Nelson Peltz's Strategic Reduction in Ferguson PLC Holdings

Overview of Nelson Peltz (Trades, Portfolio)'s Recent Trade

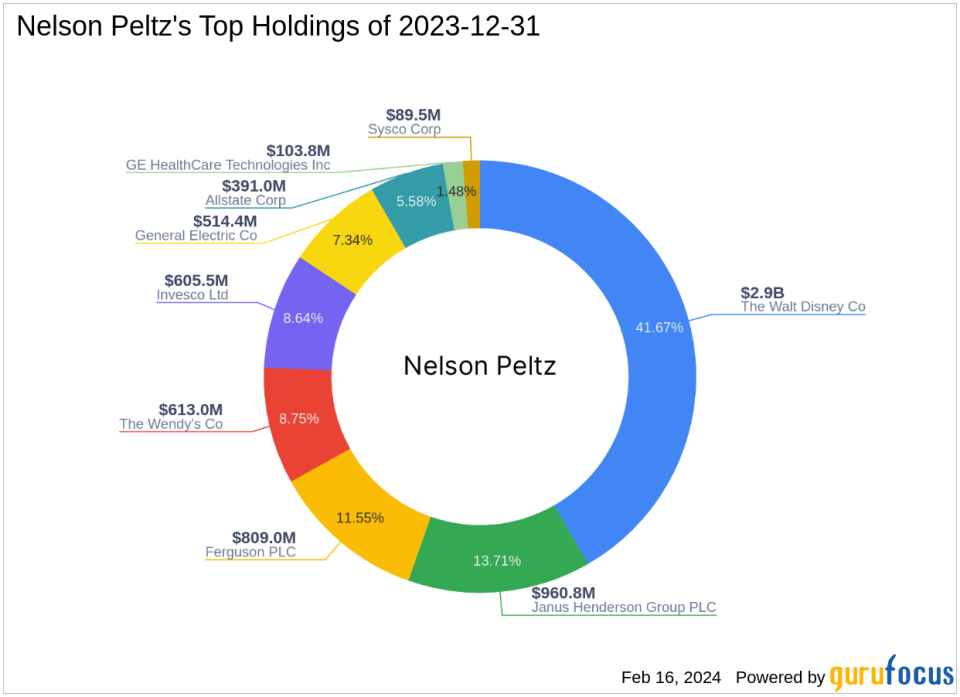

On December 31, 2023, Nelson Peltz (Trades, Portfolio)'s firm executed a significant transaction involving Ferguson PLC, a leading distributor of plumbing and HVAC products. The firm reduced its stake in Ferguson by 430,714 shares, resulting in a 7.95% decrease in its holdings. This move had a 1.26% impact on the portfolio, adjusting the firm's total share count in Ferguson to 4,984,504, which now represents 14.83% of the portfolio and 2.50% of Ferguson's outstanding shares. The trade was executed at a price of $193.07 per share.

Investment Firm Led by Nelson Peltz (Trades, Portfolio)

Nelson Peltz (Trades, Portfolio) is the CEO and Founding Partner of Trian, a firm known for its concentrated investments in undervalued and underperforming companies, primarily within the Consumer, Industrial, and Financial Services sectors. Peltz holds board positions at several prominent companies, including The Wendys Company and The Procter & Gamble Company, and is recognized for enhancing shareholder value through strategic and operational initiatives. Trian's investment philosophy emphasizes asymmetric risk/reward, a long-term operational focus, collaborative engagement, and the implementation of ESG initiatives.

Ferguson PLC at a Glance

Ferguson PLC operates as the largest industrial and construction distributor in North America, with a focus on the U.S. market, which accounts for 95% of its nearly $30 billion in sales. The company has a strong presence with over 1,700 branches and a vast customer base. Ferguson's financial performance and market dominance in North America have been noteworthy, especially after divesting its U.K. business in 2021.

Impact of the Trade on Peltz's Portfolio

The reduction in Ferguson PLC shares by Nelson Peltz (Trades, Portfolio)'s firm has adjusted the composition of its portfolio, reflecting a strategic decision. Comparing the trade price to Ferguson's current stock price of $198.39 and the GF Value of $164.91, the stock is currently considered modestly overvalued with a price to GF Value ratio of 1.20. Since the transaction, Ferguson's stock has seen a gain of 2.76%.

