Neurocrine Biosciences Is Pioneering Therapies for Neurological Disorders

Neurocrine Biosciences Inc. (NASDAQ:NBIX) is a pharmaceutical company headquartered in San Diego that specializes in the development and commercialization of medicines to combat major depressive disorder, schizophrenia and various neurological and neuroendocrine disorders.

Investment thesis

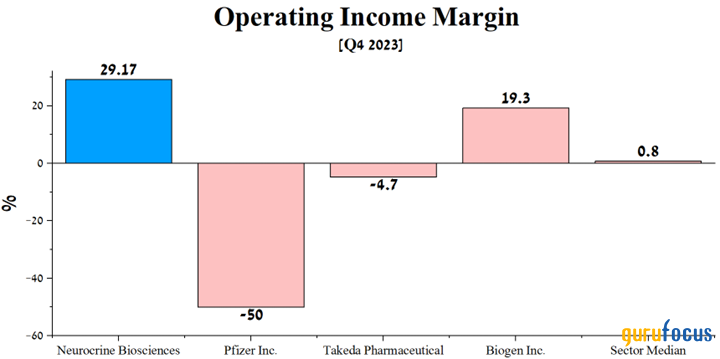

On Feb. 7, the company published financial results for the three months ended Dec. 31, 2023, which pleased investors due to the continued extremely high demand for Ingrezza, its flagship product, and the continued growth of its operating income margin, which is significantly higher than that of its key competitors.

Source: Author's elaboration, based on GuruFocus data.

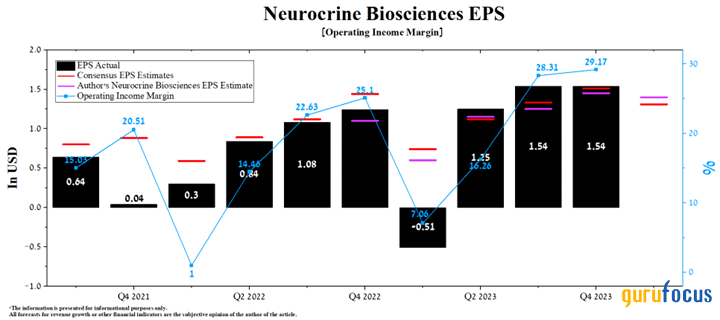

Its non-GAAP earnings per share were $1.54, up 24.20% from the prior-year quarter.

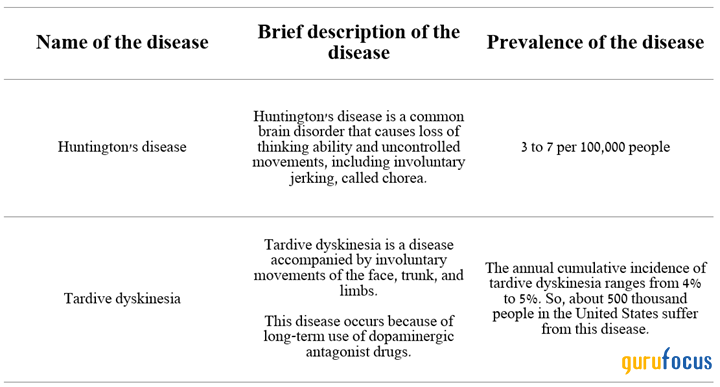

Neurocrine Biosciences' management expects total Ingrezza sales to be between $2.10 billion and $2.20 billion in 2024, up 15.60% year over year. We believe this financial guidance is conservative, and our model projects its sales will exceed the high end of this range and reach $2.35 billion due in part to the expected label expansion, competitive advantages relative to Xenazine and Teva's Austedo and the growth of the global Huntington's disease treatment market.

Some key competitive advantages of Neurocrine's flagship medicine are a shorter titration period to the recommended dose, less frequent dosing and a more favorable safety profile.

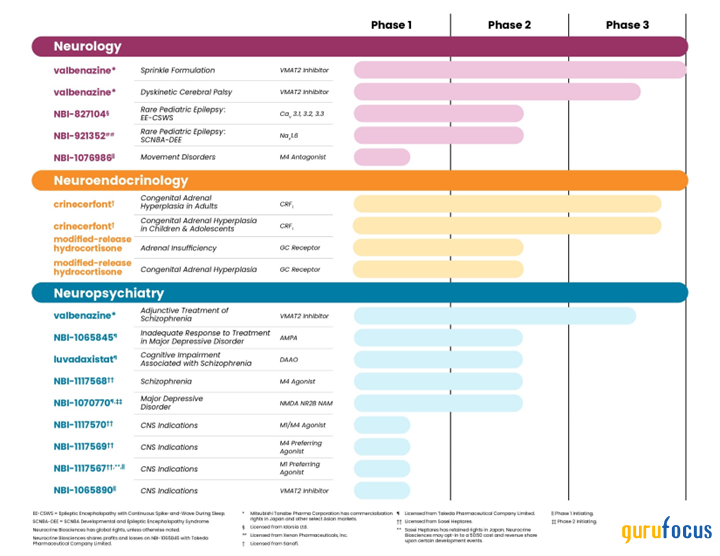

The second investment thesis is the company's rich portfolio of experimental medicines, developed using innovative technologies, through which Neurocrine can strengthen its position in the global neurological disorder drugs market.

