Newmont's (NEM) Newcrest Deal Advances With Regulatory Approvals

Newmont Corporation NEM received clearance from Australia's Foreign Investment Review Board (FIRB) and Japan's Fair Trade Commission (JFTC) for its proposed acquisition of Newcrest Mining Limited. The Treasurer issued a No Objection Notification (NON), subject to compliance with standard tax conditions under Commonwealth taxation laws. The completion of the transaction can proceed after September 30, 2023, according to the JFTC clearance.

Newmont is actively pursuing other necessary regulatory approvals and aims to complete the acquisition in the fourth quarter of this year. Earlier in August, the Australian Competition & Consumer Commission approved the acquisition and conveyed its recommendation to the FIRB. The remaining regulatory approval pending is from the Philippine Competition Commission (PCC). Additionally, Newmont and Newcrest are in ongoing discussions with the PNG Government and regulators to secure further approvals and clearances for the transaction.

Tom Palmer, Newmont's President and Chief Executive Officer, expressed satisfaction with the regulatory approvals in Australia and Japan. He noted that this acquisition enhances Newmont's operational presence and positions Australia as a significant center for Newmont's global business, attracting shareholders from Australia and the Asia Pacific region.

Newmont Corporation Price and Consensus

Newmont Corporation price-consensus-chart | Newmont Corporation Quote

The acquisition, announced on May 14, would bring together a world-class portfolio of assets, focusing on Tier 1 operations mainly in low-risk mining jurisdictions. The combined entity would have a substantial production profile from ten large, long-life, cost-effective Tier 1 operations, with increased annual copper production primarily from Australia and Canada. The merger is expected to yield annual pre-tax synergies of $500 million within the first 24 months and target at least $2 billion in cash improvements through portfolio optimization in the initial two years post-closure.

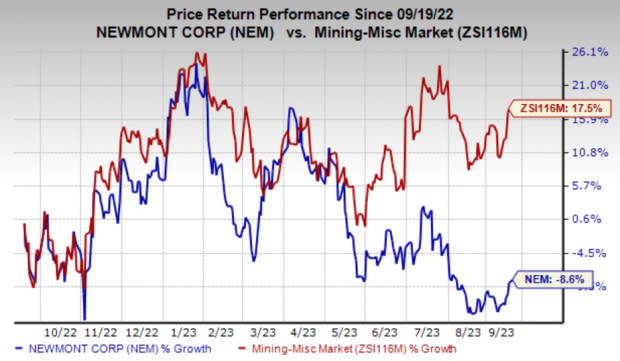

Newmont’s shares have fallen 8.6% in the past year compared with the industry's 17.5% rise in the same period.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Newmont currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Carpenter Technology Corporation CRS and Akzo Nobel N.V. AKZOY, sporting a Zacks Rank #1 (Strong Buy), and Alamos Gold Inc. AGI, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The earnings estimate for Carpenter Technology’s current year is pegged at $3.48, indicating a year-over-year growth of 205%. CRS beat the Zacks Consensus Estimate in all the last four quarters, with the average earnings surprise being 10%. The company’s shares have rallied 79.2% in the past year.

The consensus estimate for Akzo Nobel’s current-year earnings is pegged at $1.44, indicating a year-over-year growth of 67.4%. In the past 60 days, AKZOY’s current-year earnings estimate has been revised upward by 3.6%. The company’s shares have rallied 20.8% in the past year.

The earnings estimate for Alamos’ current year is pegged at 43 cents, indicating a year-over-year growth of 53.6%. The Zacks Consensus Estimate for AGI current-year earnings has been revised 7.5% upward in the past 60 days. The company’s shares have risen roughly 117.7% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Newmont Corporation (NEM) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Akzo Nobel NV (AKZOY) : Free Stock Analysis Report

Alamos Gold Inc. (AGI) : Free Stock Analysis Report