NextCure (NXTC) Down on Shelving Plans to Develop Candidate

Shares of NextCure, Inc. NXTC slumped 19.3% after it announced that it shunned plans further to develop NC762 due to the competitive environment and the limited activity to date.

The candidate was being evaluated for solid tumors in a phase Ib study.

The clinical-stage biopharmaceutical company is now focused on the development of LNCB74 (B7-H4 ADC), the first antibody-drug conjugate (“ADC”) candidate from its collaboration with LegoChem Biosciences, Inc.

NextCure is looking to invest its limited cash resources in the most promising programs. It is now shifting resources from NC762 to the ADC program. A dose range-finding toxicology study for LNCB74 is planned in early 2024 based on a comprehensive preclinical data package.

In November 2022, NextCure entered into a research collaboration and co-development agreement with LegoChem to develop up to three ADCs.

Per the terms of the agreement, both parties equally share the cost of developing the molecules and profits on commercialized products. The collaboration consists of up to three research programs for which a research plan will be developed.

The company also provided an update on its pipeline and announced that it is seeking strategic partners to accelerate the global development of programs.

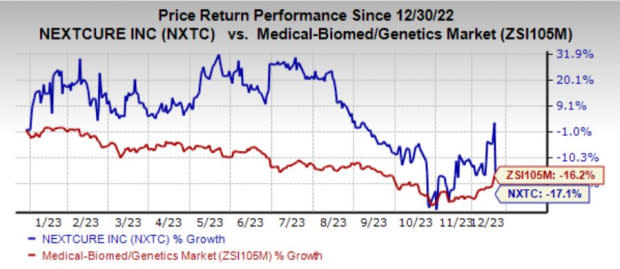

Shares of the company have lost 17.1% year to date compared with the industry's decline of 16.2%.

Image Source: Zacks Investment Research

Investors were disappointed as the company only has early-stage programs in its pipeline and such setbacks result in loss of resources. Smaller biotechs like these often need to stop the development of candidates to prioritize cash usage.

The phase Ib combination trial of NC410 with Merck’s MRK anti-PD-1 therapy Keytruda is ongoing. Additional patients are being added to the 100 mg cohort of patients with microsatellite stable/microsatellite instable-low immune checkpoint inhibitor naïve colorectal cancer without active liver metastasis, given evidence of clinical activity to date. The combination has been found safe and well tolerated to date.

NC525 is a novel LAIR-1 antibody that selectively targets acute myeloid leukemia (“AML”). The phase Ia dose escalation study in subjects with AML remains ongoing, with the fourth cohort now enrolled.

Data from both studies are expected in the first half of 2024.

Cash, cash equivalents and marketable securities as of Sep 30, 2023, were $118.2 million. NextCure expects its existing cash, cash equivalents and marketable securities balance to fund operating expenses and capital expenditures into mid-2025.

Merck’s Keytruda is one of the leading immuno-oncology drugs approved for various oncology indications.

Zacks Rank and Other Stocks to Consider

NXTC currently has a Zacks Rank #2 (Buy).

A couple of other top-ranked stocks in the overall healthcare sector are Entrada Therapeutics TRDA and Dynavax Technologies DVAX. TRDA sports a Zacks Rank #1 (Strong Buy) and DVAX carries a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Entrada’s loss per share estimate for 2023 has narrowed from $2.07 to 9 cents in the past 60 days. The same for 2024 has narrowed from $2.35 to $2.04 during the same time frame.

Dynavax’s loss per share estimate for 2023 has narrowed from 23 cents to 12 cents in the past 30 days. Earnings estimate for 2024 rose from 3 cents to 18 cents during the same period. Shares of DVAX have risen 27.5% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

NextCure, Inc. (NXTC) : Free Stock Analysis Report

Entrada Therapeutics, Inc. (TRDA) : Free Stock Analysis Report