Source: Neurocrine Biosciences presentation.

One of the company's most interesting product candidates is crinecerfont. Its mechanism of action is based on blocking corticotropin-releasing factor type 1 receptor, which ultimately helps to reduce the production of adrenal hormones.

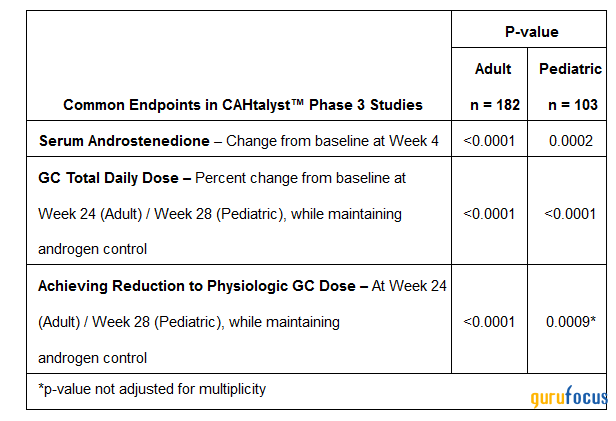

On Sept. 12, Neurocrine Biosciences published highly positive results of a pivotal clinical trial evaluating the efficacy and safety profile of crinecerfont for the treatment of adult patients with classic congenital adrenal hyperplasia. Less than a month later, the company reported that the Phase III CAHtalyst Pediatric study also met primary and secondary endpoints, giving us confidence not only that crinecerfont has a strong chance of approval, but also that it will become a commercially successful drug in the fast-growing global CAH treatment market.

Source: Neurocrine Biosciences

Also on the quarterly earnings call, the company's management reported progress regarding the NDA submission for crinecerfont in the United States. It said:

"Recall the agency granted breakthrough therapy designation for crinecerfont at the end of last year. This designation serves as an acknowledgment of the serious and life-threatening nature of CAH, highlights the significant unmet need that exists in the treatment of the disease with no approved treatment for the past 60-plus years, and identifies crinecerfont as a potentially valuable treatment for patients with CAH."

We initiate our coverage of Neurocrine Biosciences with an outperform rating for the next 12 months.

Quarterly financial results and outlook for 2024

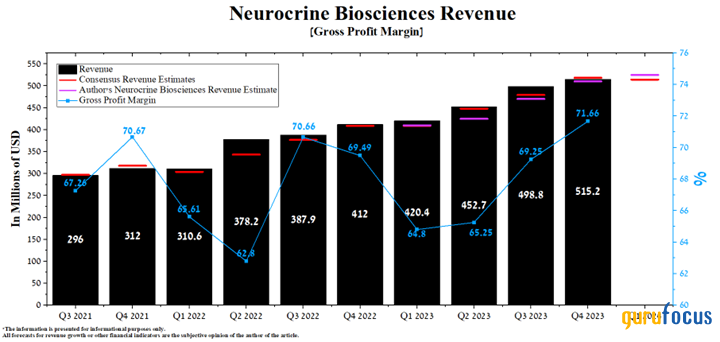

Neurocrine Biosciences' revenue for the fourth quarter of 2023 was about $515.20 million, exceeding our expectations by about $5.20 million and, just as importantly, growing 25.05% year over year.

Moreover, the company's actual revenue beat analysts' consensus estimates in seven of the last eight quarters, indicating that Mr. Market continues to underestimate the commercial prospects of its Food and Drug Administration-approved medications despite growing demand for them.

Source: Author's elaboration, based on analyst projections.

A key contributor to the company's improved financial position is Ingrezza (valbenazine), a medicine for treating adult patients with tardive dyskinesia as well as chorea associated with Huntington's disease.

Source: Author's elaboration, based on MedlinePlus data.

Its mechanism of action is based on the inhibition of vesicular monoamine transporter 2, thereby reducing the availability of dopamine in the presynaptic cleft, which ultimately leads to a decrease in involuntary movements in patients.

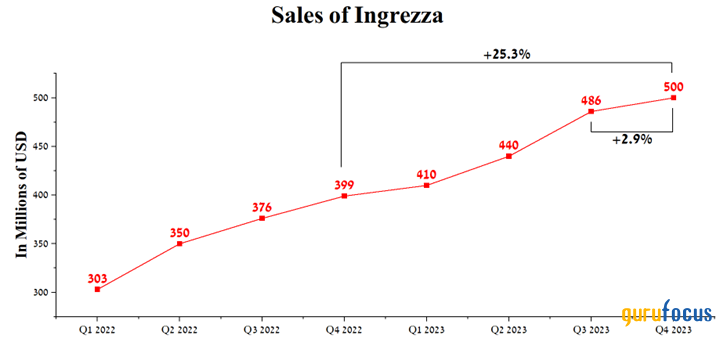

Ingrezza's total sales were $500 million in the fourth quarter, an increase of 25.30% year over year. This was driven by its FDA approval for the treatment of patients with chorea associated with Huntington's disease, aggressive expansion of its sales team and the publication of additional clinical trial results confirming its long-term effectiveness and acceptable safety profile.

