Navitas Semiconductor Corp (NVTS) Reports Record Revenue Growth in Q4 and Full Year 2023

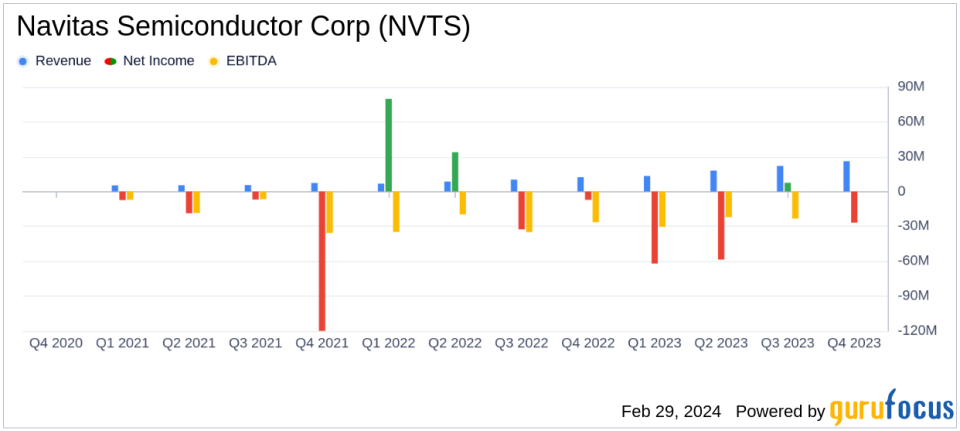

Q4 Revenue: Increased by 111% year-over-year to $26.1 million.

Full Year Revenue: Grew by 109% to $79.5 million in 2023.

Gross Margin: Improved to 42.2% in Q4, up from 40.6% in the same period last year.

Operating Loss: Decreased to $26.8 million in Q4 from $31.2 million in Q4 2022.

Cash Position: Strong liquidity with $152.8 million in cash and cash equivalents as of December 31, 2023.

On February 29, 2024, Navitas Semiconductor Corp (NASDAQ:NVTS) released its 8-K filing, announcing unaudited financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its ultra-efficient gallium nitride (GaN) semiconductors, has reported significant revenue growth and improved gross margins, reflecting its expanding influence in the semiconductor industry.

Company Overview

Navitas Semiconductor Corp develops cutting-edge GaN power ICs that are transforming power electronics across various sectors. With a focus on fast charging, high power density, and energy savings, Navitas caters to a diverse range of markets including mobile, consumer, enterprise, eMobility, and new energy. The company's operations span across China, Europe, the United States, and other parts of Asia, with the majority of its revenue generated from China.

Financial Performance and Challenges

Navitas Semiconductor Corp's performance in the fourth quarter and the full year of 2023 has been remarkable, with revenue figures more than doubling from the previous year. This growth is attributed to significant new wins in AI data centers, home appliances, solar inverters, and a major satellite internet rollout. Despite these achievements, CEO Gene Sheridan acknowledges the potential market headwinds in the first half of 2024 but remains optimistic about revenue growth accelerating in the latter half of the year.

The company's financial achievements, particularly the surge in gross margin to 42.2% in Q4 2023 from 40.6% in Q4 2022, are crucial indicators of Navitas's ability to improve its cost efficiency and profitability. For a semiconductor company, gross margin improvements reflect better control over production costs and an enhanced product mix, which is vital in a competitive industry.

Key Financial Metrics

Navitas Semiconductor Corp's financial health can be further assessed through key metrics from its income statement and balance sheet. The company ended the year with a strong cash position of $152.8 million, which is essential for funding its operations and future growth initiatives. Despite the impressive revenue growth, the company reported a GAAP loss from operations of $26.8 million for Q4 and $118.1 million for the full year. However, on a non-GAAP basis, the loss from operations was significantly lower at $9.7 million for Q4 and $40.3 million for the full year, indicating substantial non-cash expenses and adjustments.

"I am pleased to announce a record fourth quarter that caps off a year of more than doubling revenue for Navitas as we demonstrated strength across multiple markets," said Gene Sheridan, CEO and co-founder. "While we are not immune to first half 2024 market headwinds, we see revenue growth accelerating in the second half based on our strong customer pipeline including major new wins in AI data centers, home appliances, solar inverters and a major satellite internet roll-out - all of which positions Navitas for strong growth in 2024 and beyond."

Analysis of Performance

Navitas Semiconductor Corp's performance in 2023 has been driven by strategic market penetration and technological advancements. The introduction of new GaNSafe technology and Gen-3 Fast silicon carbide has fueled demand in the electric vehicle sector, while significant developments with top solar OEMs and home appliance manufacturers have bolstered the company's market presence. The company's expansion into data centers with its GaNSafe and Gen 3 Fast SiC technologies is expected to double the power density of legacy silicon solutions, catering to the growing power demands of AI data centers.

Looking ahead, Navitas anticipates Q1 2024 net revenues to be around $23 million, with a gross margin of approximately 41%. The company's focus on diversifying its customer base and scaling its technology into new markets is expected to continue driving growth, despite the anticipated market challenges in the first half of 2024.

For value investors and potential GuruFocus.com members, Navitas Semiconductor Corp's strong revenue growth, improved gross margins, and strategic market expansions present a compelling narrative. The company's financial resilience and innovative product offerings in the semiconductor industry make it a noteworthy consideration for investment portfolios.

Explore the complete 8-K earnings release (here) from Navitas Semiconductor Corp for further details.

This article first appeared on GuruFocus.