Newmont (NEM) Shareholders Approve the Acquisition of Newcrest

Newmont Corporation NEM said that over 96% of the votes cast in a special shareholder meeting on the proposal for issuing Newmont common stock about the planned acquisition of Newcrest Mining Limited were voted in favor of approval.

Tom Palmer, president and CEO of Newmont, expressed the significance of this decision, stating that the shareholders of NEM overwhelmingly voted in favor of this transformational transaction, acknowledging the strategic rationale to create the industry’s most robust portfolio of world-class gold and copper assets. Palmer emphasized the unparalleled platform that would emerge from this acquisition, with top-tier assets managed by exceptional talent in favorable mining jurisdictions. This will likely position Newmont for superior returns in the long term.

The next crucial step will be Newcrest's shareholder vote, scheduled for Friday, Oct 13, 2023The acquisition has already obtained all the necessary regulatory approvals from government authorities. Newmont and Newcrest expect to finalize the transaction in early November, subject to customary closing conditions.

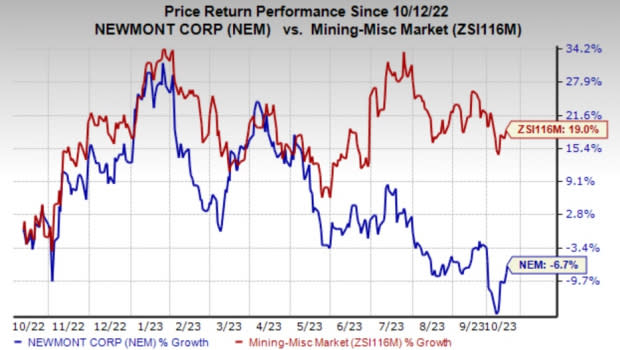

Newmont’s shares have fallen 6.7% in the past year against the industry's 19% rise in the same period.

Image Source: Zacks Investment Research

This strategic move was initially announced on May 14, 2023, when Newmont unveiled its definitive agreement to acquire Newcrest. This merger aims to create a world-class portfolio of assets, particularly in low-risk mining jurisdictions, with a significant concentration of Tier 1 operations. Upon completion, the combined company will boast a multi-decade production profile from 10 large, long-life, low-cost Tier 1 operations and increased annual copper production, primarily from Australia and Canada.

The merger is expected to yield annual pre-tax synergies of $500 million, achievable within the first 24 months and target at least $2 billion in cash improvements through portfolio optimization in the initial two years after closing.

Newmont Corporation Price and Consensus

Newmont Corporation price-consensus-chart | Newmont Corporation Quote

Zacks Rank & Key Picks

Newmont currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are WestRock Company WRK, sporting a Zacks Rank #1 (Strong Buy) and Air Products and Chemicals, Inc. APD and The Andersons Inc. ANDE, both carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, the Zacks Consensus Estimate for Westrock’s current fiscal year has been revised upward by 5.2%. WRK beat the Zacks Consensus Estimate in three of the last four quarters while missing in one quarter, with the average earnings surprise being 30.7%. The company’s shares have rallied 19.6% in the past year.

The consensus estimate for Air Products’ current fiscal year earnings is pegged at $11.47, indicating year-over-year growth of 10.2%. APD beat the Zacks Consensus Estimate in three of the last four quarters while missing in one quarter, with the average earnings surprise being 1.8%. The company’s shares have surged 26.8% in the past year.

The Zacks Consensus Estimate for ANDE's current-year earnings has been revised 3.3% upward over the past 60 days. Andersons beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4% on average. ANDE shares have rallied around 58.9% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Air Products and Chemicals, Inc. (APD) : Free Stock Analysis Report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Newmont Corporation (NEM) : Free Stock Analysis Report

WestRock Company (WRK) : Free Stock Analysis Report