Navigator Holdings Ltd.'s (NYSE:NVGS) Earnings Haven't Escaped The Attention Of Investors

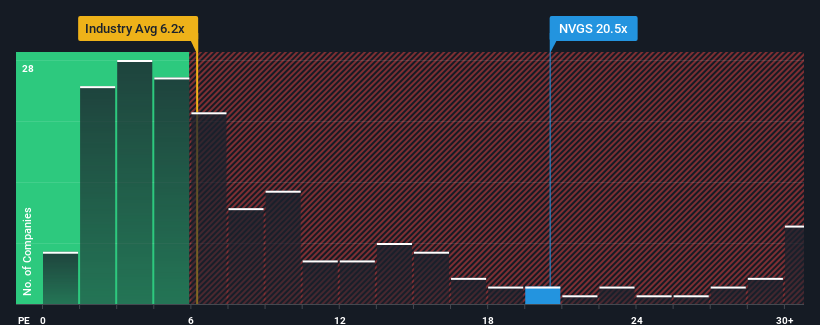

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 14x, you may consider Navigator Holdings Ltd. (NYSE:NVGS) as a stock to potentially avoid with its 20.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Navigator Holdings could be doing better as it's been growing earnings less than most other companies lately. One possibility is that the P/E is high because investors think this lacklustre earnings performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for Navigator Holdings

Want the full picture on analyst estimates for the company? Then our free report on Navigator Holdings will help you uncover what's on the horizon.

How Is Navigator Holdings' Growth Trending?

Navigator Holdings' P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. The longer-term trend has been no better as the company has no earnings growth to show for over the last three years either. Accordingly, shareholders probably wouldn't have been satisfied with the complete absence of medium-term growth.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 22% per annum over the next three years. That's shaping up to be materially higher than the 9.8% each year growth forecast for the broader market.

With this information, we can see why Navigator Holdings is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Navigator Holdings' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for Navigator Holdings that you need to take into consideration.

Of course, you might also be able to find a better stock than Navigator Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here