Nevro Corp (NVRO) Reports Modest Revenue Growth Amidst Strategic Shifts

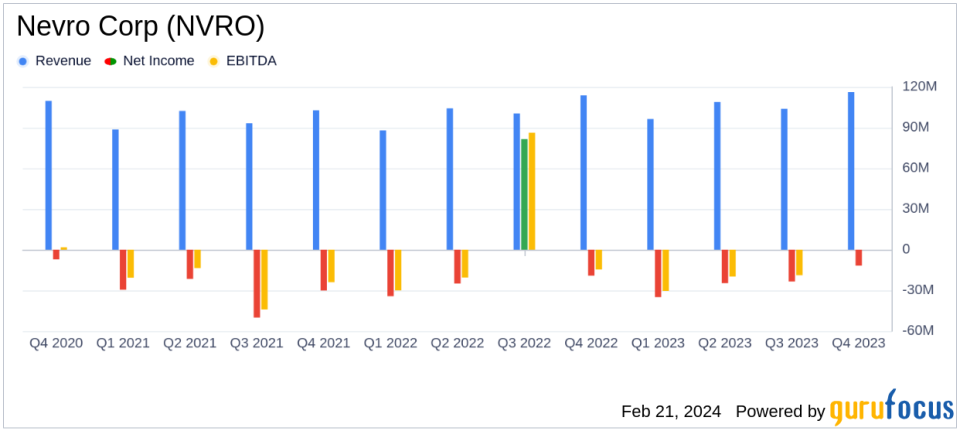

Revenue Growth: Q4 worldwide revenue increased by 2% year-over-year to $116.2 million; full-year revenue up 5% to $425.2 million.

Net Loss Improvement: Q4 net loss from operations narrowed to $11.8 million from $19.4 million in the prior year; full-year net loss was $99.3 million.

Adjusted EBITDA: Q4 adjusted EBITDA turned positive at $8.4 million; full-year adjusted EBITDA loss improved to $17.7 million from $23.8 million in 2022.

Strategic Acquisitions and Restructuring: Acquisition of Vyrsa Technologies and a workforce reduction aimed at long-term growth and profitability.

2024 Outlook: Full-year 2024 revenue projected to grow 2% to 5%, with adjusted EBITDA loss expected to narrow.

Nevro Corp (NYSE:NVRO) released its 8-K filing on February 21, 2024, detailing its fourth-quarter and full-year 2023 financial results and providing guidance for the full-year and first-quarter of 2024. The company, known for its HFX spinal cord stimulation (SCS) platform for chronic pain treatment, has shown a modest increase in revenue amidst strategic changes aimed at long-term profitability.

Financial Performance and Strategic Developments

In Q4 2023, Nevro saw worldwide revenue grow to $116.2 million, a 2% increase both reported and on a constant currency basis compared to the same period in 2022. This growth was partly driven by a 29% increase in sales for the Painful Diabetic Neuropathy (PDN) Indication, which amounted to approximately $22.4 million. Despite a slight decrease in U.S. trial procedures, U.S. PDN trial procedures made up 24% of total U.S. trials, reflecting a 17% growth over the previous year's quarter.

The company's gross profit for the quarter was $81.5 million, with a gross margin of 70.1%, up from 66.1% in Q4 2022. This improvement was primarily due to a shift to higher margin products and reduced scrap-related charges. Operating expenses decreased slightly to $93.3 million, with a notable $3.0 million one-time expense related to the Vyrsa acquisition.

Nevro's net loss from operations for Q4 2023 was $11.8 million, an improvement from a net loss of $19.4 million in the same period the previous year. The adjusted EBITDA for the quarter was a positive $8.4 million, a significant turnaround from a loss of $1.4 million in Q4 2022.

For the full year of 2023, Nevro reported a worldwide revenue of $425.2 million, a 5% increase over the previous year. The full-year net loss from operations was $99.3 million, compared to a net income from operations of $6.2 million in 2022, which included significant litigation-related credits. The adjusted EBITDA loss for the full year improved to $17.7 million from $23.8 million in 2022.

Looking Ahead: 2024 Financial Guidance

Looking forward, Nevro expects full-year 2024 revenue to be in the range of $435 million to $445 million, representing a 2% to 5% growth on a reported and constant currency basis over 2023. The adjusted EBITDA is projected to be a loss in the range of $8 million to $14 million, improving from a loss of $17.7 million in 2023.

For the first quarter of 2024, the company anticipates revenue to be between $97 million and $99 million, with an adjusted EBITDA loss of approximately $15 million to $16 million. These projections include the anticipated positive impact of the recent restructuring, which is expected to contribute $14 million to $15 million to the full-year 2024 adjusted EBITDA.

Nevro's strategic initiatives, including the acquisition of Vyrsa Technologies and a workforce reduction, are part of the company's three-pillar strategy to enhance commercial execution, market penetration, and profit progress. With over 115,000 patients globally treated with HFX 10 kHz Therapy, Nevro is poised to continue its mission of providing life-changing solutions for chronic pain sufferers while navigating towards profitable, long-term growth.

Investors and stakeholders can access the investor presentation and further details on Nevro's website, and are encouraged to review the company's upcoming filings with the Securities and Exchange Commission for a comprehensive understanding of its financial position and strategic direction.

For more in-depth analysis and updates on Nevro Corp (NYSE:NVRO) and the medical device industry, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Nevro Corp for further details.

This article first appeared on GuruFocus.