NextGen (NXGN) Behavioral Health Suite to Address Mental Health

NextGen Healthcare, Inc. NXGN recently announced that Community Reach Center had chosen NextGen Enterprise electronic health record (EHR) and NextGen Enterprise practice management (PM) to address mental health, substance abuse and primary care needs across the Denver area. Community Reach Center will also leverage NextGen Behavioral Health Suite, NextGen Virtual Visits, NextGen Mobile, and NextGen Managed Cloud Services.

Community Reach Center, a Colorado-based behavioral health and wellness provider, operates the first and currently largest school-based therapy program in Colorado.

With the latest adoption, NextGen is likely to solidify its foothold in the mental health treatment space across the nation, thereby boosting its Enterprise domain.

Significance of the Adoption

Per NextGen’s management, the latest adoption of its EHR and PM services is expected to help increase access to mental and physical health services throughout the area and boost patient care and outcomes.

Community Reach Center’s management believes NextGen’s integrated system will likely enable it to address numerous clinical specialties. Management also feels that NextGen’s seamless interoperability will make state reporting easier, thus enabling them to share patient information across providers securely and allow them to spend more time with clients.

Industry Prospects

Per a report by Prophecy Market Insights published on GlobeNewswire, the global mental health market accounted for $381.98 billion in 2020 and is anticipated to reach $527.44 billion by 2030 at a CAGR of 3.4%. Factors like the rise in elderly population, an increase in the prevalence of mental disorders and the growing number of people seeking mental health support are likely to drive the market.

Given the market potential, the latest adoption of NextGen’s product is expected to significantly boost its business.

Notable Developments

Last month, NextGen reported its first-quarter fiscal 2024 results, wherein it registered a solid uptick in the top line and bottom line, along with strength in both Recurring and Non-recurring revenues. Robust increases in Subscription services, Managed services and Transactional and data services revenues in the quarter were also seen. The improvement in Other non-recurring services revenues was recorded.

The same month, NextGen announced that Kymera Independent Physicians multi-specialty group selected NextGen Enterprise EHR to expand access to care while increasing clinical productivity, improving patient experience and ensuring healthy financial outcomes.

In June, NextGen announced that Haymarket Center chose NextGen Enterprise EHR and NextGen PM to deliver 24/7 whole-person care in Illinois.

Price Performance

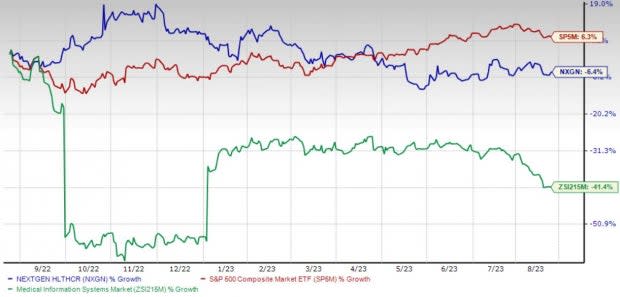

Shares of NextGen have lost 6.4% in the past year compared with the industry’s 41.4% decline. The S&P 500 has witnessed 6.3% growth in the said time frame.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, NextGen carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Patterson Companies, Inc. PDCO, HealthEquity, Inc. HQY and McKesson Corporation MCK.

Patterson Companies, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 9.2%. PDCO’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average surprise of 4.5%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Patterson Companies has gained 18.4% compared with the industry’s 11.9% rise over the past year.

HealthEquity, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 22%. HQY’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average of 9.1%.

HealthEquity has gained 9.2% against the industry’s 15.4% decline over the past year.

McKesson, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 10.7%. MCK’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 8.1%.

McKesson has gained 15.2% compared with the industry’s 11.9% rise over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McKesson Corporation (MCK) : Free Stock Analysis Report

Patterson Companies, Inc. (PDCO) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

NEXTGEN HEALTHCARE, INC (NXGN) : Free Stock Analysis Report