Nexus Announces Option to Acquire Cree East Project in Athabasca Basin

Vancouver, British Columbia--(Newsfile Corp. - January 22, 2024) - Nexus Uranium Corp. (CSE: NEXU) (OTCQB: GIDMF) (FSE: 3H1) (the "Company" or "Nexus") is pleased to announce it has entered into a letter of intent (the "Letter of Intent") with CanAlaska Uranium Ltd. ("CanAlaska"), a TSX Venture Exchange listed issuer, dated as of January 19th, 2024 evidencing the parties' intent to negotiate and enter into an option agreement (the "Option Agreement") pursuant to which Nexus will acquire up to a 75%-interest in the Cree East uranium project (the "Project") located in the Athabasca Basin of Saskatchewan, Canada, which is wholly owned by CanAlaska.

The Cree East project is comprised of 17 contiguous mineral claims covering an area of 57,752 ha (223 square miles) of highly prospective terrain in the eastern Athabasca Basin with extensive historical exploration. The Project has been extensively explored, with over $20 million in exploration expended since 2006, which has led to the delineation of multiple zones of uranium mineralization associated with graphitic conductors and large hydrothermal alteration halos, both in basement and sandstone environments, at depths ranging from 100 metres to 450 metres below surface.

"The Cree East project represents the last, large-scale exploration project located in the heart of the Athabasca Basin with the potential for discovery of high-grade unconformity-style uranium mineralization in either basement-hosted like Arrow or sandstone-hosted like McArthur River or Cigar Lake," commented Jeremy Poirier, CEO of Nexus Uranium Corp. "We are able to leverage the extensive historical dataset which not only significantly expands our understanding of the project but also allows us to expedite our exploration plans to include geophysics and drilling in 2024."

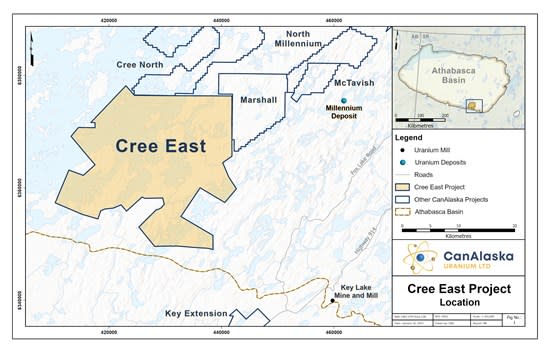

Figure 1: Cree East Project Map

To view an enhanced version of Figure 1, please visit:

https://images.newsfilecorp.com/files/7273/195156_7df0888814895900_001full.jpg

Cree East Project Summary

The Cree East project is located on the eastern shore of Cree Lake in northern Saskatchewan, approximately 40 km west-northwest of Cameco's Key Lake uranium mill and is comprised of 17 contiguous mineral claims covering an area of 57,752 hectares (223 square miles). The exploration target on the Project is a sandstone- or basement-hosted unconformity-type uranium deposit similar to the neighboring McArthur River (sandstone-hosted), Key Lake (sandstone-hosted), Millenium (basement-hosted) and Phoenix (sandstone-hosted).

The Project has seen extensive historical exploration dating back to the early 1970's, with over $20 million expended since 2006 which included multiple phases of geophysics (airborne VTEM, AMT, and ground IP-Resistivity and moving loop TDEM surveys) in addition to 34,473 metres of drilling in 91 holes. Exploration to date has delineated multiple zones of uranium mineralization associated with graphitic conductors and large hydrothermal alteration halos. The uranium is found in basement and sandstone environments, at depths ranging from 100 metres to 450 metres below surface. Two high-priority exploration targets have been identified, Zone A and Zone B, where uranium has been discovered above and below the unconformity, at approximately 400 metres depth (source: 16 October 2013 NI 43-101 Technical Report on the Cree East Project, Athabasca Basin, Saskatchewan, Canada prepared by Gary Yeo, PhD, P.Geo and Patty Ogilvie-Evans, BSc, P.Geo, published on SEDAR+ by CanAlaska Uranium Ltd.).

