NetApp Inc (NTAP) Reports Solid Growth and Record Profitability in Q3 FY2024

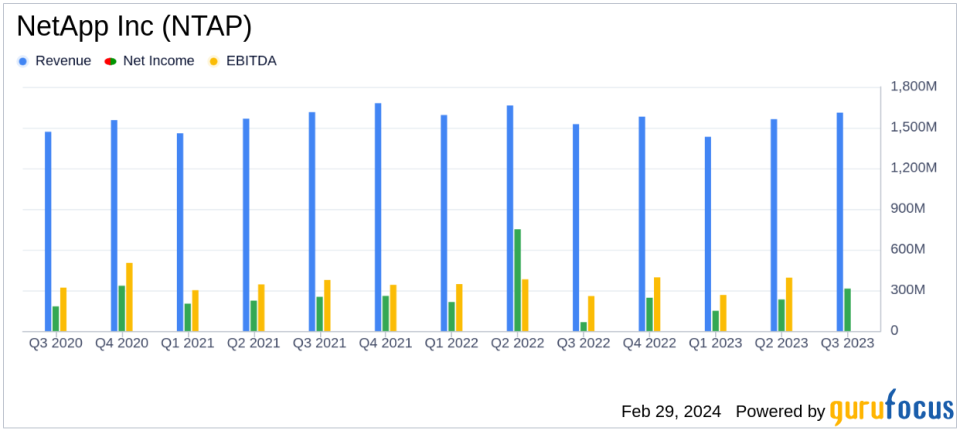

Revenue Growth: NetApp Inc (NASDAQ:NTAP) reported a 5% year-over-year increase in net revenues, reaching $1.61 billion.

Gross Margins: GAAP consolidated gross margins hit a record 72%, with non-GAAP consolidated gross margins at 73%.

Net Income: GAAP net income soared to $313 million, a significant rise from $65 million in the same quarter last year.

Earnings Per Share: GAAP net income per share was $1.48, while non-GAAP net income per share reached a record $1.94.

All-flash Array ARR: Achieved a 21% year-over-year increase, with an annualized revenue run rate of $3.4 billion.

Operating Cash Flow: Cash provided by operations was $484 million, up from $377 million in the prior year's quarter.

Capital Return: Returned $203 million to shareholders through share repurchases and dividends.

On February 29, 2024, NetApp Inc (NASDAQ:NTAP), a leader in enterprise data management and storage solutions, released its 8-K filing, detailing the financial results for the third quarter of fiscal year 2024. The company, known for its Hybrid Cloud and Public Cloud segments, has reported solid revenue growth and record profitability, indicating a strong market position and operational efficiency.

Financial Performance and Challenges

NetApp Inc (NASDAQ:NTAP) has demonstrated robust financial health in the third quarter, with a 5% increase in net revenues year-over-year, amounting to $1.61 billion. This growth is particularly significant in the context of the competitive and rapidly evolving hardware industry. The company's record all-flash array annualized revenue run rate, which increased by 21% to $3.4 billion, underscores NetApp's strength in product innovation and market demand for its storage solutions.

Despite these achievements, NetApp's Public Cloud segment revenue showed relatively flat year-over-year growth, which may pose a challenge as the company continues to navigate the cloud storage market. Additionally, the company's future performance could be influenced by broader economic factors, such as inflation, interest rates, and foreign exchange volatility.

Key Financial Metrics

NetApp Inc (NASDAQ:NTAP) reported significant improvements in profitability, with GAAP operating margins at 23% and non-GAAP operating margins reaching a record 30%. The company's GAAP net income per share increased dramatically to $1.48, up from $0.30 in the same quarter of the previous year. Non-GAAP net income per share also reached a record high of $1.94, compared to $1.37 in the prior year's quarter.

The balance sheet remains strong with $2.92 billion in cash, cash equivalents, and investments. The company's operational efficiency is reflected in the cash provided by operations, which increased to $484 million from $377 million in the third quarter of fiscal year 2023. These metrics are crucial as they demonstrate NetApp's ability to generate profit and maintain liquidity, which is vital for ongoing investments and shareholder returns.

Analysis and Outlook

NetApp Inc (NASDAQ:NTAP) has provided financial guidance for the fourth quarter of fiscal year 2024, with net revenues expected to be between $1.585 billion and $1.735 billion. The company anticipates GAAP earnings per share to be in the range of $1.25 to $1.35 and non-GAAP earnings per share to be between $1.73 and $1.83. For the full fiscal year 2024, NetApp expects net revenues to range from $6.185 billion to $6.335 billion, with consolidated gross margins projected to be between 70% and 72%.

CEO George Kurian expressed confidence in the company's strategy and execution, stating,

In Q3, our focused execution and continued operational discipline delivered solid revenue growth and again yielded company all-time highs across key profitability metrics."

This sentiment is bolstered by the company's innovation in data management and strategic partnerships, which continue to drive customer value and market leadership.

NetApp's commitment to shareholder returns is evident in its dividend policy, with the next cash dividend of $0.50 per share to be paid on April 24, 2024. The company's performance, strategic initiatives, and financial outlook position it well for continued growth and profitability in the dynamic data management industry.

For detailed financial tables and further information on NetApp Inc (NASDAQ:NTAP)'s third quarter results, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from NetApp Inc for further details.

This article first appeared on GuruFocus.