NetScout Systems Inc (NTCT) Faces Headwinds: A Dive into Q3 FY24 Earnings

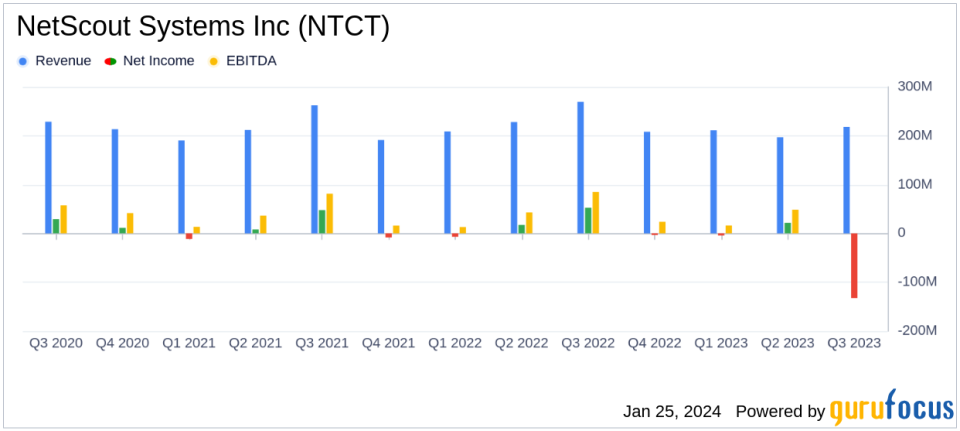

Revenue: Q3 FY24 total revenue was $218.1 million, a decrease from $269.5 million in Q3 FY23.

Net Loss: GAAP net loss for Q3 FY24 was $132.6 million, including a non-cash goodwill impairment charge, compared to a net income of $52.6 million in Q3 FY23.

Non-GAAP Performance: Non-GAAP net income was $52.0 million for Q3 FY24, down from $73.0 million in Q3 FY23.

Share Repurchase: NetScout repurchased 705,892 shares at an average price of $26.66 per share during Q3 FY24.

Financial Outlook: Updated FY24 revenue forecast at the low end of the previously disclosed range of $840 million to $860 million.

Cost Containment: Non-GAAP EPS performance expected at the higher end of the previously disclosed range due to ongoing cost containment actions.

On January 25, 2024, NetScout Systems Inc (NASDAQ:NTCT) released its 8-K filing, reporting financial results for the third quarter of fiscal year 2024. The company, a leading provider of service assurance and cybersecurity solutions, faced a challenging market environment with constrained customer spending and elongated sales cycles, particularly impacting its service assurance business. Despite these challenges, the cybersecurity business continued to grow year-over-year, reflecting the prioritization of cybersecurity spending by enterprise and service provider customers.

NetScout's Q3 FY24 total revenue was $218.1 million, down from $269.5 million in the same quarter of the previous fiscal year. The company's product revenue decreased to $95.8 million, constituting 44% of total revenue, compared to $149.5 million or 55% in Q3 FY23. Service revenue, however, saw a slight increase to $122.2 million from $120.1 million in the prior year's quarter.

The company reported a significant GAAP net loss of $132.6 million for Q3 FY24, which includes a non-cash goodwill impairment charge of $167.1 million. This is a stark contrast to the net income of $52.6 million reported in Q3 FY23. The non-GAAP net income for the quarter was $52.0 million, or $0.73 per share (diluted), down from $73.0 million, or $1.00 per share (diluted), in the same quarter of the previous year.

NetScout's cash, cash equivalents, and marketable securities stood at $330.1 million as of December 31, 2023, a decrease from $427.9 million as of March 31, 2023. The company also continued its share repurchase program, buying back shares worth approximately $18.8 million during the quarter.

Looking ahead, NetScout anticipates full fiscal year 2024 revenue to be at the low-end of its previously disclosed target range, with non-GAAP EPS performance expected to be at the higher end due to benefits from cost containment actions. The company remains strategically focused on leveraging its 'Visibility Without Borders' platform to address the performance, availability, and security challenges of the digital world.

Financial Tables and Outlook

The detailed financial tables provided by NetScout offer a reconciliation of GAAP to non-GAAP financial measures, highlighting the adjustments made for share-based compensation expense, amortization of acquired intangible assets, restructuring charges, and the significant goodwill impairment charge.

For the fiscal year 2024, NetScout has updated its financial outlook, now expecting revenue to be approximately $840 million, with a GAAP loss per share in the range of ($1.29) to ($1.24), primarily due to the non-cash goodwill impairment charge. Non-GAAP net income per share (diluted) is expected to be in the range of $2.15 to $2.20.

Investors and analysts can access the conference call to discuss the third-quarter fiscal year 2024 financial results through NetScout's website or by dialing in directly. The company's use of non-GAAP financial information is intended to provide additional insights and should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP.

For value investors and potential GuruFocus.com members, NetScout's Q3 FY24 earnings report underscores the importance of monitoring both the challenges and strategic initiatives of companies within the software industry. The company's ability to navigate a difficult market environment while maintaining focus on long-term growth and shareholder value will be critical in the coming quarters.

Explore the complete 8-K earnings release (here) from NetScout Systems Inc for further details.

This article first appeared on GuruFocus.