Nektar Therapeutics (NKTR) Q2 Loss Narrows, Sales Miss

Nektar Therapeutics NKTR reported a loss of 27 cents per share for the second quarter of 2023, which was narrower than the Zacks Consensus Estimate of a loss of 30 cents. In the year-ago quarter, the loss was 85 cents per share.

Quarterly revenues declined 5% year over year to $20.5 million during the quarter. Revenues missed the Zacks Consensus Estimate of $20.9 million.

Quarter in Detail

In the second quarter, product sales declined 12.3% from the year-ago quarter’s levels to $4.7 million. Product revenues beat our model estimate of $3.6 million.

Non-cash royalty revenues were $15.8 million, down 2.7% from the year-ago quarter. Non-cash royalty revenues were slightly better than our model estimate of $15.5 million.

License, collaboration and other revenues were negligible in the quarter.

Research and development (R&D) expenses declined 30.4% to $29.7 million due to the winding down of the development of bempegaldesleukin (bempeg). Bempeg failed in three late-stage registrational studies in the first quarter of 2022. Following these failures, Nektar stopped all clinical studies on bempeg in April 2022.

General and administrative (G&A) expenses declined 12.7% year over year to $17.9 million due to the discontinuation of the development of bempeg.

Cash and investments in marketable securities as of Jun 30, 2023 were $409.4 million compared with $457 million as of Mar 31, 2023.

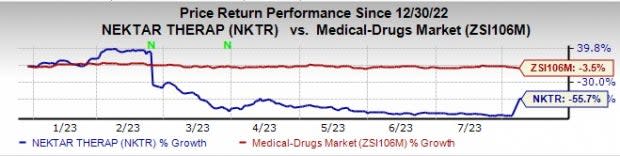

Nektar’s shares declined 3.7% in after-market hours in response to the results. Shares of Nektar Therapeutics have declined 55.7% so far this year compared with the industry’s 3.5% decrease.

Image Source: Zacks Investment Research

Pipeline Update

Nektar has two key candidates in its pipeline, rezpegaldesleukin (rezpeg, formerly NKTR-358) and NKTR-255.

The company regained full rights to rezpeg from Eli Lily LLY in April 2023, and will now take charge of its clinical development. Rezpeg is now a wholly owned asset of Nektar, and the latter owes no royalty payments to Lilly.

On Tuesday, Nektar said that the efficacy data previously generated by Eli Lilly from rezpeg studies was miscalculated for both atopic dermatitis and psoriasis. Nektar claimed that an independent statistical firm (employed to analyze the raw data) discovered the data errors, which Lilly confirmed in writing. The correct data from the atopic dermatitis study demonstrated that 12 weeks of treatment with rezpeg, at the highest dose, resulted in a mean EASI score improvement of 83% and an EASI 75 response rate of 41%. EASI is a validated and widely used standard measurement for atopic dermatitis studies. Importantly, the corrected data showed that rezpeg provided a rapid and steep drop in EASI scores immediately after the initiation of therapy.

Nektar plans to begin a phase IIb study in patients with moderate-to-severe atopic dermatitis (AS) this year. Initial data from this study is expected to be released in the first half of 2025. Nektar plans to explore rezpeg in other autoimmune indications in the future.

NKTR-255 is being developed in phase II studies in liquid and solid tumors. Key ongoing studies with partner Merck KGaA include a phase II study in combination with cell therapies and the phase II JAVELIN Bladder Medley study. Nektar is evaluating strategic partnership options for NKTR-255 while continuing the phase II studies.

In April, Nektar announced new strategic reprioritization and cost reduction initiatives that focus on programs in immunology, including rezpeg, and also extend its cash runway through at least the middle of 2026. Nektar plans to advance its next pipeline candidate in immunology with an investigational new drug application filing in 2024

2023 Guidance Maintained

In 2023, Nektar expects revenues to be between $80 million and $90 million, which includes $65 million to $70 million in non-cash royalties and $15 million to $20 million in product sales.

R&D costs are expected to range between $105 million and $115 million, while G&A costs are expected to be between $75 million and $80 million. Nektar expects to end 2023 with at least $315 million in cash and investments.

Zacks Rank & Stocks to Consider

Nektar Therapeutics currently has a Zacks Rank #3 (Hold).

Nektar Therapeutics Price, Consensus and EPS Surprise

Nektar Therapeutics price-consensus-eps-surprise-chart | Nektar Therapeutics Quote

Some better-ranked biotech companies are ACADIA Pharmaceuticals ACAD and Axsome Therapeutics AXSM, both with a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, estimates for ACADIA Pharmaceuticals’ 2023 loss per share have narrowed from 53 cents to 41 cents, while that for 2024 have improved from a loss of 11 cents to earnings of 47 cents. Year to date, shares of ACADIA Pharmaceuticals have risen 67.9%.

Earnings of ACADIA Pharmaceuticals beat estimates in two of the last four quarters and missed the mark on two occasions. On average, the company witnessed an earnings surprise of 20.33% over the trailing four quarters.

In the past 30 days, estimates for Axsome Therapeutics’ 2023 loss per share have narrowed from $3.96 to $3.79, while that for 2024 have improved from a loss of $1.59 to $1.58. Year to date, shares of Axsome Therapeutics have declined 5.9%.

AXSM beat estimates in three of the last four quarters, delivering an earnings surprise of 24.44%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Nektar Therapeutics (NKTR) : Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD) : Free Stock Analysis Report

Axsome Therapeutics, Inc. (AXSM) : Free Stock Analysis Report