Newmont (NEM) to Report Q3 Earnings: What's in the Offing?

Newmont Corporation NEM is scheduled to report third-quarter 2023 results before the opening bell on Oct 26.

The gold miner missed the Zacks Consensus Estimate in three of the trailing four quarters while beating it once. For this timeframe, the company delivered a negative earnings surprise of roughly 1.9%, on average. Newmont posted a negative earnings surprise of 15.4% in the last reported quarter. The company’s third-quarter results are expected to reflect improved grades across a number of mines. Lower costs are also likely to have aided its performance. However, weaker gold prices might have impacted its results.

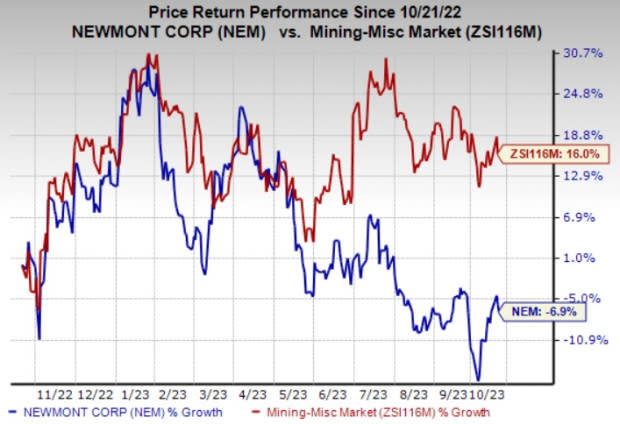

The stock has lost 6.9% in the past year compared with the industry’s 16% rise.

Image Source: Zacks Investment Research

Let’s see how things are shaping up for this announcement.

What Do the Estimates Say?

The Zacks Consensus Estimate for third-quarter consolidated revenues for Newmont is currently pegged at $3,199 million, which calls for a rise of around 21.5% year over year.

Some Factors to Watch For

Strong production performance across a number of mines is expected to have supported the company’s third-quarter results. In South America, Cerro Negro is expected to continue to have delivered improved productivity and achieved higher grades, leading to higher production in the third quarter. Yanacocha is also expected to have continued strong performance with increased production, benefiting from injection leaching technology and re-leaching programs.

In North America, Musselwhite and Porcupine are likely to have delivered improved grades. Production from Musselwhite is likely to have been supported by NEM’s development activities to increase scope availability.

In Australia, performance at the Boddington mine is expected to have been aided by strong mill performance in the to-be-reported quarter along with continued strong production from Tanami. Strong production from Ahafo driven by higher mining rates and increased production from Akyem aided by the optimization of mine plan and higher grades are also expected to have supported results of the company’s Africa operation in the September quarter.

Our estimate for attributable gold production is pegged at 1.61 million ounces for the quarter to be reported, which suggests a 29.8% increase on a sequential basis.

Newmont is also expected to have benefited from its actions to boost productivity and control costs in the third quarter. Benefits of lower unit costs are likely to have been reflected on its performance. Our estimate for all-in-sustaining costs stands at $1,050 per ounce, which indicates a sequential decrease of 28.7%.

Meanwhile, after a solid first-quarter performance, gold lost the momentum in the second quarter of 2023, with prices declining roughly 3%. The prospects of more interest rate hikes by the U.S. Federal Reserve this year, higher bond yield and a stronger U.S. dollar weighed on the yellow metal. The yellow metal started the September quarter on an upbeat note aided by a weaker dollar and held its ground at above $1,900 an ounce for much of the quarter. However, gold closed the third quarter below that level as the Federal Reserve signaled that interest rates are likely to remain higher for longer. Gold prices were down nearly 4% for the third quarter.

The impacts of weaker gold prices are expected to reflect on Newmont’s results in the third quarter. Our estimate for third-quarter average realized prices of gold stands at $1,947, which suggests around 1% decline on a sequential basis.

Newmont Corporation Price and EPS Surprise

Newmont Corporation price-eps-surprise | Newmont Corporation Quote

Zacks Model

Our proven model does not conclusively predict an earnings beat for Newmont this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. But that’s not the case here.

Earnings ESP: Earnings ESP for Newmont is -5.56%. This is because the Most Accurate Estimate is currently pegged at 40 cents while the Zacks Consensus Estimate stands at 42 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Newmont currently carries a Zacks Rank #3.

Stocks That Warrant a Look

Here are some companies in the basic materials space you may want to consider as our model shows they have the right combination of elements to post an earnings beat this quarter:

LyondellBasell Industries N.V. LYB, scheduled to release earnings on Oct 27, has an Earnings ESP of +5.26% and carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for LYB’s earnings for the third quarter is currently pegged at $1.91.

Methanex Corporation MEOH, slated to release earnings on Oct 25, has an Earnings ESP of +125.81% and carries a Zacks Rank #2 at present.

The consensus mark for MEOH’s third-quarter earnings is currently pegged at a loss of 8 cents.

Kinross Gold Corporation KGC, scheduled to release third-quarter earnings on Nov 8, has an Earnings ESP of +8.70%.

The Zacks Consensus Estimate for Kinross' earnings for the third quarter is currently pegged at 9 cents. KGC currently carries a Zacks Rank #3.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Newmont Corporation (NEM) : Free Stock Analysis Report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

Methanex Corporation (MEOH) : Free Stock Analysis Report

LyondellBasell Industries N.V. (LYB) : Free Stock Analysis Report