Next Fifteen Communications Group And Other Great Growth Stocks

Next Fifteen Communications Group is one of many stocks the market is bullish on. Its expected double-digit top-line and bottom-line growth exceeds its peers, and its financially stable position lessens the chances of risk. If your holdings could benefit from diversification towards growth stocks, whether it be in reputable tech stocks or green small-caps, take a look at my list of stocks with a bright future ahead.

Next Fifteen Communications Group plc (AIM:NFC)

Next Fifteen Communications Group plc provides communications services in the United Kingdom, Europe, Africa, the United States, and the Asia Pacific. Started in 1981, and headed by CEO Timothy Dyson, the company now has 1,610 employees and with the company’s market cap sitting at GBP £288.44M, it falls under the small-cap category.

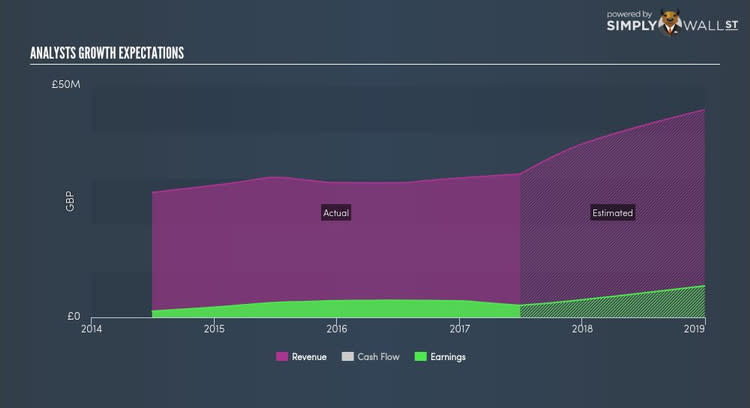

NFC’s forecasted bottom line growth is an exceptional triple-digit, driven by the underlying double-digit sales growth of 21.13% over the next few years. Although reduction in cost is not the most sustainable operational activity, the expanding top-line growth, on the other hand, is encouraging. We see this bottom-line expansion directly benefiting shareholders, with expected return on equity coming in at a notable 24.04%. NFC’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Interested to learn more about NFC? Take a look at its other fundamentals here.

Michelmersh Brick Holdings plc (AIM:MBH)

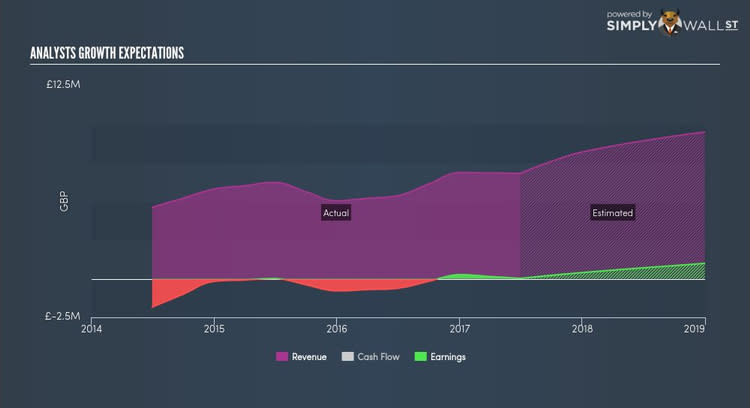

Michelmersh Brick Holdings Plc, through its subsidiaries, manufactures and sells bricks, tiles, and building products in the United Kingdom, Europe, and internationally. Established in 1997, and currently headed by CEO Frank Hanna, the company provides employment to 300 people and has a market cap of GBP £76.69M, putting it in the small-cap stocks category.

Want to know more about MBH? Take a look at its other fundamentals here.

Cambridge Cognition Holdings Plc (AIM:COG)

Cambridge Cognition Holdings Plc develops and commercializes computerized neuropsychological tests worldwide. Established in 2012, and currently run by Steven Powell, the company employs 59 people and has a market cap of GBP £33.73M, putting it in the small-cap category.

Considering COG as a potential investment? Other fundamental factors you should also consider can be found here.

For more financially robust companies with high growth potential to enhance your portfolio, use our free platform to explore our interactive list of these stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.