NextCure's (NASDAQ:NXTC) Stock Price Has Reduced 73% In The Past Year

While it may not be enough for some shareholders, we think it is good to see the NextCure, Inc. (NASDAQ:NXTC) share price up 17% in a single quarter. But that hardly compensates for the shocking decline over the last twelve months. To wit, the stock has dropped 73% over the last year. So the rise may not be much consolation. Only time will tell if the company can sustain the turnaround.

View our latest analysis for NextCure

NextCure isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last twelve months, NextCure increased its revenue by 459%. That's a strong result which is better than most other loss making companies. So the hefty 73% share price crash makes us think the company has somehow offended market participants. Something weird is definitely impacting the stock price; we'd venture the company has destroyed value somehow. What is clear is that the market is not judging the company on its revenue growth right now. Of course, markets do over-react so share price drop may be too harsh.

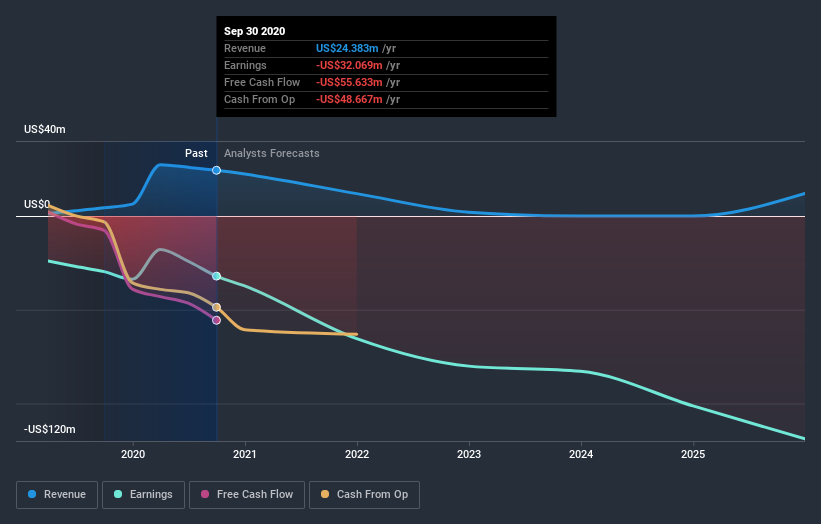

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While NextCure shareholders are down 73% for the year, the market itself is up 25%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 17%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). It's always interesting to track share price performance over the longer term. But to understand NextCure better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for NextCure you should be aware of, and 1 of them shouldn't be ignored.

Of course NextCure may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.