Navigating the nuance of rising interest rates

Note: A version of this article appeared on Tker.co.

Stocks ticked higher last week, with the S&P 500 rising 0.5% to close at 4,308.50. The index is now up 12.2% year to date, up 20.4% from its October 12 closing low of 3,577.03, and down 10.2% from its January 3, 2022 record closing high of 4,796.56.

As we discussed here last week, there continues to be a deluge of unsettling headlines about everything ranging from volatile energy prices to ongoing government dysfunction to uncertainty about the path for monetary policy.

Yet critical economic metrics like personal consumption expenditures and job creation continue to be very healthy.

What’s going on?

Much of the resilience in the economy can be explained by the strength of business and consumer finances, even despite rapidly rising interest rates. More here, here, here, and here.

While rising interest rates are usually considered a headwind, there’s some counterintuitive nuance to the narrative.

First, many companies refinanced much of their debt over the past three years, locking in very low interest rates. So as market interest rates have risen, the effective interest rate corporations are paying today remains low.

Similarly, the vast majority of outstanding mortgages have a locked-in rate that’s lower than the current market rate. So for many consumers, the financing cost of their largest liability has been unchanged.

Second, many companies and consumers have quite a bit of cash. And higher interest rates means they’re earning more interest income. From Deutsche Bank’s George Saravelos on Monday:

"… It is effectively as if the Fed cut rates. Why? Because corporates took advantage of QE to term out borrowing at record-low rates and are now earning 5%+ interest on their cash. A similar dynamic can be seen with households: US aggregate household net interest receipts are still where they were before this hiking cycle started as the interest earned on cash has matched payments on borrowings."

It’s counterintuitive but as Saravelos’ chart shows, the net interest corporations have been paying has actually declined as interest rates have risen thanks to the higher interest income.

To be clear, there are still businesses and consumers who are actively borrowing today at interest rates that are much higher than they were years ago.

And should today’s elevated rates persist, over time more borrowers could find themselves facing more onerous debt costs as they refinance at higher rates.

Of course, it’s also possible that interest rates come down. After all, there’s little about the future that is certain.

The bottom line: Rising interest rates are currently having a limited negative impact on businesses and consumers as a whole. For many, it’s actually been a net positive.

A quick note about excess savings

Excess savings — the extra cash that consumers piled up since February 2020, thanks to a combination of government financial support and limited spending options during the pandemic — has been a key driver of the economic recovery.

But as time has passed and these savings have been drawn down, the concept of excess savings has become less relevant. (Also, more comprehensive measures of household finances suggest cash levels are very high.)

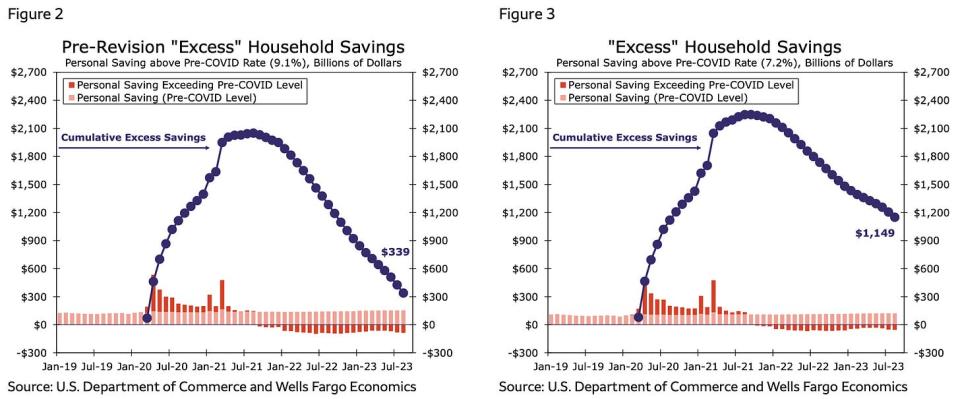

Having said all that, new government data suggests these excess savings balances have actually been much higher than previously estimated. From Wells Fargo (emphasis added):

The benchmark revisions to the National Accounts last week caused some pretty big changes to our measure of excess savings again. Essentially, the data now suggest there is $1.1T remaining in excess savings through August, whereas the previous data suggested only about $339B remaining through July. This all comes down to our pre-pandemic baseline shifting from a 9.1% saving rate in January 2020 down to 7.2%. Since our baseline of comparison is now lower, the excess today looks higher because we are not as far from that base as we were. We have thus "spent it down" at a slower rate. The data now suggest there is more than three times the amount the pre-revised data suggested (~$340B) through July.

The Wells Fargo economists also argue that "it is not sensible to hang your hat on an estimate subject to such comically large revisions." They also point to the more comprehensive measures of checking and savings balances, noting the readings are "clearer and suggests households still have excess liquidity."

Nevertheless, the idea that there continues to be a lot of excess savings helps us understand why consumer spending continues to be so resilient.

