Nevro Corp. (NYSE:NVRO) Q3 2023 Earnings Call Transcript

Nevro Corp. (NYSE:NVRO) Q3 2023 Earnings Call Transcript November 1, 2023

Nevro Corp. beats earnings expectations. Reported EPS is $-0.65, expectations were $-0.77.

Operator: Hello. My name is Chris, and I will be your conference operator today. At this time, I would like to welcome everyone to Nevro Third Quarter 2023 Financial Results Conference Call. All lines have been placed on mute to prevent any background noise. After the speakers’ remarks, there will be a question-and-answer session. [Operator Instructions] Thank you. [Ian Toll] (Ph) you may begin.

Unidentified Company Representative: Good afternoon. And welcome to Nevro’s third quarter 2023 earnings conference call. With me today are Kevin Thornal, CEO and President; and Rod MacLeod, Chief Financial Officer. On today’s Kevin will discuss third quarter business results. And Rod will conclude with detailed financials and guidance before we open up the call for questions. Please note, there are also slides available related to our Nevro’s third quarter performance on the Investor Relations website in the Events & Presentations section. Earlier today Nevro released its financial results for the third quarter ended September 30, 2023. A copy of the earnings release is available on the Investor Relations section of Nevro website at nevro.com.

This call is being broadcast live over the Internet to all interested parties on November 1, 2023 and an archived copy of this webcast will be available on Nevro’s Investor Relations website. Before we begin, I would like to remind everyone that comments made on today’s call may include forward-looking statements within the meaning of the federal securities laws. Results could differ materially from those expressed or implied as a result of certain risks and uncertainties. Please refer to Nevro’s SEC filings including its annual report on Form 10-K filed on February 21, 2023 for a detailed presentation of risks. The forward-looking statements in this call speak only as of today, and the company undertakes no obligation to update or revise any of these statements.

In addition, management will refer to adjusted EBITDA, a non-GAAP measure used to help investors understand Nevro’s ongoing business performance. Non-GAAP adjusted EBITDA excludes interest, taxes and non-cash items such as stock-based compensation, depreciation and amortization, litigation-related expenses, certain litigation charges and credits and other adjustments, such as restructuring charges. Please refer to the GAAP to non-GAAP reconciliation tables within the earnings release. And now, it is my pleasure to turn the call over to Kevin.

Kevin Thornal: Thanks Ian and good afternoon, everyone. We appreciate you joining us. On today’s call I would like to discuss our progress on our three cores of growth, our third quarter results the overall SCS market and our updated 2023 revenue guidance. I will then turn the call over to Rod to discuss the details of our Q3 financials. As we discussed during our second quarter earnings call, we believe focusing on commercial execution, market penetration, and profit progress is essential to moving our business forward to the next level. Starting with our first pillar of growth, commercial execution. In mid June, Greg Filler was appointed Senior Vice President and Chief Commercial Officer and was given the mandate of increasing sales productivity, improving physician education, and maximizing the growth opportunity of Nevro.

While changes don’t happen overnight, Greg has hit the ground running and has quickly made his mark, guided by the philosophy and approach of talent, strategy and culture. During the third quarter, Greg implemented several key changes including realigning our sales force to improve rep performance, filling and rightsizing our sales territories and enhancing the compensation plan to align the sales force at the customer level. In the third quarter, Greg and his team turned their focus to our marketing department. While the ongoing commercial changes will be dynamic for both sales and marketing, we are driving focus and execution on areas of the business that will move the needle from both a growth and leverage perspective. For instance, new product introductions and expanded indications of the current portfolio.

