NB Bancorp Inc (NBBK) Reports Full Year 2023 Financial Results Amidst IPO and Conversion Expenses

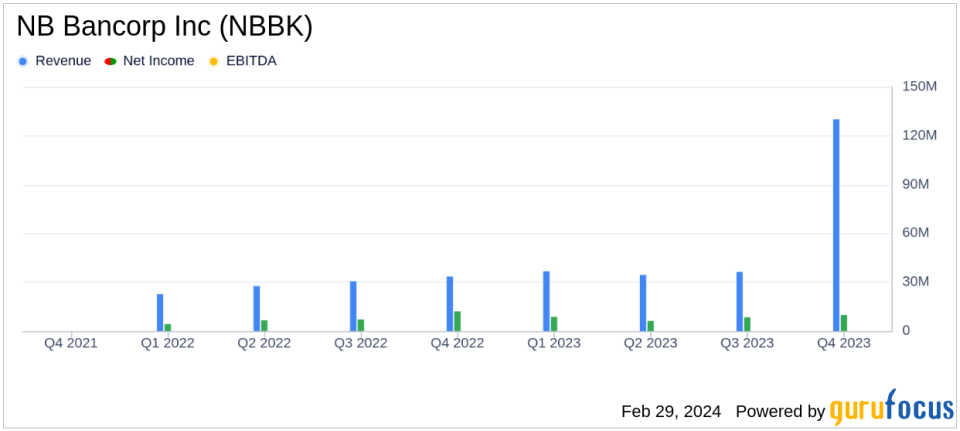

Net Income: Reported $9.8 million due to one-time IPO-related expenses, compared to $30.1 million in the previous year.

Adjusted Net Income: Excluding one-time items, net income was $34.3 million, an increase from $30.1 million year-over-year.

Total Assets: Increased by 26.2% to $4.53 billion as of December 31, 2023.

Net Interest Income: Grew by 23.9% to $130.1 million for the year.

Noninterest Income: Jumped by 67.9% to $15.6 million for the year.

Noninterest Expense: Rose by 68.5% to $119.9 million, including one-time costs.

Efficiency Ratio: Excluding one-time expenses, was 62.5% for the year.

On February 28, 2024, NB Bancorp Inc (NASDAQ:NBBK) released its 8-K filing, detailing the financial outcomes for the full year of 2023. The company, which operates as the holding company of Needham Bank, faced significant one-time expenses related to its initial public offering (IPO) and mutual-to-stock conversion. These expenses included a substantial charitable contribution to the Needham Bank Charitable Foundation and various IPO-related compensation and pension termination expenses.

Despite these one-time costs, the company's adjusted net income, which excludes these expenses, rose to $34.3 million from $30.1 million in the previous year, indicating underlying growth in the company's operations. This growth is particularly important for NB Bancorp Inc as it reflects the company's ability to expand and generate profits amidst significant structural changes and market challenges.

Financial Performance Overview

NB Bancorp Inc reported a total asset increase to $4.53 billion, up by 26.2% from the previous year, demonstrating the company's continued expansion. Net interest income saw a significant rise to $130.1 million, a 23.9% increase from the prior year, despite a slight decrease in net interest margin due to rapidly rising interest rates. The company's noninterest income also experienced a substantial increase, up by 67.9% to $15.6 million, highlighting the diversification of revenue streams.

However, noninterest expenses also rose to $119.9 million, a 68.5% increase, largely due to the aforementioned one-time costs. When excluding these one-time expenses, noninterest expenses were $91.0 million, still representing a 27.9% increase from the previous year as the company invested in infrastructure to support its growth.

"The capital that the Company raised from its IPO will be transformative as we move forward. It will provide us with the ability to grow in a safe and prudent manner, allowing us to be selective in how we deploy the capital into growing market share and serving our customers needs," said Joseph Campanelli, Chairman, President and Chief Executive Officer.

Key Financial Metrics and Analysis

The company's balance sheet strength is evident in the increase in total assets, and the growth in net interest income is a positive indicator of NB Bancorp Inc's core business performance. The rise in noninterest income suggests that the company is successfully diversifying its income sources, which is crucial for stability in the volatile banking industry.

Asset quality remains a critical metric for banks, and NB Bancorp Inc's financials show a solid position. The efficiency ratio, excluding one-time expenses, stood at 62.5%, which is a measure of the bank's operational efficiency. A lower ratio typically indicates a more efficiently run bank, and NB Bancorp Inc's ratio suggests that it is managing its overhead well relative to its revenue.

As NB Bancorp Inc navigates the post-IPO landscape, the adjustments to its financials provide a clearer picture of its operational health. The company's ability to grow net income excluding one-time expenses by over 14% is a testament to its underlying business strength and the potential for future growth.

For a more detailed analysis and to stay updated on NB Bancorp Inc's financial journey, investors and interested parties are encouraged to visit GuruFocus.com for comprehensive reports and investment insights.

Explore the complete 8-K earnings release (here) from NB Bancorp Inc for further details.

This article first appeared on GuruFocus.