Valuation and Performance of Ferguson PLC

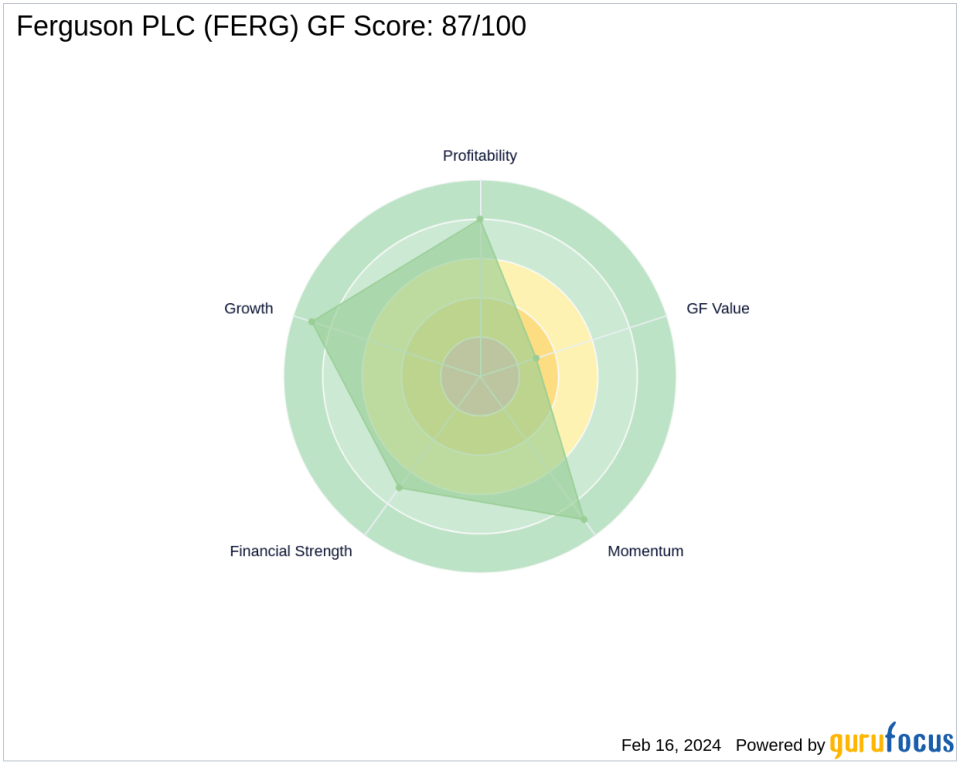

Ferguson PLC's stock performance metrics reveal a PE Percentage of 22.49 and a robust GF Score of 87 out of 100, indicating a high potential for outperformance. However, the stock's GF Value Rank stands at 3 out of 10, suggesting that it may be overvalued at the current price level.

Sector and Financial Health Insights

Ferguson's financial health is solid, with a Financial Strength rank of 7 out of 10 and a Profitability Rank of 8 out of 10. The company's Growth Rank is impressive at 9 out of 10, supported by strong revenue, EBITDA, and earnings growth over the past three years. Ferguson's interest coverage ratio stands at 14.32, and its Altman Z score is a healthy 5.54, indicating low bankruptcy risk.

Other Notable Investors in Ferguson PLC

Davis Selected Advisers is currently the largest guru shareholder in Ferguson PLC, while other notable investors like Tom Gayner (Trades, Portfolio) also maintain positions in the company. Their continued interest in Ferguson underscores the company's strong market position and potential for growth.

Market Context and Prospects for Ferguson PLC

Ferguson's stock has maintained positive momentum within the industrial distribution industry, with a year-to-date price change ratio of 5.19%. The company's future performance potential is bolstered by its high GF Score and ranks in Momentum Rank and Growth. Investors will be watching closely to see how Ferguson's strategic initiatives unfold in the dynamic North American market.

Conclusion: Analyzing the Transaction's Influence

Nelson Peltz (Trades, Portfolio)'s firm's decision to reduce its stake in Ferguson PLC reflects a strategic portfolio adjustment. While the firm still holds a significant position in Ferguson, the trade's timing and impact suggest a calculated move based on the company's current valuation and the firm's investment strategy. As Ferguson continues to perform strongly in its sector, the firm's future transactions will be closely monitored by investors seeking insights into the value investing landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.