Reviewing the macro crosscurrents

There were a few notable data points and macroeconomic developments from last week to consider:

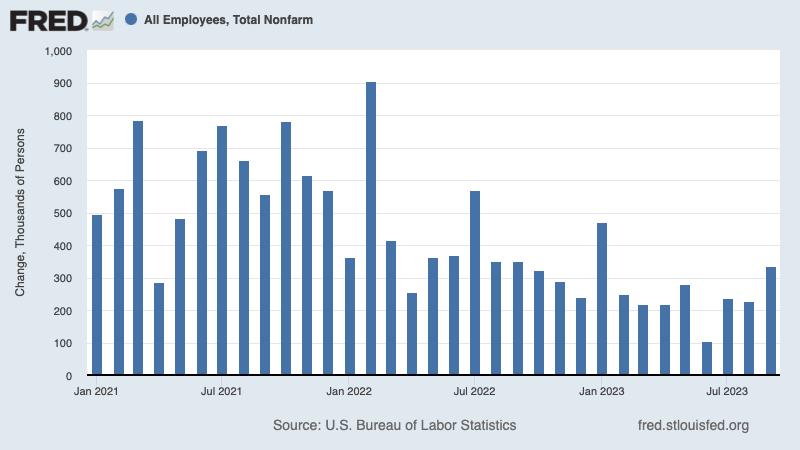

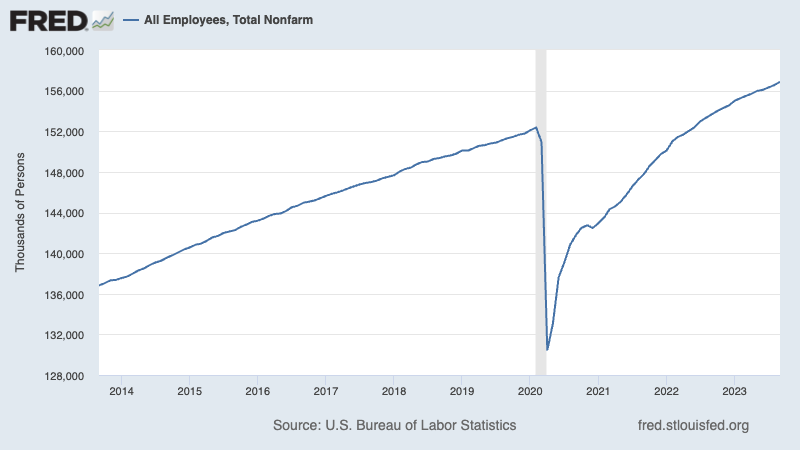

The labor market is still hot. According to the BLS’s Employment Situation report released Friday, U.S. employers added 336,000 jobs in September, the 33nd straight month of gains. While the pace of job growth has generally been cooler, the numbers continue to confirm an economy with robust demand for labor.

Employers have now added a whopping 2.3 million jobs since the beginning of the year. Total payroll employment is at a record 156.9 million jobs.

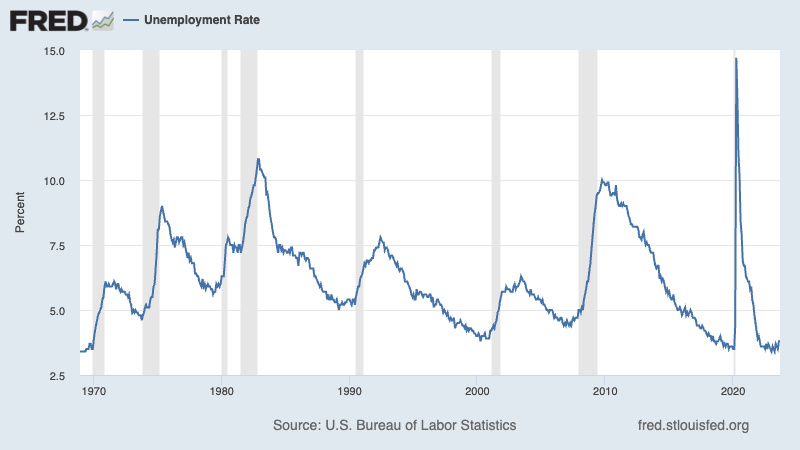

The unemployment rate — that is, the number of workers who identify as unemployed as a percentage of the civilian labor force — was 3.8% during the month. While it’s above its cycle low of 3.4%, it continues to hover near 53-year lows.

