NeoGames' (NGMS) Pariplay Expands Its Presence in the US

NeoGames S.A.'s NGMS subsidiary, Pariplay — a leading aggregator and content provider, made its debut in Pennsylvania in partnership with Rush Street Interactive (“RSI”). This marks the fifth US state that Pariplay has ventured into.

Pariplay has been excelling in North America with its diverse content offerings, featuring games tailored to specific player demographics and top-notch content from its proprietary studio, Wizard Games. Pariplay offers an aggregation platform featuring more than 14,000 games from over 120 suppliers. Additionally, it provides essential back-office tools like Fusion Tournaments, Raffle Rocket and Spin That Wheel to enhance player value.

The company remains optimistic in this regard and anticipates this strategic move to enhance Pariplay's position and solidify the company's presence in the competitive iLottery and iGaming market.

Focus on Expansion

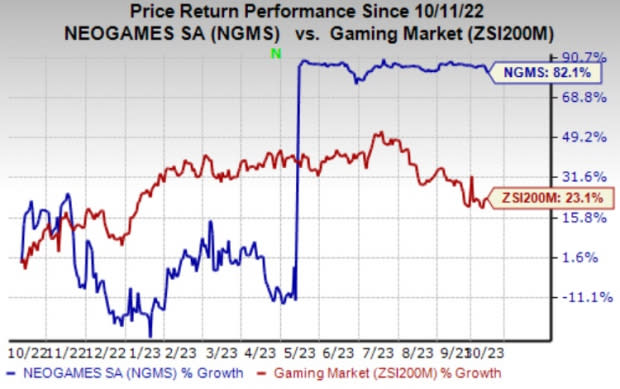

Image Source: Zacks Investment Research

Shares of NGMS rose 82.1% in the past year compared with the industry’s 23.1% growth. The company has benefited from strong contributions from digital gaming and its diverse content offerings. Also, its emphasis on expansion efforts bodes well. In first-quarter 2023, the company’s total revenues (plus a share of NPI revenues) were $64 million, up 187% year over year.

Furthermore, the company has been focusing on expanding its U.S. footprint through strategic partnerships. The company's subsidiary BtoBet entered the North American market with a PlayAlberta Sportsbook partnership. Also, the company signed a deal with Scientific Games to deliver its premium NeoGames Studio content to the Pennsylvania Lottery. It expanded its presence in Canada through NeoGames Studio's eInstant games launch with Atlantic Lottery (AL).

Zacks Rank & Key Picks

NeoGames currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Zacks Consumer Discretionary sector are:

OneSpaWorld Holdings Limited OSW currently carries a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter earnings surprise of 42.6%, on average. The stock has gained 37.8% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for OSW’s 2023 sales and earnings per share (EPS) indicates growth of 44.5% and 117.9%, respectively, from the year-ago period’s levels.

Bragg Gaming Group Inc. BRAG currently sports a Zacks Rank #2 (Buy). It has a trailing four-quarter earnings surprise of 31.2%, on average. The stock has surged 18.1% in the past year.

The Zacks Consensus Estimate for BRAG’s 2023 sales and EPS suggests growth of 18.8% and 111.8%, respectively, from the year-ago period’s levels.

Hilton Worldwide Holdings Inc. HLT flaunts a Zacks Rank #2. It has a trailing four-quarter earnings surprise of 12.5%, on average. The stock has gained 27% in the past year.

The Zacks Consensus Estimate for HLT’s 2023 sales and EPS suggests increases of 14.8% and 23.7%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hilton Worldwide Holdings Inc. (HLT) : Free Stock Analysis Report

OneSpaWorld Holdings Limited (OSW) : Free Stock Analysis Report

NeoGames S.A. (NGMS) : Free Stock Analysis Report

Bragg Gaming Group Inc. (BRAG) : Free Stock Analysis Report