NewMarket Corp (NEU) Reports Solid Full Year 2023 Earnings and Strategic Acquisition

Net Income: Full year net income increased to $388.9 million, or $40.44 per share.

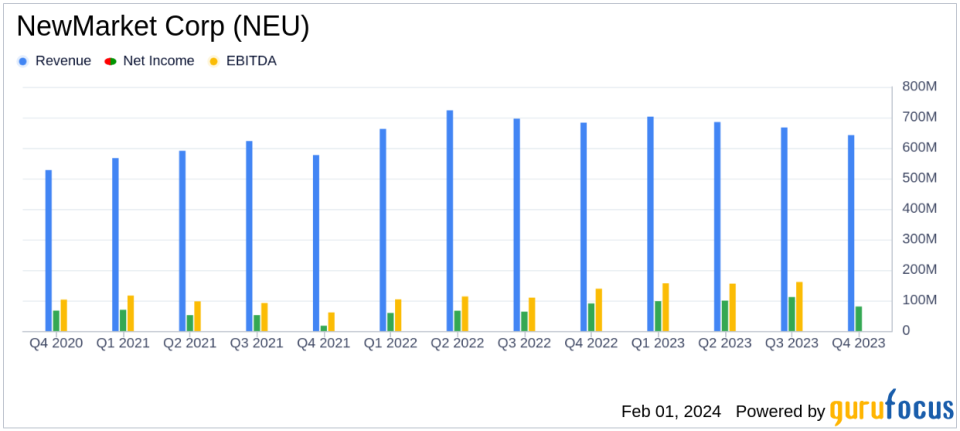

Revenue: Petroleum additives sales reached $2.7 billion for the year 2023.

Debt Management: NEU improved its Net Debt to EBITDA ratio from 2.0 to 0.9.

Working Capital: The company improved working capital by $134.3 million in 2023.

Strategic Acquisition: NEU acquired AMPAC for approximately $700 million in January 2024.

Shareholder Returns: Returned $127.9 million to shareholders through dividends and share repurchases.

On January 31, 2024, NewMarket Corp (NYSE:NEU) released its 8-K filing, announcing the company's financial results for the fourth quarter and full year of 2023. The company, a leading manufacturer of petroleum additives, reported a significant increase in net income for the year, despite facing economic headwinds and inflationary pressures.

NewMarket Corp (NYSE:NEU) is a holding company that operates through its subsidiaries, manufacturing and selling petroleum additives used in lubricating oils and fuels. These additives enhance performance in machinery, vehicles, and other equipment. The company's revenue is primarily generated in the United States, with a broad product range including lubricant and fuel additives.

Financial Performance and Challenges

For the fourth quarter of 2023, NEU reported net income of $80.4 million, or $8.38 per share, a decrease from $90.5 million, or $9.26 per share, in the same period of 2022. Full-year net income for 2023 was $388.9 million, or $40.44 per share, compared to $279.5 million, or $27.77 per share, for the previous year. This substantial increase in annual net income highlights the company's ability to navigate a challenging economic environment effectively.

NEU's petroleum additives sales for the fourth quarter were $642.0 million, down from $680.3 million in the prior year's quarter. The company experienced a decrease in operating profit due to higher operating costs and lower shipments, partially offset by lower raw material costs and favorable product mix. Despite these challenges, NEU's petroleum additives operating profit for the full year increased to $514.4 million, up from $378.2 million in 2022, underscoring the company's resilience and strategic pricing adjustments.

Strategic Moves and Financial Health

NewMarket Corp's strategic acquisition of American Pacific Corporation (AMPAC) in January 2024 for approximately $700 million is expected to be accretive to net income in 2024. This acquisition positions NEU to capitalize on the growing demand for performance additives used in aerospace and defense applications.

The company's financial health is further evidenced by its improved working capital and aggressive debt management. NEU improved its working capital by $134.3 million in 2023 and repaid $361 million on its revolving credit facility. These actions contributed to a significant improvement in the Net Debt to EBITDA ratio, from 2.0 at the end of 2022 to 0.9 at the end of 2023.

NEU's commitment to shareholder returns remained strong, with $127.9 million returned to shareholders through dividends and share repurchases. The company's disciplined approach to capital allocation supports its long-term objective of creating value for shareholders.

Outlook and Management Commentary

Thomas E. Gottwald, Chairman and CEO of NewMarket Corp, expressed satisfaction with the company's performance, citing four quarters of strong operating profit and solid cash flows. Gottwald emphasized the company's focus on managing operating costs, inventory levels, and portfolio profitability while continuing to invest in technology.

"We are very pleased with the performance of our petroleum additives business during 2023 and the work done by our team to achieve four quarters of strong operating profit. We generated solid cash flows throughout the year, our working capital improved by $134.3 million, and we made payments of $361.0 million on our revolving credit facility."

Looking ahead, NEU anticipates continued strength in its petroleum additives segment and successful integration of AMPAC. The company's long-term view, safety-first culture, customer-focused solutions, technology-driven product offerings, and world-class supply chain capability are expected to continue benefiting all stakeholders.

For value investors and potential GuruFocus.com members, NewMarket Corp's robust financial performance, strategic acquisition, and commitment to shareholder value present a compelling investment narrative. The company's ability to navigate economic challenges and its strategic positioning for future growth are key factors to consider.

Investors are invited to join the conference call and Internet webcast scheduled for 3:00 p.m. ET on February 1, 2024, to review the fourth quarter and full year 2023 financial results.

Explore the complete 8-K earnings release (here) from NewMarket Corp for further details.

This article first appeared on GuruFocus.