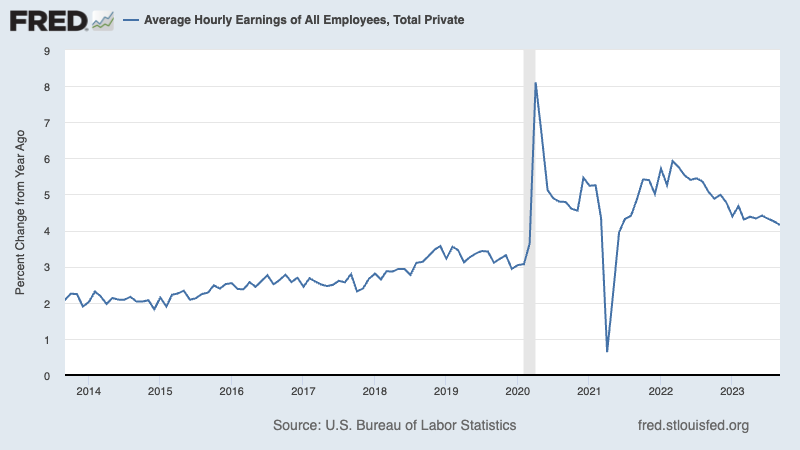

Wage growth cools. Average hourly earnings rose by 0.21% month-over-month in September, down slightly from the 0.24% pace in August. On a year-over-year basis, this metric is up 4.15%, a rate that’s been cooling but remains elevated.

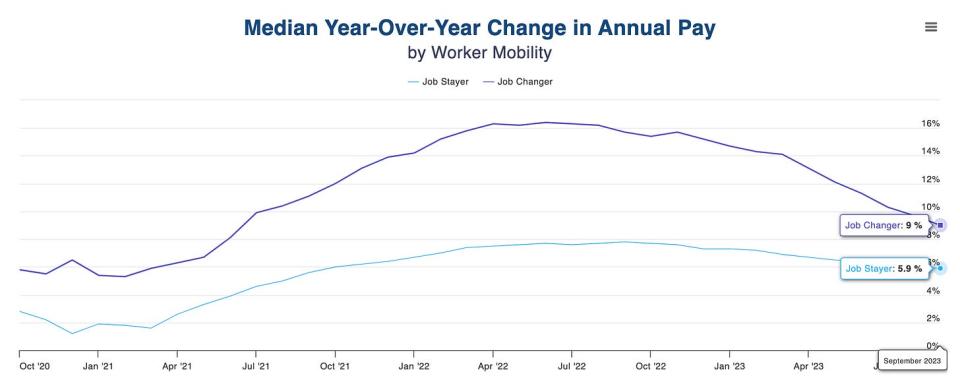

Job switchers get better pay. According to ADP, which tracks private payrolls and employs a different methodology than the BLS, annual pay growth in September for people who changed jobs was up 9% from a year ago. For those who stayed at their job, pay growth was 5.9%.

Job openings tick up. According to the BLS’s Job Openings and Labor Turnover Survey, employers had 9.61 million job openings in August. While this remains elevated above prepandemic levels, it’s down from the March 2022 high of 12.03 million.

And yes, August’s print was an uptick from July’s. But the trend still appears to be downward.

During the period, there were 6.36 million unemployed people — meaning there were 1.51 job openings per unemployed person. This continues to be one of the most obvious signs of excess demand for labor.

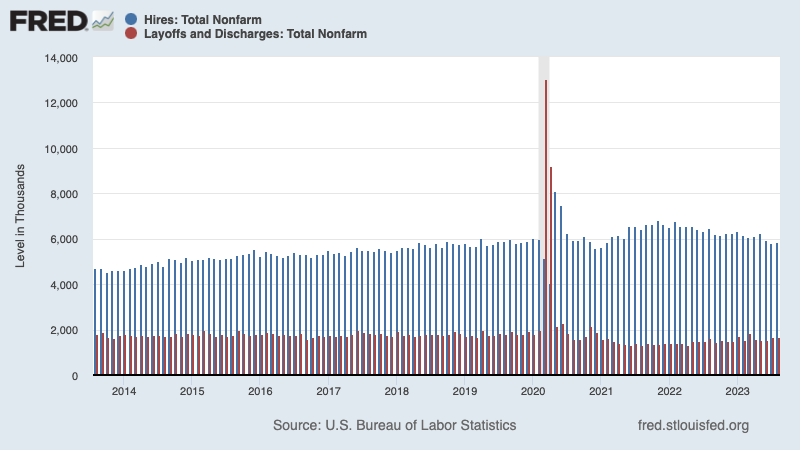

Layoffs remain depressed, hiring remains firm. Employers laid off 1.68 million people in August. While challenging for all those affected, this figure represents just 1.1% of total employment. This metric continues to trend below pre-pandemic levels.

Hiring activity continues to be much higher than layoff activity. During the month, employers hired 5.86 million people.

