Neuronetics Inc (STIM) Reports Record Revenues in Q4 and Full Year 2023

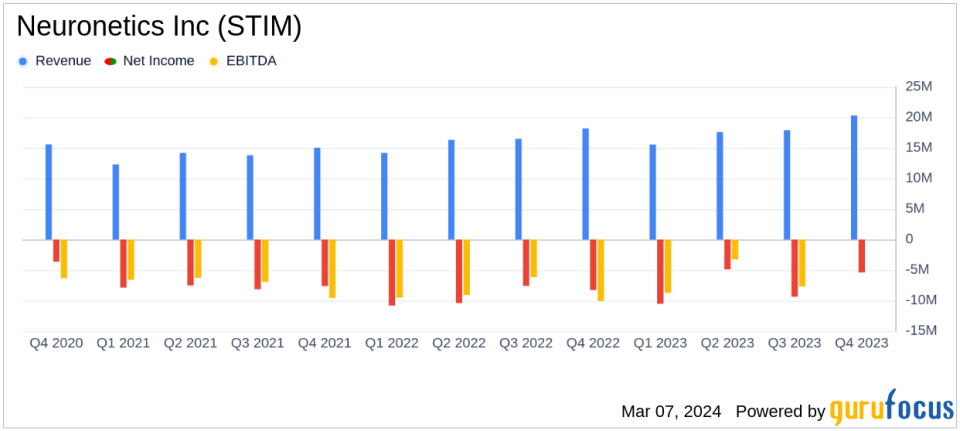

Q4 Revenue Growth: 12% increase to $20.3 million, driven by U.S. treatment session sales.

Full Year Revenue Increase: 9% rise to $71.3 million, with both U.S. and international revenues up.

Gross Margin Expansion: Q4 gross margin improved to 77.6%, up from 75.9% in Q4 2022.

Operating Expenses: Decreased by 6.2% in Q4 and 2.9% for the full year.

Net Loss Reduction: Q4 net loss narrowed to $(5.4) million from $(8.3) million in Q4 2022.

Positive Cash Flow: Achieved $1.5 million in cash generation for Q4, a first in company history.

2024 Outlook: Anticipates total worldwide revenue between $78.0 million and $80.0 million.

On March 5, 2024, Neuronetics Inc (NASDAQ:STIM), a commercial stage medical technology company, released its 8-K filing, announcing record financial and operating results for the fourth quarter and the full year of 2023. Neuronetics, known for its NeuroStar Advanced Therapy System for psychiatric disorders, reported significant revenue growth and operational achievements, setting a positive tone for 2024.

Financial Performance Highlights

Neuronetics' fourth quarter revenue saw a 12% increase to $20.3 million, compared to $18.2 million in the same period the previous year. This growth was primarily fueled by a 20% increase in U.S. treatment session sales. Despite a slight decrease in NeuroStar Advanced Therapy System sales, the company's overall U.S. revenue grew by 13%. International revenue, however, experienced a 35% decrease.

For the full year, Neuronetics' revenue climbed by 9% to $71.3 million, with U.S. revenue up by 9% and international revenue by 12%. The company's gross margin for the fourth quarter expanded to 77.6%, an improvement from the previous year's 75.9%. However, the full year gross margin saw a decrease to 72.5%, attributed to inventory impairment and one-time expenses related to a transition to a new contract manufacturer.

Operational Efficiency and Market Expansion

Operating expenses for the fourth quarter decreased by 6.2%, and by 2.9% for the full year, reflecting effective expense management and reduced marketing spending. Neuronetics achieved a milestone by generating positive cash flow of $1.5 million in the fourth quarter, a testament to its strong revenue growth and margin improvement efforts.

The company also launched the first cohort of its Better Me Guarantee Provider pilot program, aiming to enhance patient care standards and access to NeuroStar TMS therapy. Policy updates from healthcare providers like Magellan and BlueCross BlueShield of Kansas City have improved patient access to NeuroStar, indicating a favorable shift in mental health coverage.

Looking Ahead

Neuronetics provided an optimistic business outlook for 2024, with projected total worldwide revenue between $78.0 million and $80.0 million, and operating expenses expected to be between $80.0 million and $84.0 million. The company's strategic initiatives and operational improvements position it well for continued growth in the neurohealth therapy market.

Neuronetics' commitment to transforming lives through innovative treatments like NeuroStar Advanced Therapy for Mental Health is reflected in its strong financial performance and operational achievements. With a focus on expanding access and improving patient outcomes, Neuronetics is poised for further success in the coming year.

Investors and analysts interested in further details can access the webcast and conference call hosted by Neuronetics' management team, providing additional insights into the company's performance and future plans.

For value investors and potential GuruFocus.com members, Neuronetics Inc (NASDAQ:STIM) presents a compelling case of a medical technology company on the rise, with a clear strategic vision and a track record of financial growth. The company's latest earnings report underscores its potential in the neurohealth therapy market and its commitment to improving patient care.

Explore the complete 8-K earnings release (here) from Neuronetics Inc for further details.

This article first appeared on GuruFocus.