging.

We note that earlier this year, given the current inflationary environment, the company implemented the first pricing change to America's Best signature offer in more than 15 years.

Over the past year, National Vision’s shares have underperformed the industry it belongs to. The stock has lost 58.9% compared with the industry’s 38.5% decline.

Key Picks

Some better-ranked stocks in the broader medical space are Hologic, Inc. HOLX, Henry Schein, Inc. HSIC and Avanos Medical, Inc. AVNS.

Hologic, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 15.2%. HOLX’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 30.6%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Hologic has gained 1.7% against the industry’s 17.5% growth in the past year.

Henry Schein, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 8.1%. HSIC’s earnings surpassed estimates in three of the trailing four quarters and matched the same in the other, the average beat being 2.9%.

Henry Schein has lost 12.4% compared with the industry’s 10.9% decline in the past year.

Avanos, carrying a Zacks Rank #2 at present, has an estimated growth rate of 1.8% for 2023. AVNS earnings surpassed estimates in all the trailing four quarters, the average beat being 11%.

Avanos has lost 13.7% compared with the industry’s 17.5% decline in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

National Vision Holdings, Inc. (EYE) : Free Stock Analysis Report

AVANOS MEDICAL, INC. (AVNS) : Free Stock Analysis Report