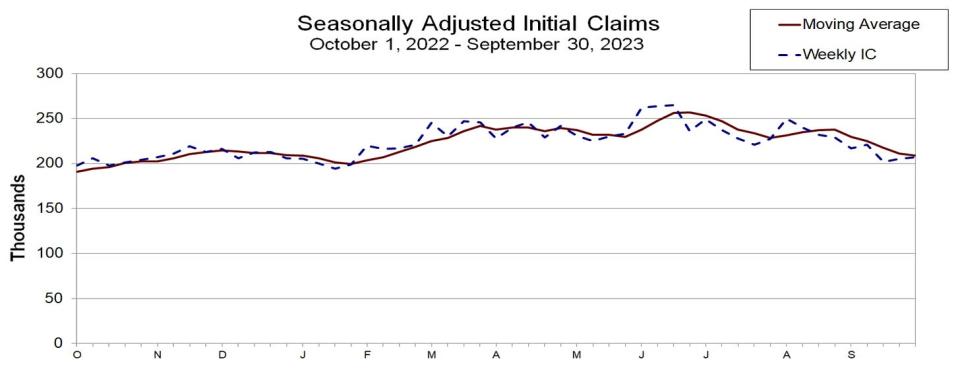

Unemployment claims tick up. Initial claims for unemployment benefits increased to 207,000 during the week ending September 20, up from 205,000 the week prior.While this is up from a September 2022 low of 182,000, it continues to trend at levels associated with economic growth.

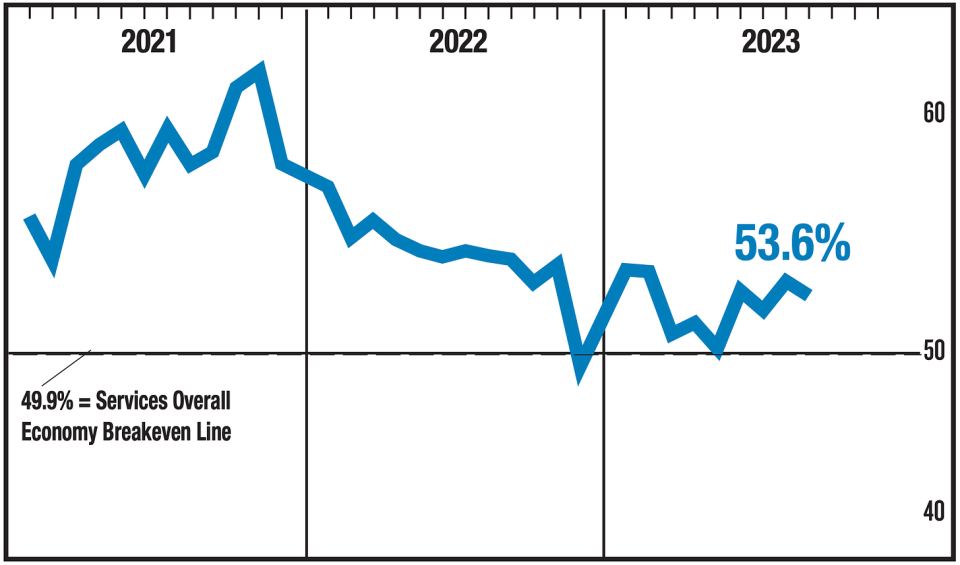

Services surveys signal cooling growth. The ISM’s September Services PMI reflected growth in the sector, but at a decelerating pace.

From S&P Global’s September Services PMI report: "The final PMI data for September add to indications that the US economy has started to cool again after a resurgence of growth earlier in the summer. Inflationary pressures in the service sector meanwhile remain uncomfortably sticky. The biggest change in recent months has been the waning in demand for consumer services, such as travel, tourism and recreation, along with a slump in financial services activity…"

