Newmont (NEM) Prices $2B Private Offering of Senior Notes

Newmont Corporation NEM and its fully-owned subsidiary, Newcrest Finance Pty Limited, announced the pricing of a private offering totaling $2 billion in aggregate principal amount. The offering consists of $1 billion of 5.3% notes due 2026 (the "2026 Notes") and $1 billion of 5.35% notes due 2034 (the "2034 Notes"). The Notes will be guaranteed on an unsecured senior basis by Newmont USA Limited, another subsidiary of Newmont. The Offering is expected to close on Mar 7, 2024, subject to customary closing conditions.

The Issuers will utilize the proceeds from the offering to repay all outstanding borrowings under Newmont's revolving credit facility, with the remaining funds allocated for general corporate purposes. Notably, Newmont had previously utilized borrowings under its revolving credit facility, along with available cash, to repay approximately $1.9 billion of bilateral credit debt obtained during the acquisition of Newcrest Mining Limited.

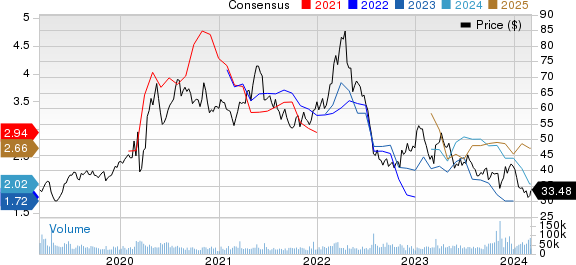

Newmont Corporation Price and Consensus

Newmont Corporation price-consensus-chart | Newmont Corporation Quote

The announcement does not constitute an offer to sell or a solicitation of an offer to buy securities, nor will there be any sale of securities in jurisdictions where such activities would be unlawful without registration or qualification under relevant securities laws. The securities being offered have not been approved or disapproved by any regulatory authority, and no such authority has assessed the accuracy or sufficiency of any offering document, NEM noted.

Additionally, the Notes will not be registered under the Securities Act or the securities laws of any state or jurisdiction and, thus, may not be offered or sold in the United States unless registered or exempt from registration requirements. The Notes will be offered solely to qualified institutional buyers pursuant to Rule 144A under the Securities Act and certain non-U.S. persons in compliance with Regulation S under the Securities Act.

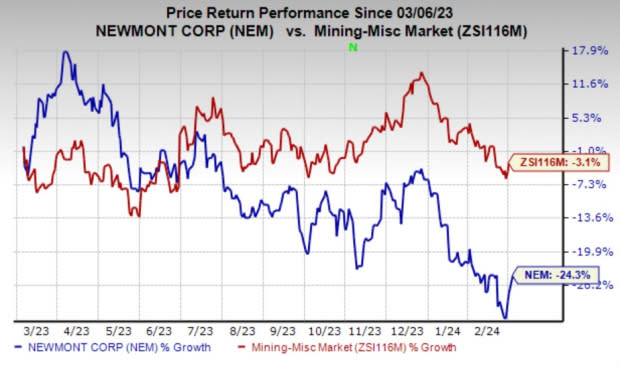

Newmont’s shares have lost 24.3% in the past year compared with a 3.1% fall of the industry.

Image Source: Zacks Investment Research

In the fourth quarter of 2023, Newmont reported adjusted earnings of 50 cents per share, excluding one-time items, which was higher than the prior-year quarter's 44 cents per share but fell short of the Zacks Consensus Estimate of 51 cents. Despite the earnings miss, NEM saw a notable 23.7% increase in fourth-quarter revenues, reaching $3,957 million, surpassing the Zacks Consensus Estimate of $3,171.4 million. This growth was primarily driven by higher sales volumes and realized gold prices.

Newmont anticipates attributable gold production to be around 6.9 million ounces for 2024, with gold CAS projected at $1,050 per ounce and AISC at $1,400 per ounce.

Zacks Rank & Key Picks

Newmont currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Ecolab Inc. ECL, sporting a Zacks Rank #1 (Strong Buy), and Carpenter Technology Corporation CRS and Hawkins, Inc. HWKN, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ecolab has a projected earnings growth rate of 22.65%% for the current year. The Zacks Consensus Estimate for ECL’s current-year earnings has been revised upward by 6.5% in the past 60 days. ECL topped the consensus estimate in each of the last four quarters, with the average earnings surprise being 1.7%. The company’s shares have rallied 40.3% in the past year.

The consensus estimate for CRS’ current fiscal year earnings is pegged at $3.97 per share, indicating a year-over-year surge of 248.3%. CRS beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 14.3%. The company’s shares have rallied 30% in the past year.

The consensus estimate for HWKN’s current fiscal year earnings is pegged at $3.61 per share, indicating a year-over-year rise of 26%. The Zacks Consensus Estimate for HWKN’s current-year earnings has been revised upward by 4.3% in the past 30 days. HWKN beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 70.6%. The company’s shares have surged 73.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Newmont Corporation (NEM) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report