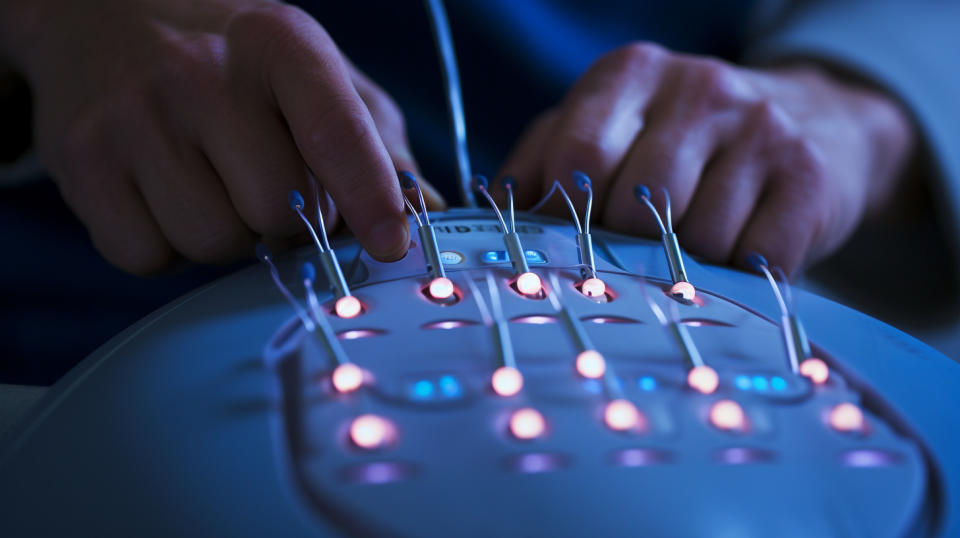

Another area of focus is to increase our physician education and training, specifically fellowship programs. All chronic pain patients deserve our best-in-class, high frequency, paresthesia free therapy and we must continually educate implanting physician on why it is superior and differentiated. Best practice dictate that multiple physician touch points and training are essential despite having the best-in-class technology. Over the past 90-days, we trained over 100 fellows on the implementation and use of the unique capabilities of our HFX iQ system. These three cadaver skill labs held in three different areas of the country allow physicians in their fellowship program to learn more about the benefits of our HFX iQ system and why it is technologically superior to other SCS offerings.

In addition to these training sessions, we held many targeted local events to provide additional knowledge and training to physicians nationwide. Moving to our second pillar of growth, market penetration. Nevro can expand the market in several ways. For example, through our PDN indication. In August, we announced the publication of 24-month data from the SYNZA painful diabetic neuropathy, PDN, randomized controlled trial, RCT in diabetes research and clinical practice. These data, which were also presented during the American Diabetes Association 83rd Scientific Sessions, demonstrated high frequency 10 KHz SCS long-term efficacy in treating refractory PDN. The data show that patients who received a high frequency 10 KHz SCS implant and conventional medical management, CMM compared to CMM alone experienced durable pain relief with a 90.1% responder rate and significant improvements in both human related quality of life and sleep at 24 months post implementation.

These robust data are critical and set Nevro apart from its competition as our technology demonstrates durable pain relief and significant improvements without paresthesia. This is so important because a large portion of PDM patients suffer from numbness, which is how products from our competitors mask PDM pain. Using paresthesia as the mechanism of action may increase the overall numbness a patient already experiences. These robust data combined with health plan coverage of over 205 million lives for PDN gives us an excellent opportunity to expand the market for our best in class technology. Regarding our new PDN Sensory Study, the enrollment now stands at almost 50 patients. We are very excited about this study as it is the first prospective RCT specifically designed to evaluate changes in pain and neurological function using high frequency 10 KHz SCS therapy in patients with chronic, intractable lower limb pain associated with PDN.

We will keep you updated on the enrollment progression of this important clinical trial. Last quarter, we mentioned the potential of augmenting our product portfolio through strategic opportunities. We have received many questions on this topic, so I would like to briefly expand how we think about a potential acquisition. We have a large global field force that interacts with treating physicians and we believe we can leverage those call points to: one, strengthen our physician relationships, two, increase our growth and three, accelerate our path to profitability. There are many potential adds to our sales bag that we are currently evaluating to take advantage of the synergies with our best in class SCS therapy that will be accretive to our margin and growth, but we will be thoughtful as we explore opportunities and will only expand our capital if a potential target meets all of our criteria, we will be a disciplined buyer.

And finally, profit progress. We continue to invest in our Costa Rica manufacturing plant and have other initiatives ongoing as we drive towards profitability. The manufacturing ramp at our Costa Rica plant is proceeding as 46% of our iQ volumes were manufactured in our Costa Rica plant in Q3, and we continue to evaluate our internal processes looking for additional ways to improve our operational efficiencies. Turning now to our third quarter results. For the three months ending September 30, 2023, Nevro reported revenue of 103.9 million, an increase of 3% on both a reported and constant currency basis compared to prior year results. Our permanent procedure growth was 7% year-over-year and PDN had another strong quarter increasing revenue by 56% compared to last year.

In the third quarter, HFX iQ accounted for roughly 43% of our permanent implant procedures, up 1,300 basis points over the previous quarter and we expect this trend to continue. The feedback for HFX iQ and its ability to deliver personalized pain relief continues to be very positive and we are confident that the combination of our superior high frequency, paresthesia-free SCS and our HFX algorithm will enable us to outpace our competitors. While we believe we held share in new implants this quarter, we are obviously not content as it is our moral obligation to win for patients to receive the superior pain relief from the only high frequency SCS provider in the world. Additionally, with three of the leading players having now reported growth for the quarter, we remain confident that the SCS market continues on the road to recovery and showing consistent growth.

Turning now to our PDN business, PDN trials represented approximately 24% of our total U.S. trial volume, an increase of 41% from Q3 of last year. Among our permanent implant procedures, PDN represented 20% of total worldwide procedures, resulting in approximately 21 million in PDN indication sales. In Q3, approximately 21% of our U.S. PDN trial procedures came from leads generated from our direct-to-consumer marketing program. We believe that patient and physician education is imperative to drive awareness of the proven clinical benefits for patients that suffer from debilitating painful diabetic neuropathy. I would now like to say a few words about our updated guidance. First, while we exceeded our Q3 expectations, we know we can accelerate our top line growth.

