Nevro's (NVRO) Latest Buyout to Boost SI Joint Pain Treatment

Nevro Corp. NVRO recently acquired Vyrsa Technologies (Vyrsa). The transaction was signed and closed on Nov 30, 2023.

Vyrsa is a privately-held medical technology company focused on a minimally invasive treatment option for patients suffering from chronic sacroiliac joint (SI Joint) pain.

Per the terms of the transaction, apart from Nevro paying $40 million at closing, it has agreed to pay up to an additional $35 million in cash or stock tied to the achievement of certain development and sales milestones.

Vyrsa is expected to be accretive to Nevro in 2024 for both revenue and AEBITDA.

The latest acquisition is expected to strengthen Nevro’s foothold in the SI joint treatment space.

Rationale Behind the Buyout

Per Nevro’s estimates, the U.S. SI joint fusion market is valued at more than $2 billion and is expected to grow by double digits over the next several years. Currently, it is the only SI joint company that manufactures and supports a complete portfolio of FDA-cleared, innovative SI Joint fusion devices.

Nevro’s management believes that Vyrsa's comprehensive product suite will likely allow physicians to personalize therapy to specific patient needs. Vyrsa's implants are also expected to provide optimal stability and enhance the opportunity for the SI joint to fuse, providing relief to patients suffering from chronic SI joint pain.

Industry Prospects

Per a report by Grand View Research, the global SI Joint fusion market size was valued at $721.2 million in 2023 and is projected to grow at a CAGR of 19.8% between 2024 and 2030. Factors like the increasing prevalence of pain in the lower back, technological advancements and rising incidence of sacroiliitis or sacroiliac joint dysfunction are likely to drive the market.

Given the market potential, the latest acquisition is expected to significantly boost Nevro’s business.

Notable Developments

Last month, Nevro announced the publication of new 24-month data from the SENZA Nonsurgical Refractory Back Pain (NSRBP) multicenter randomized controlled trial in the Journal of Neurosurgery: Spine. The published 24-month data assessed results for NSRBP patients treated with Nevro's high-frequency (10 kHz) spinal cord stimulation system plus conventional medical management (CMM) against CMM alone.

The same month, Nevro reported its third-quarter 2023 results, wherein it registered a solid improvement in overall top-line results. The company also recorded robust domestic revenues. An uptick in total U.S. permanent implant procedures and U.S. trial procedures was seen. The improvement in U.S. Painful Diabetic Neuropathy trial procedures was also encouraging.

In September, Nevro announced the publication of new data validating the health economic benefits of its 10 kHz Therapy.

Price Performance

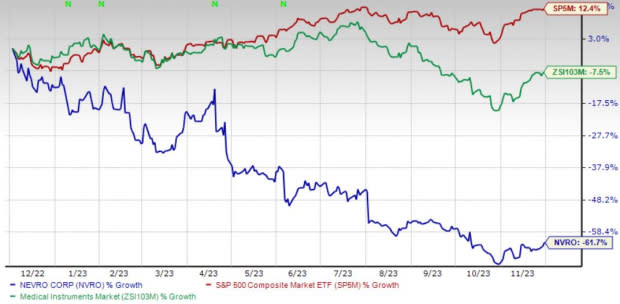

Shares of the company have lost 61.7% in the past year compared with the industry’s 7.6% decline. The S&P 500 has witnessed 12.4% growth in the said time frame.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Currently, Nevro carries a Zacks Rank #2 (Buy).

A few other top-ranked stocks in the broader medical space are DaVita Inc. DVA, Cardinal Health, Inc. CAH and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 18.3%. DVA’s earnings surpassed estimates in all the trailing four quarters, with an average surprise of 36.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 36.5% compared with the industry’s 1% rise in the past year.

Cardinal Health, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 15.2%. CAH’s earnings surpassed estimates in all the trailing four quarters, with an average of 15.7%.

Cardinal Health’s shares have gained 32.4% compared with the industry’s 6.8% rise in the past year.

Integer Holdings, flaunting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 11.9%.

Integer Holdings’ shares have rallied 19.1% against the industry’s 7.6% decline in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Nevro Corp. (NVRO) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report