NBT Bancorp Inc. (NBTB) Reports Decline in Annual Net Income for 2023

Net Income: Full-year net income decreased to $118.8 million from $152.0 million in the previous year.

Earnings Per Share (EPS): Diluted EPS for the year fell to $2.65 from $3.52 year-over-year.

Net Interest Margin (NIM): NIM for Q4 2023 contracted to 3.15% from 3.68% in Q4 2022.

Loan Growth: Year-over-year loan growth of 3.9%, excluding loans acquired from Salisbury Bancorp, Inc.

Deposit Increase: Deposits rose to $10.97 billion, including $1.31 billion from Salisbury acquisition.

Asset Quality: Nonperforming loans to total loans increased to 0.39% in Q4 2023 from 0.26% in Q4 2022.

Dividend: NBTB declared a dividend, continuing its commitment to shareholder returns.

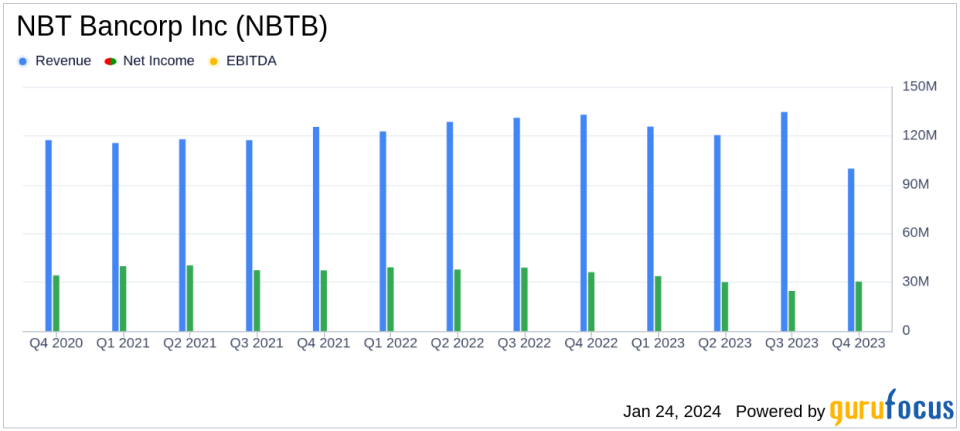

On January 23, 2024, NBT Bancorp Inc. (NASDAQ:NBTB) released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023. The report shows a year marked by challenges, including market volatility and a decrease in net income and diluted earnings per share (EPS) compared to the previous year.

NBT Bancorp Inc. is a financial holding company that operates through its subsidiaries, including NBT Bank, a full-service community bank. The bank offers a range of retail and commercial banking products, as well as trust and investment services, with a significant portion of its loan portfolio in commercial loans. NBTB serves a diverse clientele across several Northeastern states.

Financial Performance and Challenges

The company reported a net income of $30.4 million for Q4 2023, a decrease from $36.1 million in Q4 2022. The diluted EPS for the same period was $0.64, down from $0.84 in the prior year's quarter. For the full year, net income was $118.8 million, or $2.65 per diluted common share, compared to $152.0 million, or $3.52 per diluted common share, in the previous year. The operating diluted EPS, a non-GAAP measure, was $3.23 for 2023, down from $3.56 in 2022.

President and CEO John H. Watt, Jr. commented on the results, stating:

"NBT's fourth quarter and full year results reflect our consistent dedication to improving our traditional banking franchise while growing our diversified revenue sources. In a year characterized by unprecedented market volatility, we grew loans and deposits, maintained strong asset quality, improved our capital position, completed the high-value acquisition of Salisbury Bancorp, Inc., and continued to deliver best-in-class customer service."

Financial Highlights and Metrics

The net interest margin (NIM) on a fully taxable equivalent basis was 3.15% for Q4 2023, a decrease from 3.68% in Q4 2022. The period-end total loans were $9.65 billion, up $1.50 billion year-over-year, including $1.18 billion of loans acquired from Salisbury Bancorp, Inc. Excluding the Salisbury acquisition, loans grew by $320.6 million, or 3.9%. Nonperforming loans to total loans increased to 0.39%, up from 0.26% in Q4 2022. The allowance for loan losses to total loans was 1.19%.

Deposits increased to $10.97 billion, up $1.47 billion from the previous year, with $1.31 billion in deposits acquired from Salisbury. The total cost of deposits for Q4 2023 was 1.51%, up from the previous quarter. The company's capital position remained strong, with stockholders' equity at $1.43 billion and a tangible equity to assets ratio of 7.93%.

Analysis and Outlook

The decline in net income and EPS reflects the impact of market volatility and the challenges faced by the banking sector. However, the growth in loans and deposits, along with the strategic acquisition of Salisbury Bancorp, Inc., positions NBTB for potential future growth. The increase in nonperforming loans is a concern that warrants monitoring, but the company's strong capital position and diverse deposit base provide a buffer against potential headwinds.

NBTB's commitment to shareholder returns is evidenced by the declared dividend, despite the year's challenges. The company's performance in 2023 underscores the importance of strategic acquisitions and the need to maintain asset quality in a volatile market environment.

Investors and stakeholders can expect NBTB to continue focusing on enhancing its traditional banking franchise and growing diversified revenue streams while navigating the complexities of the current economic landscape.

For a more detailed analysis and to access the full earnings report, please visit the NBT Bancorp Inc. Event Calendar page.

Explore the complete 8-K earnings release (here) from NBT Bancorp Inc for further details.

This article first appeared on GuruFocus.