Newmark's (NASDAQ:NMRK) Q4 Earnings Results: Revenue In Line With Expectations

Real estate services firm Newmark (NASDAQ:NMRK) reported results in line with analysts' expectations in Q4 FY2023, with revenue up 23.1% year on year to $747.4 million. It made a non-GAAP profit of $0.46 per share, improving from its profit of $0.04 per share in the same quarter last year.

Is now the time to buy Newmark? Find out by accessing our full research report, it's free.

Newmark (NMRK) Q4 FY2023 Highlights:

Revenue: $747.4 million vs analyst estimates of $743.5 million (small beat)

EPS (non-GAAP): $0.46 vs analyst expectations of $0.47 (1.4% miss)

Gross Margin (GAAP): 33.4%, down from 35.9% in the same quarter last year

Market Capitalization: $1.79 billion

Founded in 1929, Newmark (NASDAQ:NMRK) provides commercial real estate services, including leasing advisory, global corporate services, investment sales and capital markets, property and facilities management, valuation and advisory, and consulting.

Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

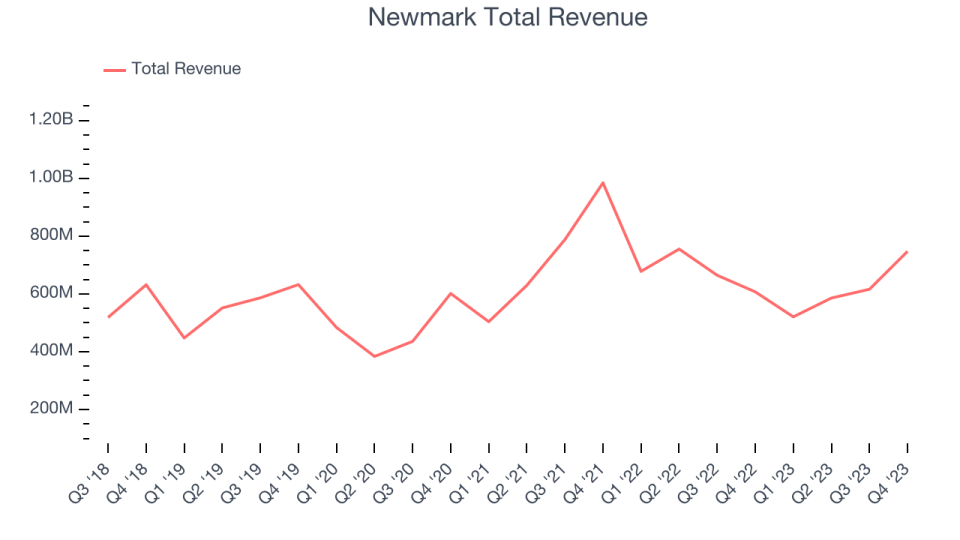

Sales Growth

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Newmark's annualized revenue growth rate of 3.8% over the last five years was weak for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Newmark's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 7.8% over the last two years.

This quarter, Newmark's year-on-year revenue growth of 23.1% was excellent, and its $747.4 million of revenue was in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 4.9% over the next 12 months, a deceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

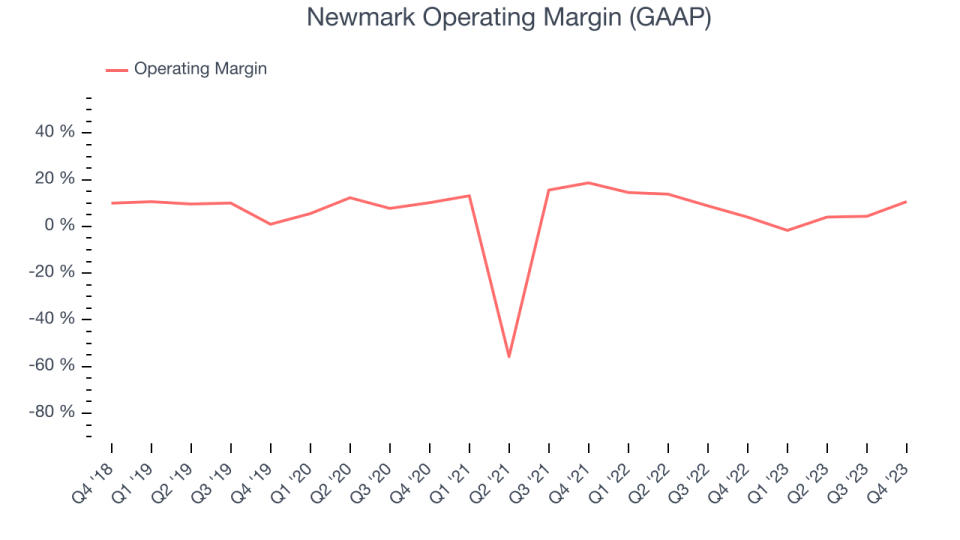

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Newmark was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer discretionary business, producing an average operating margin of 7.9%.

This quarter, Newmark generated an operating profit margin of 10.6%, up 6.6 percentage points year on year.

Over the next 12 months, Wall Street expects Newmark to become more profitable. Analysts are expecting the company’s LTM operating margin of 4.9% to rise to 13.9%.

Key Takeaways from Newmark's Q4 Results

We struggled to find many strong positives in this quarter's results as its operating margin and EPS missed Wall Street's estimates. Newmark's 2024 guidance, however, was quite bullish as it expects industry volumes to accelerate in the second half of the year, leading to anticipated earnings outperformance. So far in 2024, the company has hired an affordable housing team, perhaps signaling future opportunities in that sub-asset class. Overall, this quarter's results could have been better, but the company's 2024 forecast was encouraging. The stock is up 3.4% after reporting and currently trades at $10.76 per share.

So should you invest in Newmark right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.