Netflix stock spikes after Q3 earnings beat expectations

Netflix (NFLX) beat third-quarter earnings expectations in the third quarter, sending its shares more than 10% higher on Wednesday with competition stiffening as a new batch of streaming services hit the market.

Here were the main metrics from the report, compared to Bloomberg-compiled estimates:

Revenue: $5.24 billion vs. $5.25 billion expected and $4 billion YOY

GAAP earnings: $1.47 vs. $1.05 per share expected and 89 cents YOY

Domestic streaming paid net adds: +517,000 vs. 800,000 expected and 1.5 million YOY

International streaming paid net adds: +6.26 million vs. 6.2 million expected and 7.3 million YOY

Total paid net streaming additions totaled 6.8 million in Q3, coming in below the company’s earlier expectations for 7.0 million new subscribers during the three months ending in September. However, this still represented an all-time third-quarter record for net adds.

Shares of Netflix rallied from Wednesday’s closing level in late trading, adding 10.4% to $316.53 following the release.

Netflix also signaled it was taking strides to stem its free cash outflow as it spends heavily on content. In the third quarter, free cash flow totaled -$551 million, versus -$859 million in the comparable year-ago period. The company reiterated its guidance for free cash flow of about -$3.5 billion for the full year, and expects that free cash flow will improve in 2020 versus the current fiscal year.

For the fourth quarter, however, Netflix’s guidance was light on virtually all major measures.

The streaming giant expects to add a total of 7.6 million global subscribers in the final three months of the year, well below current consensus for 9.23 million adds. And guidance for fourth-quarter earnings per share of 51 cents came in below expectations for 82 cents a share, and fourth-quarter sales guidance of $5.44 billion was short of expectations by $70 million.

“Really what we’re just trying to do there is be prudent,” CFO Spencer Neumann said during the company’s earnings interview Wednesday. “There’s a number of moving parts in Q4 and variables that are just difficult to forecast.”

These variables include a dense content slate of new titles set for release over the next three months, the potential for some of the subscriber churn seen during the third quarter to extend into the fourth, and the launch of new competitors into the streaming space, Neumann said.

Netflix’s stock has been under considerable pressure since its last earnings report, when the company reported a loss of domestic paid subscribers for the first time since 2011. Shares were down 22% since reporting second-quarter results in July through Wednesday’s close, versus a little-changed S&P 500.