We have made many changes to our marketing and commercial teams over the past several months and it will take time for these changes to translate into meaningful financial results. The positive enhancements we have driven in our culture over the last seven-months have been significant and we believe these changes will lead to a stronger Nevro. We are confident in the direction of our company and look forward to executing our current strategies, driving growth and taking advantage of the meaningful leverage opportunities we have to drive towards profitability and deliver shareholder value. Before turning the call over to Rod, I would like to briefly discuss our thoughts on GLP-1s and proactively explain why these therapies will not adversely impact our PDN business.

There has been a lot of noise regarding how GLP-1s will affect the market for medical devices. We acknowledge that these therapies can help many people with obesity lose weight and patients with diabetes lower their A1C. This is not our target patient population, however, and GLP-1s We are never intended to nor do they address PDN. Many PDN patients have been using GLP-1s for years to control their glucose level and importantly, these drugs have never been shown to reduce the incidence of PDN or the severity of its symptoms. In fact, a large number of patients that were included in our since the PDN study were already taking GLP-1s or similar types of drugs for years and unfortunately still suffered from painful diabetic neuropathy. These patients responded very well to our high frequency SCS therapy.

PDN is not simply a result of the patient’s A1C or their weight and even patients with normal BMI and controlled A1C levels experience PDN. We continue to believe that there remains a large addressable refractory PDN market around two million to three million patients and penetration rates are very low in that market today. And with that, I will pass the call over to Rod to provide further details on our third quarter results and guidance.

Rod MacLeod: Thanks, Kevin, and good afternoon. I will begin with our worldwide revenue for the third quarter of 2023, which increased 3% as reported and on a constant currency basis compared to the third quarter of 2022. PDN represented 20% of permanent implant procedures worldwide resulting in approximately 21 million in PDN indication sales in the third quarter of 2023, this quarter included one less selling day than Q3 of 2022. U.S. revenue in the third quarter of 2023 was 89.8 million, an increase of 4% compared to the third quarter of 2022. International revenue in the third quarter of 2023 was 14.1 million, down 2% as reported and down 6% on a constant currency basis. Now, moving on to some detail below the top line, gross margin was 66.9% in the third quarter of 2023 compared to 69% in the third quarter of 2022.

The full market release of the HFX iQ system continues to progress well and we are capturing a pricing uplift on our HFX iQ product. Our legacy products, which still represent over 50% of our mix, continue to experience pricing erosion. This pricing pressure along with regulatory delays of selling iQ into Europe and the reduction in second half guidance on volumes continue to cause us to sell off our higher cost iQ product sourced from contract manufacturers. We are still optimistic on our long run margin expansion opportunities with our Costa Rica sourced products assuming pricing remains stable. Looking at operating expenses, the total for the third quarter of 2023 was 95.1 million, compared to 92.2 million in the third quarter of 2022. Excluding the 105 million of certain litigation credits in the third quarter of 2022.

The increase in OpEx is primarily due to litigation and personnel related costs, partially offset by a decrease in stock based compensation. Litigation related legal expenses were 4.3 million for the third quarter of 2023 compared to 1.9 million in the third quarter of 2022. Non-GAAP adjusted EBITDA for the third quarter of 2023 was a loss of 5.8 million, compared to a loss of 3.8 million in the third quarter of 2022. Cash, cash equivalents and short-term investments totaled 320.3 million as of September 30, 2023. This represents a decrease during the third quarter of 2023 of 9.7 million. Uses of cash were in line with normal business operations as well as our projections. We continue to manage our working capital and are very comfortable with our balance sheet to fund operations.

Turning now to guidance, it is important to note that we will be using non-GAAP financial measures to describe our outlook for the business. Please see the financial tables in our press release issued today for GAAP to non-GAAP reconciliations. We expect fourth quarter worldwide revenue of approximately 108 million to 110 million, which represents a decrease of 4% to 6% on a constant currency basis. We expect fourth quarter of 2023 non-GAAP adjusted EBITDA to be a gain of approximately $1 million to $2 million. We expect worldwide revenue for full-year 2023 of approximately $417 million to $419 million, an increase of 3% over prior year on both an as reported and constant currency basis. We expect full-year 2023 non-GAAP adjusted EBITDA to be in the range of negative $24 million to negative $25 million, which compares to a non-GAAP adjusted EBITDA loss of 23.8 million in 2022.

In closing, we continue to make good progress and remain on track to drive growth and scale profitably in our core business in years ahead. We are strategically positioned with best-in-class SCS technologies and with the changes we are making to our commercial and marketing functions, we expect to outpace our competitors and expand the overall market. Our strategic plan is in place and now it is time to execute it. That concludes our prepared remarks. I will turn the call back over to Ian to moderate the Q&A session.

Unidentified Company Representative: Thanks Rod. In order to get through the question queue efficiently and take as many questions as we can. We ask that you please limit yourself to one question and a brief related follow-up question. You can then rejoin the queue and if time allows, you will take additional questions. Operator, we are ready for Q&A instructions.

See also 10 Best Blockchain and Bitcoin ETFs and 20 Most Feminist Countries in the World.

To continue reading the Q&A session, please click here.