Newmark Group Inc (NMRK) Reports Mixed Financial Results for Q4 and Full Year 2023

Quarterly Revenue Increase: Q4 revenues surged by 23.1% year-over-year.

Annual Revenue Decline: Full-year revenues decreased by 8.7% compared to the previous year.

GAAP Net Income Fluctuations: GAAP net income for fully diluted shares saw a significant increase in Q4 but a decrease for the full year.

Adjusted Earnings: Post-tax Adjusted Earnings per share (Adjusted Earnings EPS) rose in Q4 but fell annually.

Dividend Announcement: A quarterly dividend of $0.03 per share has been declared.

Market Share Gains: Newmark gained significant market share in leasing and capital markets.

On February 22, 2024, Newmark Group Inc (NASDAQ:NMRK), a leading commercial real estate service provider, released its financial results for the fourth quarter and full year of 2023, revealing a mixed financial performance. The company also announced a quarterly dividend. The full details of the financial results can be found in Newmark's 8-K filing.

Company Overview

Newmark Group Inc is a global commercial real estate advisory firm, providing a suite of services to institutional investors, global corporations, and other property owners and occupiers. With a focus on large-scale transactions, the company has positioned itself as a key player in the real estate sector, offering strategic consulting and technology solutions to a diverse client base.

Financial Performance and Challenges

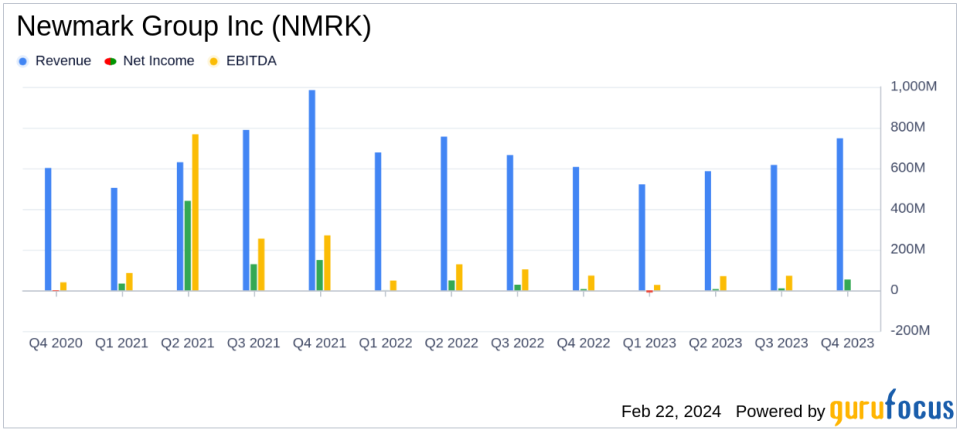

For the fourth quarter of 2023, Newmark reported a 23.1% increase in total revenues, reaching $747.4 million, compared to the same period in the previous year. This growth was attributed to significant gains across all revenue categories, including a historic $50 billion Signature portfolio sale. However, the full-year results painted a different picture, with total revenues declining by 8.7% to $2,470.4 million. The company's GAAP net income for fully diluted shares also experienced contrasting trends, with a 493.4% increase in Q4 but a 61.4% decrease for the full year.

Despite these challenges, Newmark's financial achievements in the fourth quarter are noteworthy, particularly in gaining market share in leasing and capital markets. These gains are critical for the company's positioning in the competitive real estate industry.

Key Financial Metrics

Important metrics from the financial statements include:

Financial Metric | Q4 2023 | Q4 2022 | Change |

|---|---|---|---|

Total Revenues | $747.4M | $607.3M | 23.1% |

GAAP Pre-Tax Income | $82.4M | $18.5M | 346.6% |

GAAP Net Income | $52.9M | $8.9M | 493.4% |

Adjusted Earnings EPS | $0.46 | $0.32 | 43.8% |

These metrics are crucial for understanding Newmark's profitability and operational efficiency.

Management Commentary

"Newmark's revenues increased by over 23% in the quarter, with double-digit gains in every revenue category... We anticipate industry volumes accelerating throughout the second half of 2024. Due to our strong incremental margins and our investments in talent, we expect significant earnings outperformance towards the end of the year and into 2025." - Barry M. Gosin, Chief Executive Officer of Newmark

Analysis of Performance

Newmark's performance in the fourth quarter demonstrates the company's ability to capitalize on market opportunities, despite a challenging year overall. The strategic transactions and market share gains in leasing and capital markets are indicative of Newmark's strong positioning and adaptability in the commercial real estate market.

For value investors and potential GuruFocus.com members, Newmark's mixed financial results highlight the importance of a nuanced approach to evaluating the company's prospects. The robust Q4 performance, coupled with the company's strategic initiatives and market share gains, suggest potential for future growth, despite the full-year revenue decline.

For more detailed information and analysis, investors are encouraged to review Newmark's full 8-K filing and consider the company's future outlook in the context of the broader commercial real estate market trends.

Explore the complete 8-K earnings release (here) from Newmark Group Inc for further details.

This article first appeared on GuruFocus.