Netflix downplays ‘noisy’ streaming wars

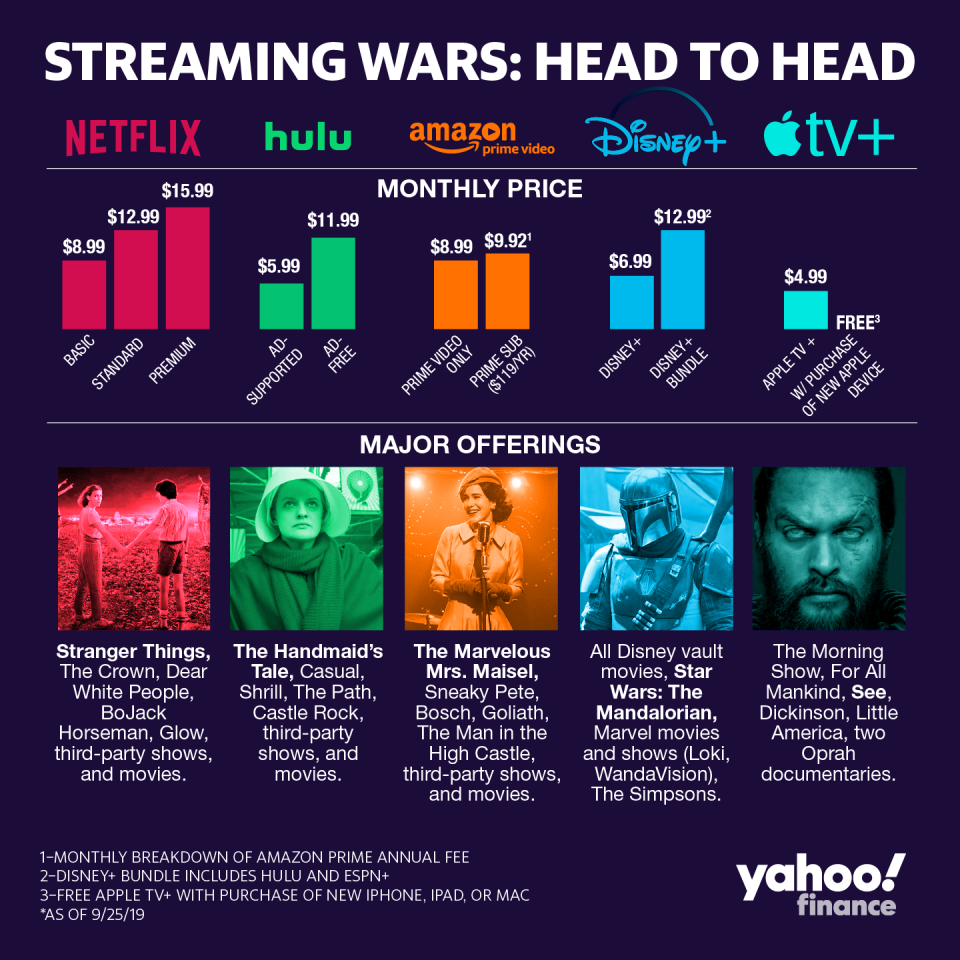

Next month, the pool of streaming services available to consumers is set to become more crowded. Disney (DIS) is set to launch its eponymous streaming service, Disney+, on November 12, priced at $7 per month. Apple’s (AAPL) streaming platform will launch November 1 at a starting price of $4.99 per month. Netflix’s standard service currently costs $12.99 per month. That’s in addition to other players already in the space, including Amazon (AMZN) Prime Video.

The specter of new entrants into the over-the-top streaming space has been an overhang for Netflix — an effect the company went out of its way to minimize in its Q3 report.

“The launch of these new services will be noisy,” Netflix said in its statement announcing third-quarter earnings. “There may be some modest headwind to our near-term growth, and we have tried to factor that into our guidance. In the long-term, though, we expect we’ll continue to grow nicely given the strength of our service and the large market opportunity.”

Last quarter, the company blamed a weaker slate of content, but not an increase in competition, for the miss on new subscribers.

“Many are focused on the ‘streaming wars,’ but we’ve been competing with streamers (Amazon, YouTube, Hulu) as well as linear TV for over a decade,” Netflix said Wednesday. “The upcoming arrival of services like Disney+, Apple TV+, HBO Max, and Peacock is increased competition, but we are all small compared to linear TV.”

That said, many analysts believe the market can sustain multiple players — and Netflix will retain its dominance in the near term as the less established players build up their audience and content.

“It is indeed a different operating environment for Netflix going forward, one in which the streaming landscape becomes more populated by large, well-funded players, some of whom are more closely controlling their content distribution,” JPMorgan (JPM) analyst Doug Anmuth wrote in a note ahead of third-quarter results.

“But at the same time, we believe the global disruption of linear TV is a strong secular trend that remains early stage in many international markets, and Netflix will remain a key beneficiary as more people cut the cord,” he added.

In the third-quarter specifically, Netflix had the benefit of what Cowen analyst John Blackledge called an “original content tailwind,” with a beefier slate of original programming helping to buoy results.

Third-quarter new titles included the third season of “Stranger Things” – a franchise that Netflix’s management has said performs “off the charts in every country in the world” – as well as new seasons of “Orange is the New Black” and “Mindhunter.”

Moreover, Netflix has invested heavily in locally produced original series, helping to drive gains in international paid subscribers, Blackledge added. Netflix has added more international subscribers than domestic subscribers in every year since 2014.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

FedEx CEO: ‘Whistling past the graveyard’ on the U.S. consumer belies a broader slowdown

There won’t be ‘billion-dollar beverage brands’ in the future: Iris Nova CEO

Iris Nova CEO calls his company the ‘Netflix’ of the beverage space

Tech companies like Lyft want your money – not ‘your opinion’

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.