Nerdwallet Inc (NRDS) Faces Revenue Decline Amidst Economic Headwinds

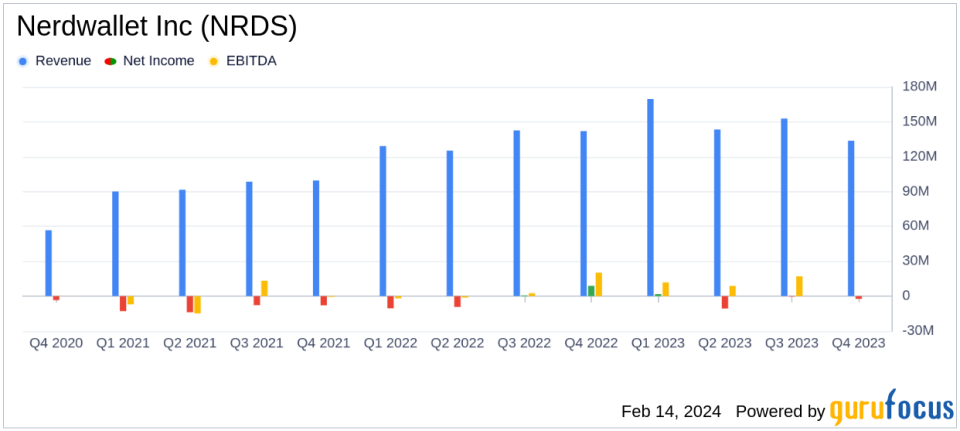

Revenue: Q4 revenue fell by 6% year-over-year to $133.7 million, with full-year revenue up 11% to $599.4 million.

Net Loss: Q4 GAAP net loss reported at $2.3 million, with a full-year net loss of $11.8 million.

Adjusted EBITDA: Q4 adjusted EBITDA reached $29.3 million, marking a 6% decrease year-over-year.

Operational Efficiency: Non-GAAP operating income for Q4 was $12.6 million, a 9% decrease from the previous year.

User Growth: Average Monthly Unique Users (MUUs) increased by 24% year-over-year to 24 million.

Cash Position: Cash and cash equivalents stood at $100.4 million, a 20% increase from the previous year.

On February 14, 2024, Nerdwallet Inc (NASDAQ:NRDS), a trusted source for financial guidance, released its 8-K filing, detailing the fourth quarter and full-year financial results for 2023. Despite a challenging economic environment, the company reported an 11% increase in full-year revenue, reaching $599.4 million. However, Q4 revenue saw a 6% decline year-over-year, settling at $133.7 million.

Nerdwallet Inc provides consumers and small and mid-sized businesses (SMBs) with free tools and expert content to make informed financial decisions. The company's offerings include credit cards, loan comparisons, and a suite of other financial products and services.

The fourth quarter was marked by a GAAP net loss of $2.3 million, or a $0.03 loss per diluted share, and a full-year GAAP net loss of $11.8 million, or a $0.15 loss per diluted share. Despite these losses, Nerdwallet Inc achieved a non-GAAP operating income of $12.6 million for Q4 and $26.4 million for the full year. Adjusted EBITDA for Q4 was $29.3 million, a 6% decrease from the same period last year, while the full-year adjusted EBITDA climbed to $97.6 million.

CEO Tim Chen acknowledged the headwinds faced in 2023 but emphasized the company's structural improvements and operational enhancements. CFO Lauren StClair expressed cautious optimism for recovery, highlighting the company's ability to navigate financial challenges.

The company's performance in various segments varied, with credit cards revenue decreasing by 18% year-over-year, while loans revenue increased by 5%. SMB products revenue grew by 6%, and emerging verticals revenue saw a slight decline of 3%. The increase in average Monthly Unique Users (MUUs) by 24% year-over-year to 24 million indicates a growing audience and engagement on the platform.

The balance sheet shows a healthy cash and cash equivalents balance of $100.4 million, up from $83.9 million the previous year. Total assets stood at $418.6 million, with total liabilities at $51.7 million, indicating a strong financial position.

Looking ahead, Nerdwallet Inc provided guidance for the first quarter of 2024, expecting revenue in the range of $155-$160 million and adjusted EBITDA between $21-$24 million. The company anticipates a 2024 annual GAAP operating income margin in the range of 3-4.5% and a non-GAAP operating income margin of 6.5-8%.

Overall, Nerdwallet Inc's earnings report reflects resilience in the face of economic challenges, with a focus on operational efficiency and user growth. The company's strategic improvements and cautious optimism for recovery position it to navigate the evolving financial landscape.

Explore the complete 8-K earnings release (here) from Nerdwallet Inc for further details.

This article first appeared on GuruFocus.