Neogen's (NEOG) Q2 Earnings Miss Estimates, 2024 View Down

Neogen Corporation NEOG reported drab second-quarter fiscal 2024 earnings per share (EPS) of 11 cents, down 26.7% year over year. The reported figure also missed the Zacks Consensus Estimate by 26.7%.

Revenues in the fiscal second quarter dropped 0.2% on a year-over-year basis to $229.6 million. Core revenues fell 0.9%. Acquisitions and discontinued product lines contributed 0.2% revenue growth, while foreign currency added 0.5%. The metric missed the Zacks Consensus Estimate by 2.1%.

Segments in Detail

Within segments, Neogen registered Food Safety revenues of $164.4 million inthe fiscal second quarter, marking a 1.9% improvement from $161.3 million in the prior-year period, led by 0.7% core growth and 0.3% growth from acquisitions and discontinued product lines and a foreign currency benefit of 0.9%.

The core revenue growth in the segment was led by the Bacterial & General Sanitation product category, which benefited from new business wins and increased distributor orders for the company’s pathogen detection products.

Revenues from Animal Safety were $65.2 million, down 5% year over year. The downside was caused by a core revenue decline of 4.7%, a 0.2% headwind from discontinued product lines and a negative foreign currency impact of 0.1%.

Within the segment, the company registered a decline in the domestic Genomics business, led primarily by the attrition of a customer as the company continues to shift its primary strategic focus toward genetic testing for larger production animals.

On a global basis, Neogen’s Genomics business witnessed a core revenue decline in the mid-single-digit range, with increased sales in international beef markets offset by customer attrition in the United States, a result of the aforementioned strategic shift in focus.

Margin Details

Neogen’s fiscal second-quarter gross profit increased 3.8% year over year to $116.8 million. The gross margin expanded 193 basis points (bps) to 50.9%. The upside was led by a favorable impact from the product mix.

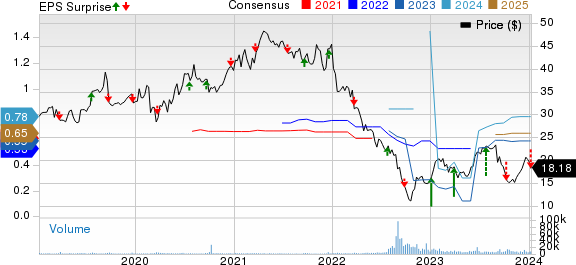

Neogen Corporation Price, Consensus and EPS Surprise

Neogen Corporation price-consensus-eps-surprise-chart | Neogen Corporation Quote

Sales and marketing expenses rose 23.3% to $44.8 million, whereas administrative expenses fell 32.8% from the prior-year quarter to $51.7 million.

R&D expenses were $5.8 million, down 15.9% year over year. Operating costs totaled $1.02 billion, down 14.9% from the last year’s quarter.

The company reported an operating profit of $14.5 million for the quarter under review compared with an operating loss of $7.7 million in the last year’s quarter.

Cash Position

Neogen exited the second quarter of fiscal 2024 with cash and investments of $205.8 million, compared with $178.8 million at the end of the first quarter of fiscal 2024. At the fiscal second-quarter end, the company’s non-current liabilities included a total outstanding debt of $900 million and committed borrowing headroom of $150 million.

Full-Year Guidance

Neogen updated its outlook for fiscal 2024.

The company continues to anticipate full-year revenues in the band of $935 million-$955 million (down from the previous guidance of $955-$985 million). The Zacks Consensus Estimate for the same is currently pegged at $960.9 million.

NEOG expects capital expenditures to be approximately $130 million, which includes approximately $100 million related specifically to the integration of the former 3M Food Safety Division (unchanged).

Our Take

Neogen exited the second quarter of fiscal 2024 with lower-than-expected earnings and revenues. The company registered a decline in the domestic Genomics business, led primarily by the attrition of a customer as the Company continues to shift its primary strategic focus towards genetic testing for larger production animals. The Animal Care & Other product category also experienced a core revenue decline due to lower sales of small-animal supplements and wound-care products. Neogen narrowed its revenue outlook for the fiscal 2024 due to macroeconomic headwinds, which looks discouraging.

On a positive note, the company’s legacy Food Safety business performed well, led by the Bacterial & General Sanitation product category, which benefited from new business wins and increased distributor orders for the company’s pathogen detection products. The gross margin expanded led by the favorable impact of product mix.

Zacks Rank and Other Key Picks

Neogen currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader medical space that are expected to report their earnings soon are Haemonetics HAE, DaVita DVA and HealthEquity HQY. Haemonetics and HealthEquity each carry a Zacks Rank #2, and DaVita sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Haemonetics’ earnings estimates have remained constant at $3.89 in 2023 and at $4.15 in 2024 in the past 30 days. The company is expected to release third quarter 2023 earnings on Feb 6.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.1%. In the last reported quarter, it posted an earnings surprise of 5.3%.

Estimates for DaVita’s 2023 earnings per share have remained constant at $8.07 in the past 30 days. The company is expected to release fourth quarter 2023 earnings on Feb 28.

DVA’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 36.6%. In the last reported quarter, it delivered an average earnings surprise of 48.4%.

Estimates for HealthEquity’s 2023 earnings per share have increased from $2.03 to $2.15 in the past 30 days. The company is expected to release fourth quarter 2023 earnings on Mar 19.

HQY’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 16.5%. In the last reported quarter, it delivered an average earnings surprise of 22.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Neogen Corporation (NEOG) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report