NeoGenomics Inc (NEO) Reports Growth in Revenue and Reduction in Net Loss for Q4 and Full Year 2023

Revenue Growth: Q4 revenue rose to $156 million, marking a 12% increase, with full-year revenue up 16% to $592 million.

Clinical Services Expansion: Clinical Services revenue surged by 20% in Q4 and 18% for the full year.

Net Loss Reduction: Q4 net loss decreased by 37% to $14 million, with a full-year net loss down 39% to $88 million.

Adjusted EBITDA Improvement: Q4 Adjusted EBITDA turned positive at $9 million, a significant improvement from the previous year.

2024 Financial Guidance: NEO anticipates a 10-12% revenue increase and a further reduction in net loss for FY 2024.

On February 20, 2024, NeoGenomics Inc (NASDAQ:NEO), a leader in oncology testing and global contract research services, released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. The company, which operates a network of cancer-focused genetic testing laboratories in the United States and a laboratory in Switzerland, has reported a notable increase in revenue and a significant decrease in net loss, indicating a strong performance in the highly competitive Medical Diagnostics & Research industry.

Financial Performance Highlights

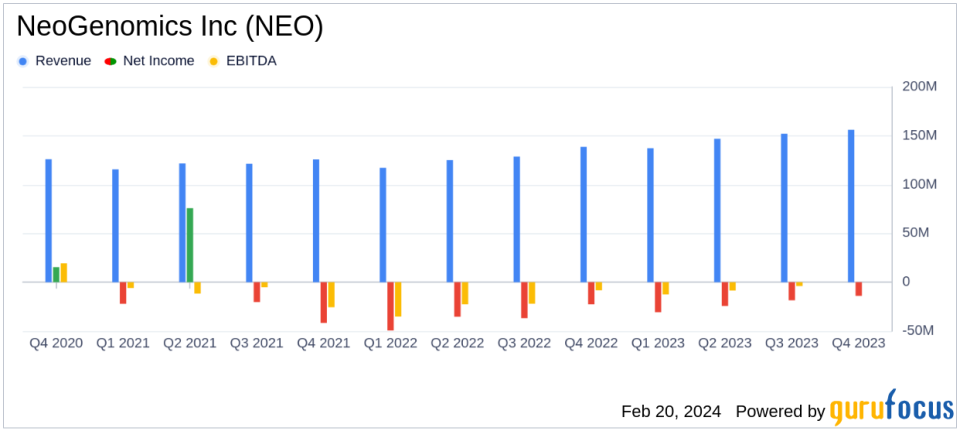

NEO's consolidated revenue for Q4 2023 was $156 million, a 12% increase over the same period in 2022. The full-year revenue also saw a healthy rise, reaching $592 million, which represents a 16% increase over the previous year. This growth was primarily driven by an increase in test volume and a more favorable test mix in the Clinical Services segment, alongside strategic reimbursement initiatives and growth in the Advanced Diagnostics segment.

Despite the revenue growth, the company faced a net loss, which, however, decreased by 37% to $14 million in Q4 and by 39% to $88 million for the full year. This reduction in net loss is a positive sign, reflecting NEO's efforts to streamline operations and improve profitability.

Adjusted EBITDA for Q4 was a positive $9 million, a remarkable improvement from a negative $1 million in the same quarter of the previous year. The full-year Adjusted EBITDA was also positive at $3 million, compared to a negative $48 million in 2022. These figures demonstrate NEO's ability to enhance its operational efficiency and financial stability.

Financial Metrics and Importance

Key financial metrics from the income statement include a 20% increase in Clinical Services revenue for Q4, reaching $130 million, and an 18% increase for the full year, totaling $496 million. Advanced Diagnostics revenue, however, decreased by 17% to $25 million in Q4, although it increased by 6% to $96 million for the full year.

The balance sheet shows that cash and cash equivalents, along with marketable securities, totaled $415 million at the end of the quarter. This liquidity is crucial for NEO as it plans to continue investing in its people and technologies, which is vital for sustaining growth and innovation in the diagnostics and research space.

From the cash flow statement, it is evident that NEO has managed to improve its cash position, ending the year with $342,488 in cash and cash equivalents, up from $263,180 the previous year.

"NeoGenomics' fourth quarter and full year 2023 results show the momentum and strength of our business as we continued to deliver long-term, sustainable growth on our way to becoming the leading oncology laboratory," said Chris Smith, CEO of NeoGenomics.

2024 Outlook and Challenges

NEO has issued financial guidance for 2024, projecting a consolidated revenue increase of 10-12% and a further reduction in net loss by 18-25%. This guidance reflects the company's confidence in its growth trajectory and its commitment to achieving profitability.

However, challenges remain, including the need to maintain the pace of innovation, manage operational costs effectively, and navigate the competitive landscape of the Medical Diagnostics & Research industry. NEO's ability to address these challenges will be critical to its success in the coming year.

For a more detailed analysis of NeoGenomics Inc (NASDAQ:NEO)'s financial results and future outlook, investors and interested parties are encouraged to review the full earnings release and listen to the webcast and conference call.

For further information and to stay updated on NEO's progress, visit GuruFocus.com for comprehensive financial data and expert analysis.

Explore the complete 8-K earnings release (here) from NeoGenomics Inc for further details.

This article first appeared on GuruFocus.