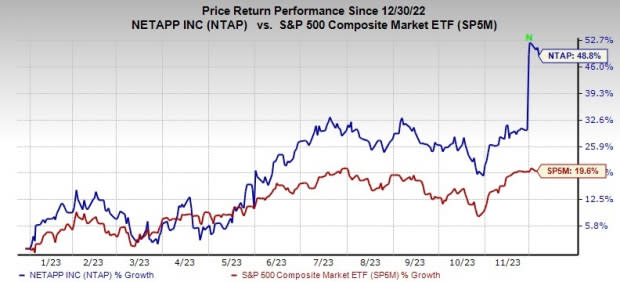

NetApp (NTAP) Appears Primed for Uptrend With 49% YTD Growth

NetApp NTAP witnessed strong momentum this year, with its shares rallying 48.8% year to date compared with S&P 500 composite’s 19.6% growth.

The Sunnyvale, CA-based company provides enterprise storage as well as data management software and hardware products, and services.

NTAP remains well-poised to gain from data-driven digital and cloud transformations. Frequent product launches, and secular trends in generative AI and high-performance computing bode well. Cost cutting efforts and new go-to-market measures, along with focused approach to boost storage and cloud business, are added positives.

The company recently reported second-quarter fiscal 2024 results, wherein both top and bottom-lines surpassed Zacks Consensus Estimate. Non-GAAP earnings per share (EPS) of $1.58 increased 7% year over year. Management anticipated non-GAAP EPS in the range of $1.35-$1.45.

Image Source: Zacks Investment Research

Though revenues of $1.562 billion decreased 6% (down 8% at constant currency basis) year over year, it remained within management’s guidance of $1.455-$1.605 billion band. Weak IT spending was an overhang.

Extensive cost discipline aided margin performance. Non-GAAP gross margin of 72% expanded 570 basis points (bps) from the prior-year levels. Non-GAAP operating income improved 6.6% year over year to $419 million. Non-GAAP operating margin extended 320 bps to 26.8%.

NetApp’s cash, cash equivalents and investments were $2.620 billion. Its long-term debt was $1.991 billion as of Oct 27, 2023. For the fiscal second quarter, the company generated net cash from operations of $135 million and free cash flow of $97 million (free cash flow margin was 6.2%).

Strong balance sheet helps NetApp to continue shareholder-friendly initiatives of dividend payouts. In second-quarter fiscal 2024, it returned $403 million to shareholders as dividend payouts and share repurchases. For fiscal 2023, the company had returned $1.28 billion to shareholders in the form of dividends and share repurchases.

Raised Outlook

Despite soft macroeconomic conditions, management expects strength in product, and hyper-scaler first-party and marketplace services to drive revenues. As a result, NTAP updated its fiscal 2024 revenue guidance.

NetApp now expects revenues to inch down 2% year over year compared with the earlier projection of a decline in mid-to-low single-digit range on a year-over-year basis.

It now forecasts non-GAAP (EPS to be between $6.05 and $6.25 (previous prediction: $5.65 and $5.85).

NetApp anticipates non-GAAP gross margin to be nearly 71% compared with 70% expected earlier. Non-GAAP operating margin is envisioned to be nearly 26% compared with 25% expected earlier.

A Few Near-Term Headwinds

Currently, NetApp’s performance is affected by a muted IT spending environment amid global macroeconomic turbulence. Weakness in public cloud subscription services is likely to remain a headwind in the near term for this Zacks Rank #3 (Hold) stock.

A Look at Estimates

NTAP’s fiscal 2025 revenues are anticipated to rise 3.4% year over year. The company’s earnings are expected to climb 8.6% and 4.6% on a year-over-year basis in fiscal 2024 and 2025, respectively.

Over the past 60 days, EPS estimates for fiscal 2024 have improved 5.9% to $6.07, while the same for fiscal 2025 has risen 3.8% to $6.37.

Stocks to Consider

Some better-ranked stocks worth consideration in the broader technology space are Cadence Design Systems CDNS, Adobe ADBE and Watts Water Technologies WTS, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Cadence’s 2023 EPS has remained unchanged in the past seven days at $5.11. CDNS’ long-term earnings growth rate is 19.5%.

Cadence’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 4.1%. Shares of CDNS have surged 57.1% in the past year.

The Zacks Consensus Estimate for Adobe’s fiscal 2024 EPS has remained unchanged in the past 30 days at $17.86. ADBE’s long-term earnings growth rate is 13.5%. Shares of ADBE have gained 79.1% in the past year.

The Zacks Consensus Estimate for Watts Water Technologies 2023 EPS has improved 2.8% in the past 60 days to $8.00.

WTS’ earnings outpaced the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 11.8%. Shares of WTS have jumped 28.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NetApp, Inc. (NTAP) : Free Stock Analysis Report

Adobe Inc. (ADBE) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report