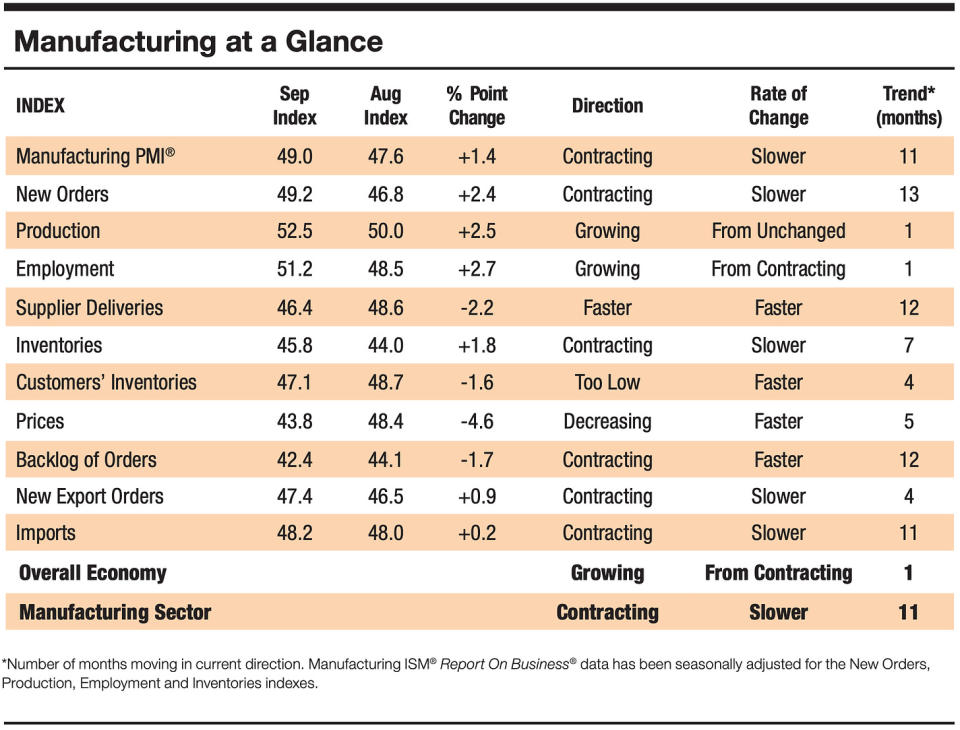

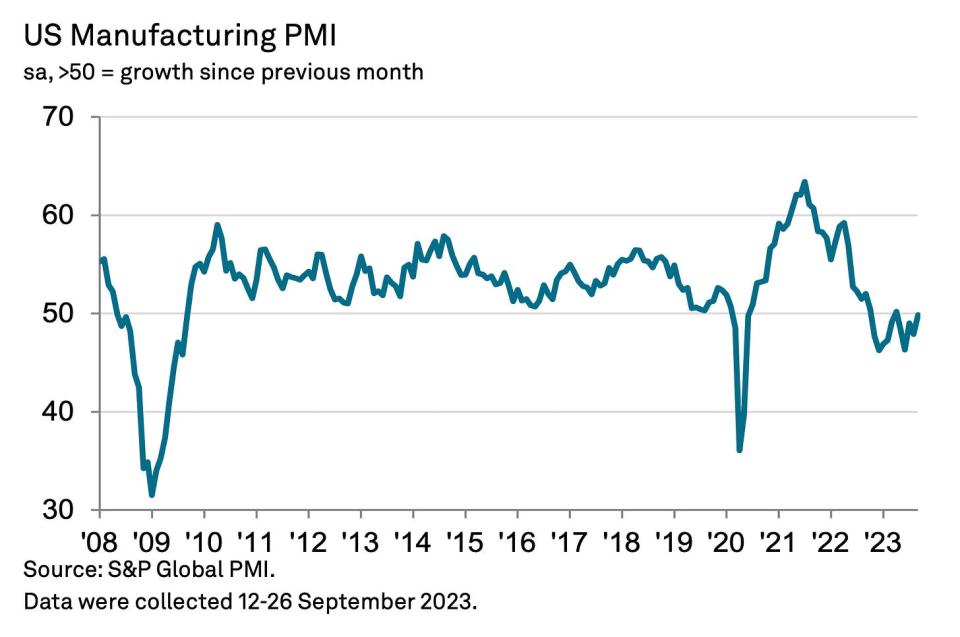

Manufacturing surveys improve. The ISM’s September Manufacturing PMI reflected contraction in the sector, but signaled the contraction was easing and is above breakeven levels for the economy.

Key ISM subindexes improved, including new orders, production, and employment. Importantly, prices declined significantly.

Similarly, S&P Global’s September Manufacturing PMI also improved. From the report: "Output reversed some of the loss seen in August as higher employment and improved supply availability helped factories fulfill backlogs of orders."

It’s worth remembering that soft data like the PMI surveys don’t necessarily reflect what’s actually going on in the economy.

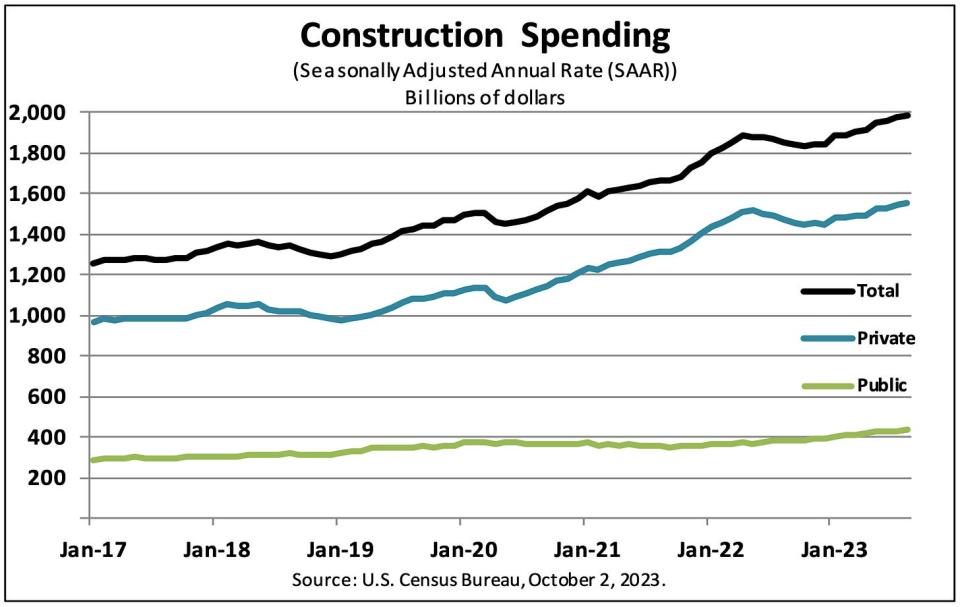

Construction spending rises. Construction spending rose 0.5% to an annual rate of $1.98 trillion in August.

