National Vision's (NASDAQ:EYE) Q4: Beats On Revenue

Optical retailer National Vision (NYSE:EYE) reported Q4 FY2023 results beating Wall Street analysts' expectations , with revenue up 8% year on year to $506.4 million. The company expects the full year's revenue to be around $1.99 billion, in line with analysts' estimates. It made a non-GAAP loss of $0.02 per share, improving from its loss of $0.08 per share in the same quarter last year.

Is now the time to buy National Vision? Find out by accessing our full research report, it's free.

National Vision (EYE) Q4 FY2023 Highlights:

Revenue: $506.4 million vs analyst estimates of $499.7 million (1.4% beat)

EPS (non-GAAP): -$0.02 vs analyst estimates of -$0.08 ($0.06 beat)

Management's revenue guidance for the upcoming financial year 2024 is $1.99 billion at the midpoint, in line with analyst expectations and implying 6.7% decline (vs 6.1% growth in FY2023)

Free Cash Flow was -$13.05 million compared to -$29.57 million in the same quarter last year

Gross Margin (GAAP): 51.2%, down from 52.6% in the same quarter last year

Same-Store Sales were up 6% year on year

Store Locations: 1,413 at quarter end, increasing by 59 over the last 12 months

Market Capitalization: $1.56 billion

“We are very pleased with our stronger than expected fourth quarter and full year 2023 performance and our team’s accomplishments throughout 2023,” said Reade Fahs, Chief Executive Officer.

Operating under multiple brands, National Vision (NYSE:EYE) sells optical products such as eyeglasses and provides optical services such as eye exams.

Specialty Retail

Some retailers try to sell everything under the sun, while others—appropriately called Specialty Retailers—focus on selling a narrow category and aiming to be exceptional at it. Whether it’s eyeglasses, sporting goods, or beauty and cosmetics, these stores win with depth of product in their category as well as in-store expertise and guidance for shoppers who need it. E-commerce competition exists and waning retail foot traffic impacts these retailers, but the magnitude of the headwinds depends on what they sell and what extra value they provide in their stores.

Sales Growth

National Vision is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

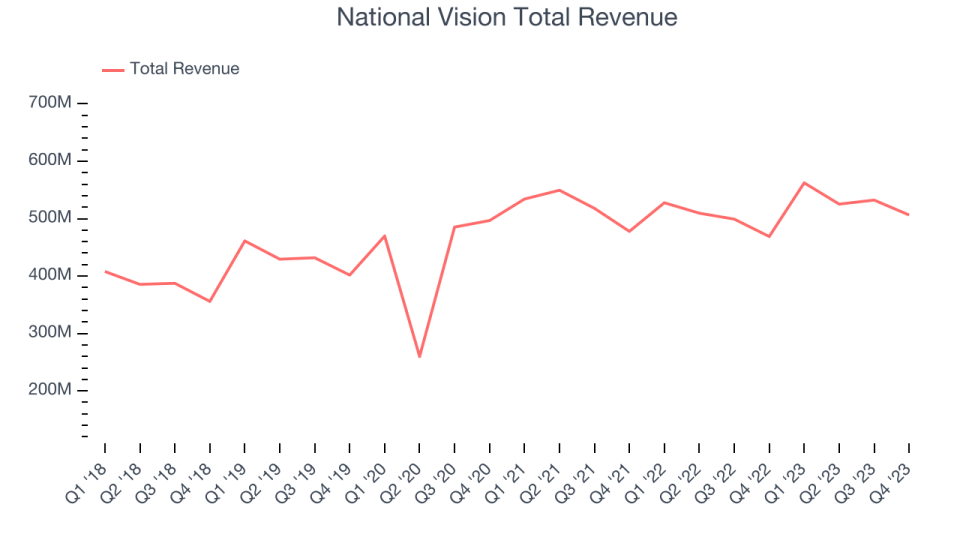

As you can see below, the company's annualized revenue growth rate of 5.4% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was weak , but to its credit, it opened new stores and expanded its reach.

This quarter, National Vision reported solid year-on-year revenue growth of 8%, and its $506.4 million in revenue outperformed Wall Street's estimates by 1.4%. Looking ahead, Wall Street expects revenue to decline 6.3% over the next 12 months, a deceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Same-Store Sales

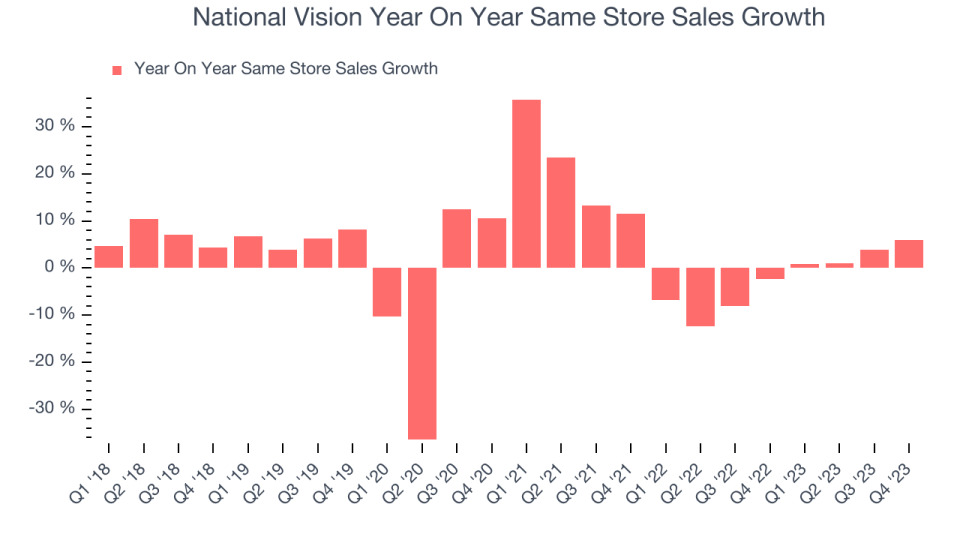

A company's same-store sales growth shows the year-on-year change in sales for its brick-and-mortar stores that have been open for at least a year, give or take, and e-commerce platform. This is a key performance indicator for retailers because it measures organic growth and demand.

National Vision's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 2.2% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, National Vision's same-store sales rose 6% year on year. This growth was a well-appreciated turnaround from the 2.4% year-on-year decline it posted 12 months ago, showing the business is regaining momentum.

Key Takeaways from National Vision's Q4 Results

We were impressed by how significantly National Vision blew past analysts' EPS expectations this quarter. We were also glad its full-year earnings guidance exceeded Wall Street's estimates. On the other hand, its gross margin missed analysts' expectations. Overall, we think this was a solid quarter that should satisfy shareholders. The stock is flat after reporting and currently trades at $19.96 per share.

National Vision may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.