Neogen's (NEOG) Innovation Aids, Currency Headwind Stays

Neogen NEOG is well positioned to gain from its extensive global foothold and diverse product mix. However, a tough competitive landscape weighs on the stock. Neogen carries a Zacks Rank #3 (Hold) currently.

Neogen, in its mission to be the leading company in the development and marketing of solutions for food and animal safety, follows a vision or a growth strategy consisting of the following elements — increasing sales of existing products, introducing products and product lines, expanding international sales, and acquiring businesses and forming strategic alliances.

Going by the first part of the growth strategy, Neogen is progressing well in terms of picking the right growth markets and gaining a bigger share of those markets. In the fiscal first quarter, the Bacterial and General Sanitation business saw its highest growth, with particularly strong sales of Clean-Trace Hygiene Monitoring products. Within worldwide genomics, the company registered solid growth in international beef markets.

As far as the second part of the growth strategy is concerned, Neogen has been progressing well with its R&D activities. During the fiscal first quarter, Neogen R&D’s expenses were $6.7 million, up 37.2% year over year.

With respect to the third aspect of international growth, the company is expanding well in other geographies. It is also forming strategic alliances. In terms of the latest developments, acquisitions added 73.5% to total revenues during the fiscal second quarter.

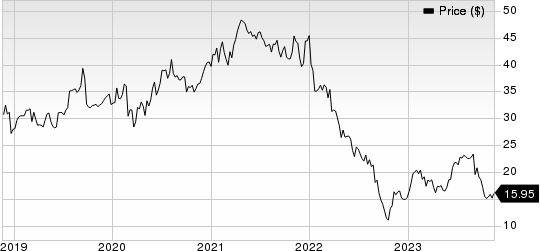

Neogen Corporation Price

Neogen Corporation price | Neogen Corporation Quote

Earlier, Neogen had completed the strategic bolt-on acquisition of Corvium, a SaaS provider behind its Neogen Analytics Platform. The buyout accelerated the company’s organic data strategy. Further, following the completion of the 3M Food Safety Division merger, its integration is currently on track. According to the company, the relocation of the former 3M pathogen and sample handling product lines in the Neogen facilities remains on track for completion in the third quarter of fiscal 2024.

Over the past year, shares have risen 2.2% against the industry’s 5.8% dip.

On the flip side, Neogen’s international business continues to be impacted by currency movements. During the pandemic, there was a move toward the safety of the U.S. dollar, which negatively impacted local currencies in the company’s international locations, particularly those where the outbreaks were less controlled.

Neogen faces intense competition from companies ranging from small businesses to divisions of large multinational companies. Some of these organizations have substantially greater financial resources than the company. Historically, Neogen has faced intense competition resulting from the development of new technologies by the company’s competitors, which could affect the marketability and profitability of its products.

Key Picks

Some better-ranked stocks in the broader medical space are Insulet PODD, Haemonetics HAE and DexCom DXCM. While Insulet presently sports a Zacks Rank #1 (Strong Buy), Haemonetics and DexCom each carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Insulet’s 2023 earnings per share have increased from $1.61 to $1.90 in the past 30 days. Shares of the company have decreased 41.6% in the past year compared with the industry’s decline of 6.7%.

PODD’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 105.1%. In the last reported quarter, it delivered an average earnings surprise of 77.4%.

Haemonetics’ stock has risen 13.2% in the past year. Estimates for Haemonetics’ 2023 earnings have increased from $3.82 to $3.86 in the past 30 days, while the same for 2024 have increased from $4.07 to $4.11.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.1%. In the last reported quarter, it posted an earnings surprise of 5.3%.

Estimates for DexCom’s 2023 earnings per share have increased from $1.23 to $1.41 in the past 30 days. Shares of the company have fallen 9.4% in the past year compared with the industry’s decline of 7.2%.

DXCM’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 36.4%. In the last reported quarter, it delivered an average earnings surprise of 47.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Neogen Corporation (NEOG) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report