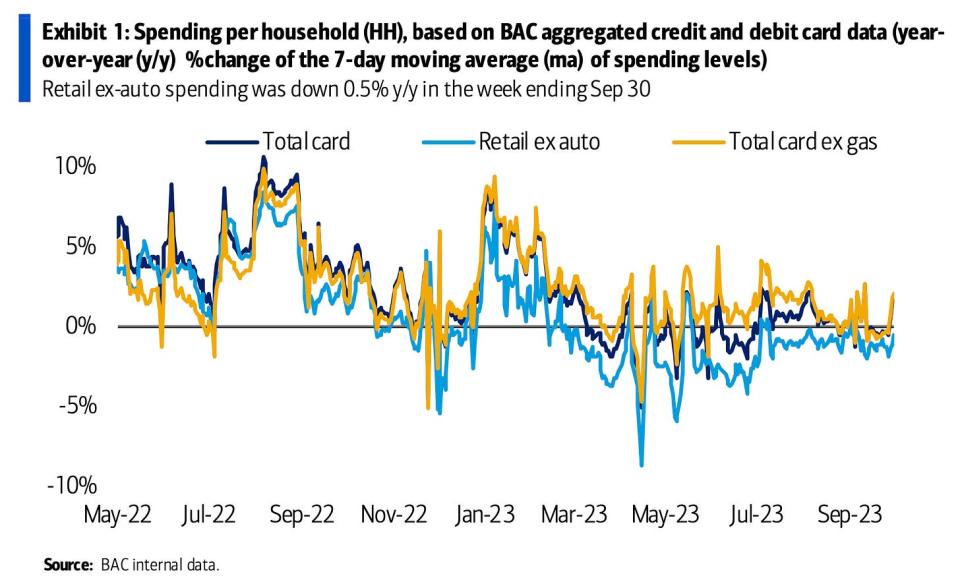

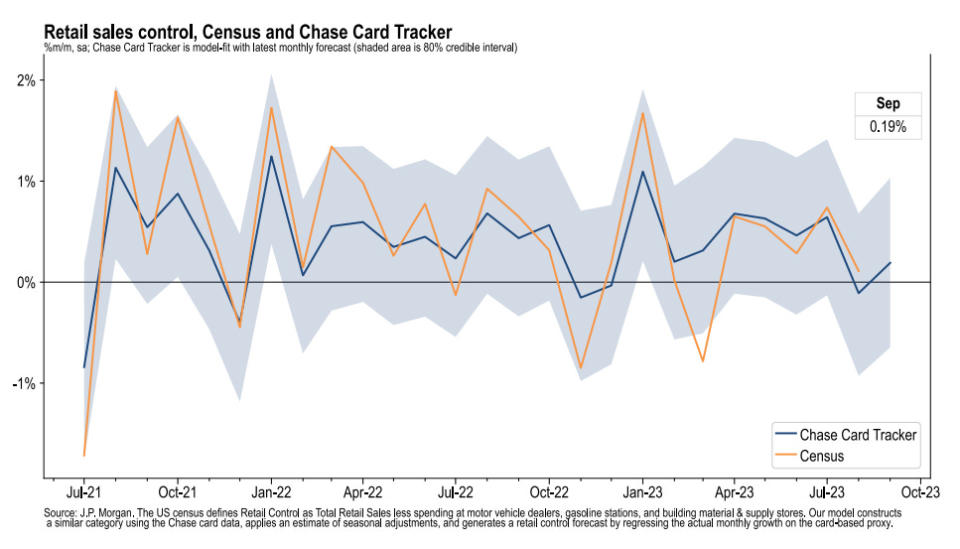

Spending is holding up, according to September card data. From BofA: "Total card spending per HH was up 1.8% y/y."

From JPMorgan Chase: "As of 30 Sep 2023, our Chase Consumer Card spending data (unadjusted) was 2.3% above the same day last year. Based on the Chase Consumer Card data through 30 Sep 2023, our estimate of the US Census September control measure of retail sales m/m is 0.14%."

