Neurocrine Biosciences Inc's Meteoric Rise: Unpacking the 22% Surge in Just 3 Months

Neurocrine Biosciences Inc (NASDAQ:NBIX), a leading player in the Drug Manufacturers industry, has seen a significant uptick in its stock price over the past three months. The company's market cap stands at $11.21 billion, with its stock price currently at $114.83. Over the past week, the stock price has seen a gain of 3.83%, and over the past three months, it has surged by an impressive 22.09%. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. The current GF Value of Neurocrine Biosciences Inc is $144.69, compared to the past GF Value of $144.62 three months ago. This indicates that the stock is modestly undervalued, a significant improvement from being significantly undervalued three months ago.

Company Overview

Neurocrine Biosciences Inc is a research-based pharmaceutical company that is making significant strides in the central nervous system and endocrine-related categories. The company's three late-stage clinical programs include elagolix, a hormone-releasing antagonist for women's health, opicapone, an inhibitor for Parkinson's patients, and ingrezza for Tourette syndrome. These innovative programs have positioned Neurocrine Biosciences Inc as a key player in the pharmaceutical industry.

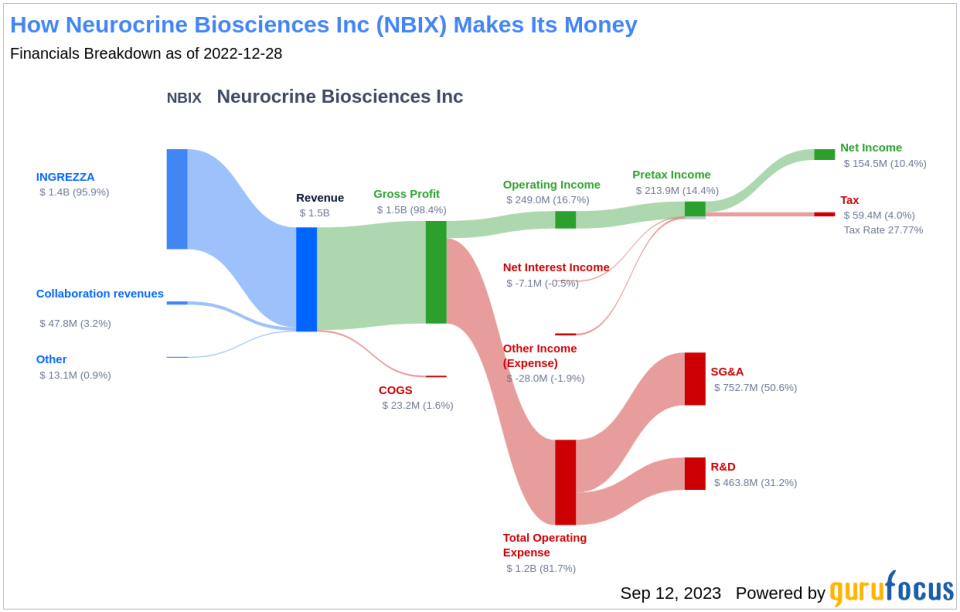

Profitability Analysis

Neurocrine Biosciences Inc has a Profitability Rank of 6/10, indicating a solid profitability profile. The company's Operating Margin of 17.60% is better than 80% of its industry peers. Its ROE and ROA stand at 10.74% and 7.68% respectively, outperforming a majority of its competitors. The company's ROIC of 18.90% is better than 88.79% of the companies in the industry. Over the past decade, the company has had 5 years of profitability, better than 29.46% of the companies in the industry.

Growth Prospects

Neurocrine Biosciences Inc has a Growth Rank of 7/10, indicating strong growth potential. The company's 3-Year Revenue Growth Rate per Share is 22.30%, and its 5-Year Revenue Growth Rate per Share is 46.90%, both outperforming a majority of its industry peers. The company's projected Total Revenue Growth Rate for the next 3 to 5 years is 16.30%, better than 87.2% of the companies in the industry. The company's 3-Year EPS without NRI Growth Rate is 58.70%, better than 90.88% of the companies in the industry.

Major Stock Holders

Jim Simons (Trades, Portfolio) is the top holder of Neurocrine Biosciences Inc's stock, holding 1,643,402 shares, which represents 1.68% of the company's shares. PRIMECAP Management (Trades, Portfolio) holds the second-largest number of shares, with 393,360 shares, representing 0.4% of the company's shares. Eaton Vance Worldwide Health Sciences Fund (Trades, Portfolio) holds 170,963 shares, representing 0.18% of the company's shares.

Competitive Landscape

Neurocrine Biosciences Inc faces competition from several companies in the Drug Manufacturers industry. Catalent Inc (NYSE:CTLT) with a stock market cap of $8.85 billion, Viatris Inc (NASDAQ:VTRS) with a stock market cap of $11.99 billion, and Elanco Animal Health Inc (NYSE:ELAN) with a stock market cap of $5.8 billion are among the company's top competitors.

Conclusion

In conclusion, Neurocrine Biosciences Inc has demonstrated strong stock performance, profitability, and growth potential. The company's stock has seen a significant surge over the past three months, and its profitability and growth ranks are impressive. The company's major stock holders and competitors further underscore its position in the industry. Given these factors, Neurocrine Biosciences Inc appears to be well-positioned for future growth and profitability.

This article first appeared on GuruFocus.