Is Natural Alternatives International (NASDAQ:NAII) A Risky Investment?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Natural Alternatives International, Inc. (NASDAQ:NAII) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Natural Alternatives International

How Much Debt Does Natural Alternatives International Carry?

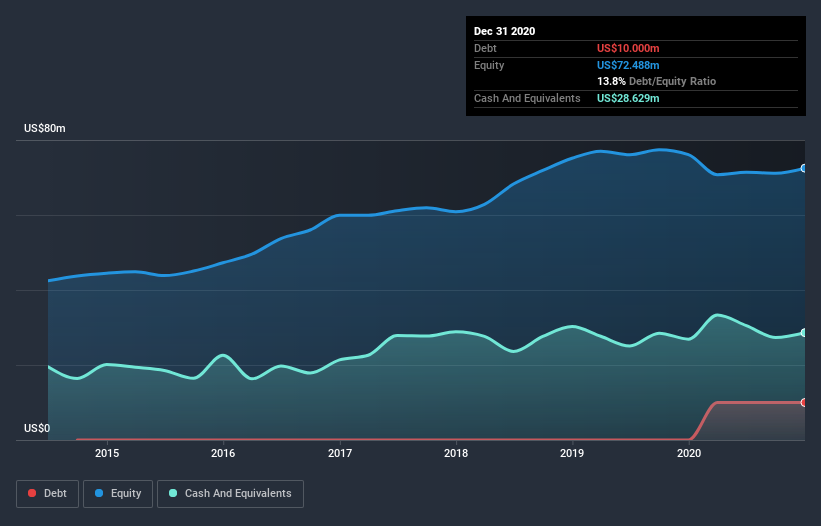

As you can see below, at the end of December 2020, Natural Alternatives International had US$10.0m of debt, up from none a year ago. Click the image for more detail. However, it does have US$28.6m in cash offsetting this, leading to net cash of US$18.6m.

How Strong Is Natural Alternatives International's Balance Sheet?

The latest balance sheet data shows that Natural Alternatives International had liabilities of US$32.7m due within a year, and liabilities of US$20.3m falling due after that. On the other hand, it had cash of US$28.6m and US$17.3m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$7.14m.

Given Natural Alternatives International has a market capitalization of US$100.2m, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, Natural Alternatives International also has more cash than debt, so we're pretty confident it can manage its debt safely.

Also positive, Natural Alternatives International grew its EBIT by 23% in the last year, and that should make it easier to pay down debt, going forward. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Natural Alternatives International will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. Natural Alternatives International may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Natural Alternatives International recorded negative free cash flow, in total. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Summing up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Natural Alternatives International has US$18.6m in net cash. And we liked the look of last year's 23% year-on-year EBIT growth. So we are not troubled with Natural Alternatives International's debt use. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 4 warning signs with Natural Alternatives International (at least 1 which makes us a bit uncomfortable) , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.