Nevro's (NVRO) New Data Supports SCS Therapy for NSRBP Treatment

Nevro Corp. NVRO recently announced the publication of new 24-month data from the SENZA Nonsurgical Refractory Back Pain (NSRBP) multicenter randomized controlled trial (RCT) in the Journal of Neurosurgery: Spine. The published 24-month data assessed results for NSRBP patients treated with Nevro's high-frequency (10 kHz) spinal cord stimulation (SCS) system plus conventional medical management (CMM) against CMM alone.

The latest publication of favorable results is expected to strengthen Nevro’s foothold in the SCS therapy business.

Significance of the Data

Per Nevro, acute back pain causes more disability worldwide than any other condition. Per the company’s estimates, a quarter of adults in the United States reported to have experienced back pain within the past three months. Also, more than 500,000 Americans who are currently living with back pain are either not good candidates for spine surgery or do not want to have it as a treatment option. This, thus, leaves them with few treatment possibilities.

The published 24-month data indicated that patients in the high-frequency SCS group experienced significant improvements in pain, function and quality of life, along with reduced opioid use, unlike the CMM arm at 24 months. The long-term data also provides evidence of the benefits of high-frequency SCS in managing patients with NSRBP.

Per management, the research reflects that high-frequency SCS will likely be able to address an unmet need to treat the challenging NSRBP patient population. This raises management’s optimism as this has the possibility of addressing the patients with chronic low back pain, which yields no results with conventional therapies and are not good candidates for spine surgery.

Industry Prospects

Per a report by Market Data Forecast, the global SCS market was estimated to be $2207 million in 2023 and is anticipated to reach $3334 million by 2028 at a CAGR of 8.6%. Factors like the rising cases of chronic and neuropathic pain and the growing adoption of SCS therapy are likely to drive the market.

Given the market potential, the publication of the latest positive data is expected to significantly boost Nevro’s business.

Recent Developments

This month, Nevro reported its third-quarter 2023 results, wherein it registered a solid improvement in overall top-line results. The company also recorded robust domestic revenues. An uptick in total U.S. permanent implant procedures and U.S. trial procedures was seen. The improvement in U.S. Painful Diabetic Neuropathy (PDN) trial procedures was also encouraging.

In September, Nevro announced the publication of new data validating the health economic benefits of its 10 kHz Therapy.

In August, Nevro announced the publication of 24-month data from the SENZA PDN RCT in Diabetes Research and Clinical Practice.

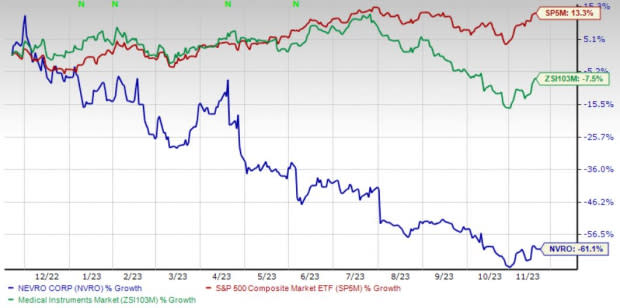

Price Performance

Shares of the company have lost 61.1% in the past year compared with the industry’s 7.5% decline. The S&P 500 has witnessed 13.3% growth in the said time frame.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, Nevro carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Cardinal Health, Inc. CAH and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 18.3%. DVA’s earnings surpassed estimates in all the trailing four quarters, with an average surprise of 36.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 36.1% compared with the industry’s 3.6% rise in the past year.

Cardinal Health, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 15.2%. CAH’s earnings surpassed estimates in all the trailing four quarters, with an average of 15.7%.

Cardinal Health’s shares have gained 33.4% compared with the industry’s 9.2% rise in the past year.

Integer Holdings, flaunting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 11.9%.

Integer Holdings’ shares have rallied 23.6% against the industry’s 7.5% decline in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Nevro Corp. (NVRO) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report