Source: Author's elaboration, based on quarterly securities reports.

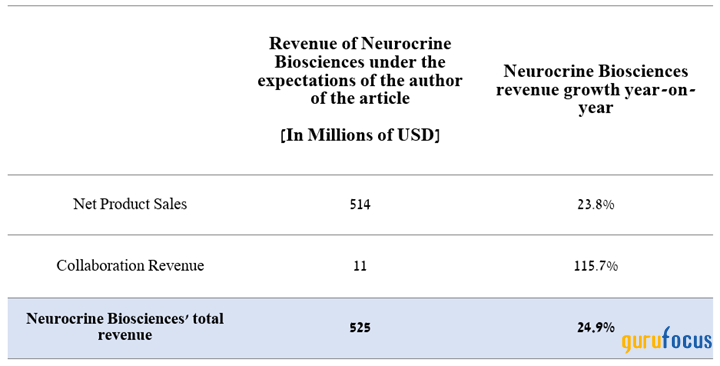

On May 2, the company will publish financial results for the first three months of 2024. According to analyst projections, Neurocrine's total revenue for the first quarter is expected to range from $493 million to $546 million, up 22.4% year over year.

Source: Author's elaboration, based on GuruFocus data.

On the other hand, our model projects the company's total revenue will reach $525 million, which is about $10.60 million above the median of the above range, mainly due to the increase in sales of Ingrezza, as well as royalties from net sales of elagolix, which was developed jointly with AbbVie (NYSE:ABBV).

Source: Created by Author

Neurocrine Biosciences' operating income margin was 29.17% for the fourth quarter, an increase of 4.07% year over year, indicating the business strategies implemented under the leadership of Kevin Gorman are beginning to bear fruit.

According to our estimates, this financial metric will reach 24.50% in 2024 and increase to 30.50% by 2025, mainly due to increased demand for Ingrezza, which has competitive advantages over Xenazine and Teva Pharmaceutical's Austedo (NYSE:TEVA), a decrease in the cost of raw materials necessary for the production of its medicines and potential regulatory approval of a new oral granule formulation of Ingrezza.

The FDA's decision is expected at the end of April. If Neurocrine Biosciences' application is approved, it will not only accelerate sales of the company's flagship product, but, more importantly, improve the quality of life of patients because it will relieve many of them from difficulties with swallowing capsules.

Besides, analysts forecast the company's earnings per share in the first quarter to be between 74 cents and $1.97, which is significantly higher than the previous year. Meanwhile, we expect the company's earnings to be 9 cents above the median of this range, reaching $1.40.

A key driver of the potential year-over-year increase in income profit is the company's agreement last year with Voyager Therapeutics (NASDAQ:VYGR) to co-develop various gene therapies for neurological diseases. Neurocrine paid $175 million upfront in January 2023 as part of this partnership.

Source: Author's elaboration, based on GuruFocus data.

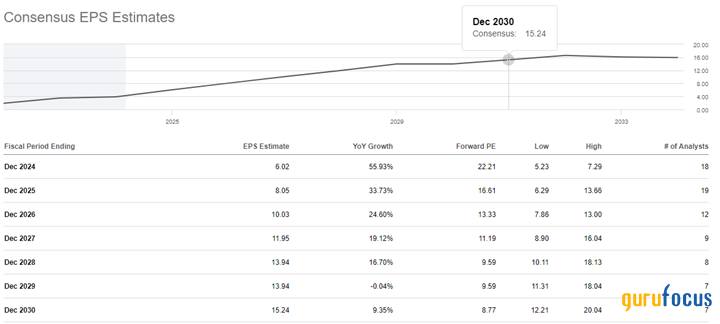

The company's trailing 12-month non-GAAP price-earnings ratio is 55.90, indicating financial market participants continue to be highly optimistic about its business prospects.

More globally, its price-earnings ratio is expected to decline to 9.59 by 2028, which we estimate is extremely attractive for long-term investors looking for pharmaceutical companies with an extensive pipeline of FDA-approved medications and product candidates with unique and novel mechanisms of action.

Source: Author's elaboration, based on analyst projections.

Conclusion

Potential risks that could negatively impact Neurocrine Biosciences' investment attractiveness and that financial market participants need to consider are the slower pace of expansion of its portfolio of FDA-approved drugs due to the need for additional clinical trials, as well as the negative impact of reforms and legislative initiatives, including the Biden administration's Inflation Reduction Act.

On the other hand, Ingrezza's sales growth rate has pleasantly surprised us in recent quarters due to its competitive advantages over Austedo and Xenazine, and we expect Neurocrine's flagship product to continue to gain share in the tardive dyskinesia treatment market.

Furthermore, despite the company's growing research and development costs due to expensive pivotal clinical trials, its operating income margin continues to grow year over year, coupled with its relatively low total debt/Ebitda ratio, making Neurocrine Biosciences an attractive asset for long-term investors.

We initiate our coverage of Neurocrine Biosciences with an outperform rating for the next 12 months.

This article first appeared on GuruFocus.