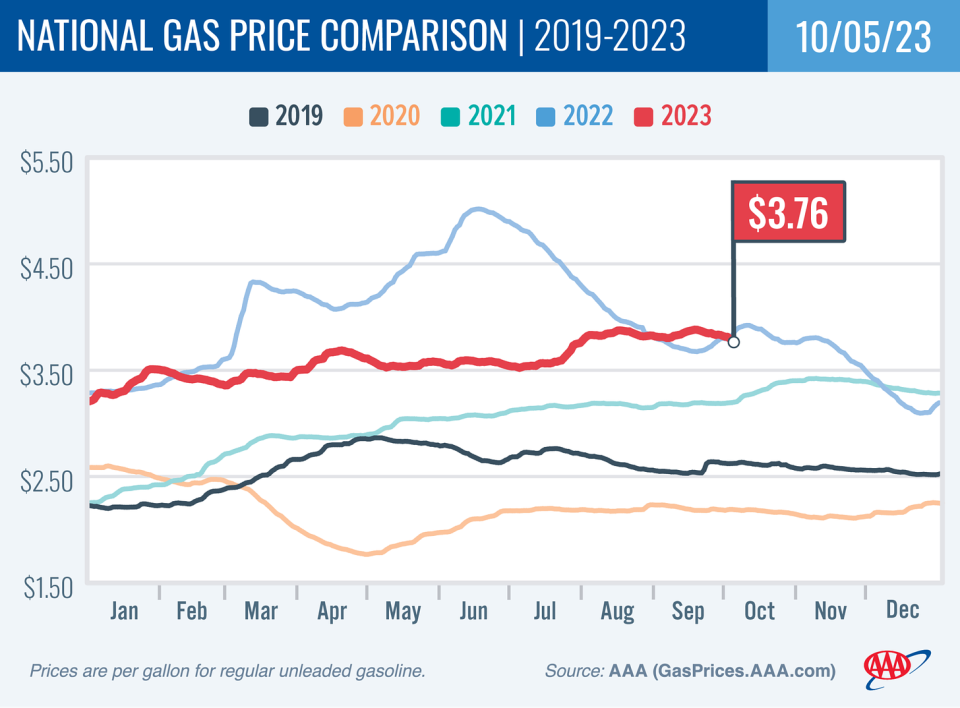

Gas prices tick lower. From AAA: "The decline in pump prices accelerated a bit since last week, with the national average falling seven cents to $3.76. The primary culprits are slack demand and the falling cost of oil, which has shaved more than $10 and is hovering near $82 per barrel."

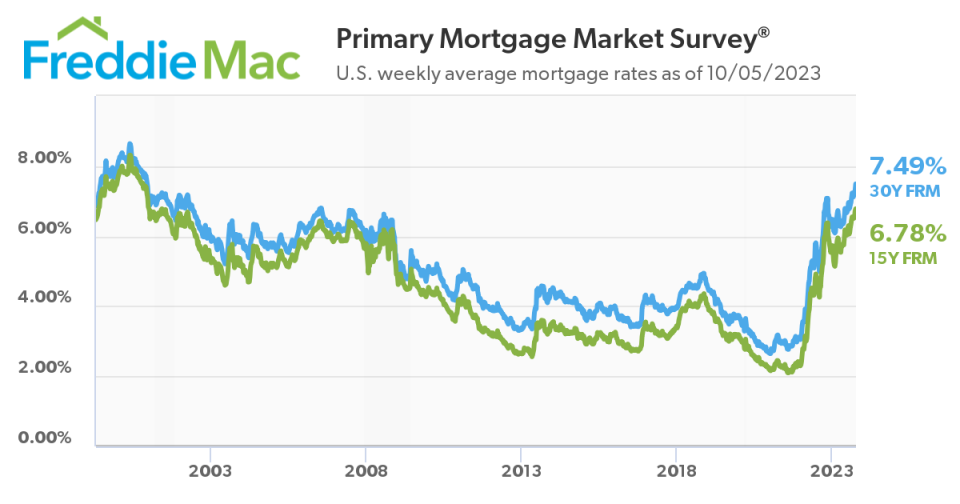

Mortgage rates continue to rise. According to Freddie Mac, the average 30-year fixed-rate mortgage rose to 7.49%, the highest level since December 2000. From Freddie Mac: "Mortgage rates maintained their upward trajectory as the 10-year Treasury yield, a key benchmark, climbed. Several factors, including shifts in inflation, the job market and uncertainty around the Federal Reserve’s next move, are contributing to the highest mortgage rates in a generation. Unsurprisingly, this is pulling back homebuyer demand."

Remember, this is the market rate. Most borrowers borrowed when rates were much lower, and so the effective average rate among all outstanding borrowers remains low.

Used car prices fall. From UBS (via Notes): "JD Power Used Car Guide retail valuations dropped substantially in September."

