Newell Brands Inc Reports Mixed Results Amidst Strategic Overhaul

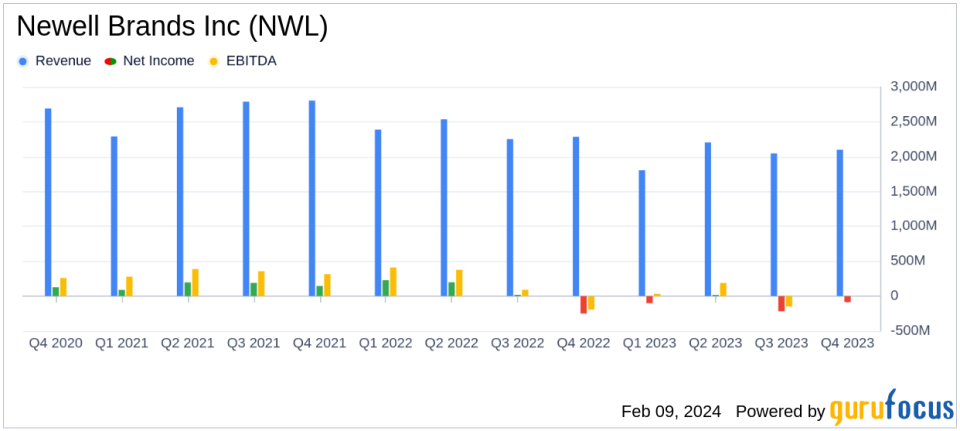

Net Sales: Q4 net sales decreased by 9.1% to $2.1 billion.

Gross Margin: Q4 reported gross margin improved to 29.9% from 26.3% in the prior year.

Operating Margin: Q4 normalized operating margin increased to 7.7% from 4.9% year-over-year.

Net Income: Q4 normalized net income rose to $92 million, with EPS at $0.22.

Cash Flow: Full year operating cash flow increased by $1.2 billion to $930 million.

Debt Reduction: Reduced debt to $4.9 billion, down from $5.4 billion at the end of 2022.

2024 Outlook: Expects net sales decline of 8% to 5% and normalized EPS of $0.52 to $0.62.

On February 9, 2024, Newell Brands Inc (NASDAQ:NWL), a leading global consumer goods company, released its 8-K filing, detailing its fourth quarter and full year 2023 financial results. The company, known for its diverse portfolio in segments such as Commercial Solutions, Home Appliances, Home Solutions, Learning and Development, and Outdoor and Recreation, faced a challenging external environment but managed to improve its gross and operating margins significantly compared to the previous year.

Financial Performance and Challenges

Despite the strategic focus on innovation and brand building, Newell Brands experienced a 9.3% decline in core sales compared to the prior year, with net sales falling to $2.1 billion in the fourth quarter. However, the company's efforts in driving productivity and reducing costs were evident in the improved gross margin of 29.9% and normalized operating margin of 7.7%. The reported diluted loss per share improved to $0.21 from $0.60 in the prior year period, while normalized diluted earnings per share increased to $0.22 from $0.16.

The company's performance is particularly important as it reflects the resilience and effectiveness of its strategic initiatives in a difficult economic climate. The improved margins and cash flow demonstrate Newell's ability to manage costs and optimize operations within the Consumer Packaged Goods industry, which is characterized by high competition and fluctuating demand.

Financial Achievements and Industry Significance

Newell Brands' significant increase in operating cash flow, which rose by $1.2 billion to $930 million, is a testament to its strong operational management and focus on working capital efficiency. This achievement is crucial for the company's financial health, allowing it to reduce debt by approximately $500 million and strengthen its balance sheet. In an industry where cash flow is king, Newell's ability to generate substantial cash from operations is a competitive advantage that supports strategic investments and debt reduction.

Key Financial Metrics

Important metrics from the financial statements include the following:

Operating cash flow increased significantly, indicating improved liquidity and financial flexibility.

Debt reduction reflects a stronger balance sheet and reduced financial risk.

Improved gross and operating margins suggest better cost management and operational efficiency.

These metrics are crucial for Newell Brands as they provide insights into the company's operational effectiveness, financial stability, and long-term sustainability.

Management Commentary

"We drove record productivity across the supply chain, significantly improved cash flow by rightsizing inventory, further reduced Newell's SKU count and took decisive actions to strengthen the company's front-end commercial capabilities, which are critical to returning Newell to sustainable and profitable growth," said Chris Peterson, Newell Brands President and Chief Executive Officer.

"We remain confident that despite a challenging macro-economic backdrop, the significant investments we are making to augment our core capabilities and accelerate our business transformation will allow us to fully operationalize our new corporate strategy and strengthen the company's performance going forward," added Mark Erceg, Newell Brands Chief Financial Officer.

Analysis and Future Outlook

While the decline in sales poses a challenge, Newell Brands' strategic actions, such as the organizational realignment announced in January 2024, are expected to bolster commercial capabilities and drive future growth. The company's initial outlook for 2024 anticipates a continued decline in net sales but also projects an increase in normalized earnings per share, suggesting confidence in its ability to manage costs and improve profitability.

Value investors may find Newell Brands' improved cash flow and margin performance appealing, as these improvements indicate a potential turnaround in profitability and operational efficiency. However, the projected sales decline suggests that the company still faces significant headwinds in driving top-line growth.

For a detailed understanding of Newell Brands Inc's financial position and future prospects, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Newell Brands Inc for further details.

This article first appeared on GuruFocus.