Neurocrine Biosciences Inc's Chief Legal Officer Darin Lippoldt Sells Shares: An Insider Analysis

Neurocrine Biosciences Inc (NASDAQ:NBIX), a prominent player in the biopharmaceutical industry, has recently witnessed a significant insider sell by its Chief Legal Officer, Darin Lippoldt. On November 27, 2023, Lippoldt sold 10,919 shares of the company, a transaction that has caught the attention of investors and market analysts alike.

Who is Darin Lippoldt?

Darin Lippoldt serves as the Chief Legal Officer at Neurocrine Biosciences Inc. With a crucial role in overseeing the company's legal affairs, Lippoldt's actions, especially in the stock market, are closely monitored. His recent sell-off of shares is particularly noteworthy given his insider position and the potential implications it may have on investor perception.

Neurocrine Biosciences Inc's Business Description

Neurocrine Biosciences Inc is a biopharmaceutical company focused on developing treatments for neurological and endocrine-related diseases and disorders. The company's portfolio includes products and candidates targeting conditions such as Parkinson's disease, tardive dyskinesia, and endometriosis, among others. Neurocrine Biosciences is known for its innovative approach to drug development, aiming to address unmet medical needs and improve the quality of life for patients.

Analysis of Insider Buy/Sell and Relationship with Stock Price

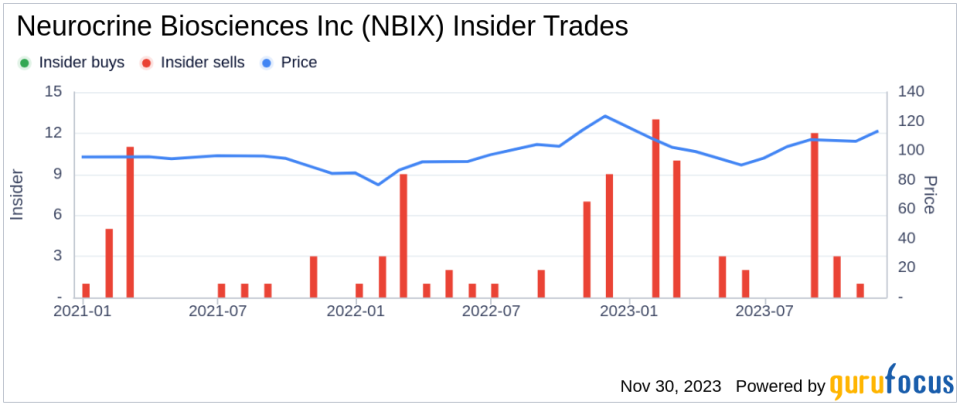

The insider transaction history for Neurocrine Biosciences Inc reveals a pattern that could be of interest to investors. Over the past year, Darin Lippoldt has sold a total of 30,576 shares and has not made any purchases. This one-sided activity raises questions about the insider's confidence in the company's future prospects.

The broader insider trend for Neurocrine Biosciences Inc shows a total absence of insider buys over the past year, contrasted with 46 insider sells during the same period. This trend could suggest that insiders, including Lippoldt, may believe that the stock is fully valued or that they are taking profits after a period of stock appreciation.

Valuation and Market Reaction

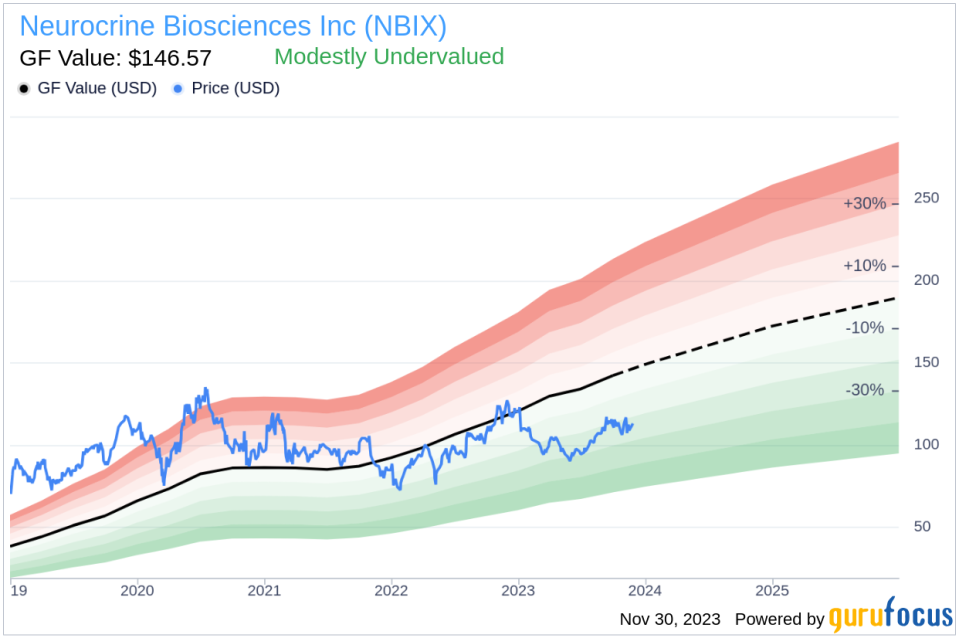

On the day of Lippoldt's recent sell, Neurocrine Biosciences Inc's shares were trading at $112.27, giving the company a market cap of $11.155 billion. The price-earnings ratio stood at 61.04, higher than the industry median of 23.12 but lower than the company's historical median price-earnings ratio. This indicates that while the stock may be trading at a premium compared to its peers, it is somewhat more reasonably priced in the context of its own trading history.With a price of $112.27 and a GuruFocus Value of $146.57, Neurocrine Biosciences Inc has a price-to-GF-Value ratio of 0.77, suggesting that the stock is modestly undervalued based on its GF Value.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

Conclusion

The recent insider sell by Darin Lippoldt, the Chief Legal Officer of Neurocrine Biosciences Inc, is a significant event that warrants attention from investors. While the company's stock appears modestly undervalued based on the GF Value, the lack of insider buying and the prevalence of insider selling over the past year could be a signal for investors to proceed with caution. As always, it is essential for investors to conduct their own due diligence and consider the broader market context when making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.