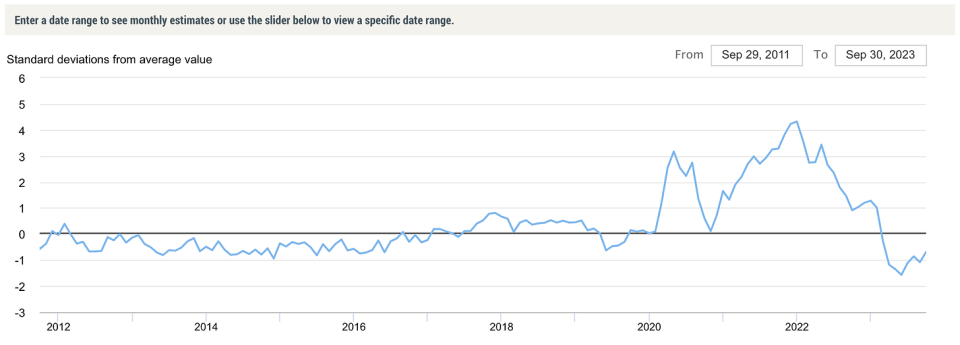

Supply chain pressures tighten a little. The New York Fed’s Global Supply Chain Pressure Index 1— a composite of various supply chain indicators — ticked up in September, but remains below levels seen even before the pandemic. It's way down from its December 2021 supply chain crisis high.

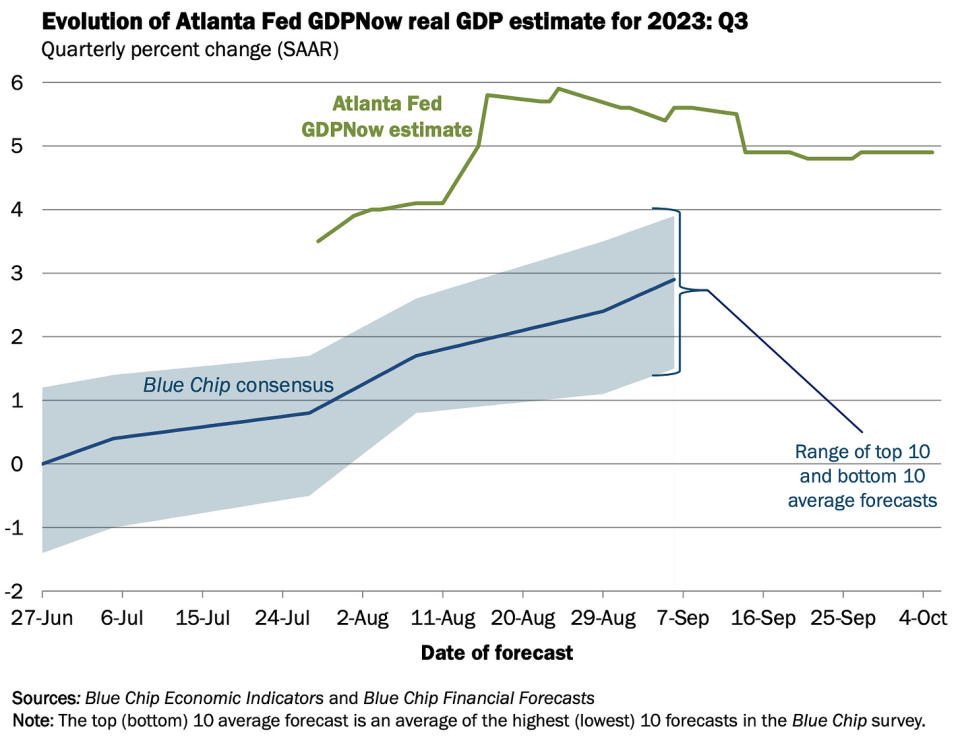

Near-term GDP growth estimates remain positive. The Atlanta Fed’s GDPNow model sees real GDP growth climbing at a 4.9% rate in Q3.

Putting it all together

We continue to get evidence that we could see a bullish "Goldilocks" soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

This comes as the Federal Reserve continues to employ very tight monetary policy in its ongoing effort to bring inflation down. While it’s true that the Fed has taken a less hawkish tone in 2023 than in 2022, and most economists agree that the final interest rate hike of the cycle has either already happened or is near, inflation still has to cool more and stay cool for a little while before the central bank is comfortable with price stability.

So we should expect the central bank to keep monetary policy tight, which means we should be prepared for tight financial conditions (e.g., higher interest rates, tighter lending standards, and lower stock valuations) to linger. All this means monetary policy will be unfriendly to markets for the time being, and the risk the economy slips into a recession will be relatively elevated.

At the same time, we also know that stocks are discounting mechanisms, meaning that prices will have bottomed before the Fed signals a major dovish turn in monetary policy.

Also, it’s important to remember that while recession risks may be elevated, consumers are coming from a very strong financial position. Unemployed people are getting jobs, and those with jobs are getting raises.

Similarly, business finances are healthy as many corporations locked in low interest rates on their debt in recent years. Even as the threat of higher debt servicing costs looms, elevated profit margins give corporations room to absorb higher costs.

At this point, any downturn is unlikely to turn into economic calamity, given that the financial health of consumers and businesses remains very strong.

And as always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. While markets have had a pretty rough couple of years, the long-run outlook for stocks remains positive.

Note: A version of this article appeared on Tker.co.