The technical content of this news release has been reviewed and approved by Warren D. Robb, P.Geo. (BC), a Director and VP Exploration of Nexus Uranium Corp. and a Qualified Person under National Instrument 43-101.

Transaction Terms

Pursuant to the Letter of Intent, the Company will have 30 days from the date of the Letter of Intent to conduct its due diligence investigation regarding the Project and will have an exclusive dealing period of 60 days from the date of the Letter of Intent, during which the parties will use commercially reasonable efforts to negotiate the terms and conditions of the Option Agreement.

The Option Agreement will provide that Nexus may acquire up to a 75% interest in the Project through staged cash, share and work commitments, as follows: (a) to earn an initial 40% interest in the Project (the "40% Interest"), the Company will (i) pay to CanAlaska $750,000 in cash, (ii) issue to CanAlaska that number of Common shares of Nexus ("Common Shares") as will be equal in value to an aggregate of $3,000,000, and (iii) incur $5,500,000 in exploration expenditures within the first 18 months from the effective date of the Option Agreement; (b) to earn an additional 20% (for a total of 60%) interest in the Project (the "60% Interest"), the Company will additionally (i) pay to CanAlaska $1,000,000 in cash, (ii) issue to CanAlaska that number of Common Shares as will be equal in value to an aggregate of $3,000,000, and (iii) incur $6,500,000 in exploration expenditures within the following 24 months; and (c) to earn an additional 15% (for a total of 75%) interest in the Project (the "75% Interest"), the Company will additionally (i) pay to CanAlaska $1,250,000 in cash, (ii) issue to CanAlaska that number of Common Shares as will be equal in value to an aggregate of $4,000,000, and (iii) incur $7,000,000 in exploration expenditures within the following 24 months.

The Option Agreement will further provide that the parties will be deemed to have entered into a joint venture arrangement in the following cases: (a) if Nexus has earned the 40% Interest but has not earned the 60% Interest in accordance with the Option Agreement; (b) if Nexus has earned the 60% Interest but has not earned the 75% Interest in accordance with the Option Agreement; or (c) if Nexus has earned the 75% Interest in accordance with the Option Agreement.

The Option Agreement remains subject to the approval of the Canadian Securities Exchange (the "CSE"). All Common Shares issued under the Option Agreement will be subject to an escrow agreement of up to 12 months and in accordance with Canadian securities laws.

About Nexus Uranium Corp.

Nexus Uranium Corp. is a multi-commodity development company focused on advancing the Wray Mesa uranium-vanadium project in Utah in addition to its precious metals portfolio that includes the development-stage Independence mine located adjacent to Nevada Gold Mine's Phoenix-Fortitude mine in Nevada, the Napoleon gold project in British Columbia, and a package of gold claims in the Yukon. The Wray Mesa project covers 6,282 acres within the heart of the prolific Uruvan mining district in Utah and has extensive historical drilling of over 500 holes defining multiple mineralized zones. The Independence project hosts an M&I (measured and indicated) resource of 334,300 ounces of gold (28M tonnes at 0.41 g/t gold) and an inferred resource of 847,000 ounces (9M tonnes at 3.22 g/t gold) of gold with a substantial silver credit. A 2021 Preliminary Economic Assessment (PEA) outlined a low-cost heap leach operation focusing on the near-surface resource with total production of 195,443 ounces of gold at an all-in sustaining cost of $1,078 (U.S.) per ounce of gold. The Napoleon project comprises over 1,000 hectares and prospective for multiple forms of gold mineralization, with exploration in the area dating back to the 1970s with the discovery of high-grade gold. The Yukon gold projects are comprised of almost 8,000 hectares of quartz claims prospective for high-grade gold mineralization with historical grab sampling highlights of 144 g/t gold.

Nexus Uranium cautions investors the preliminary economic assessment is preliminary in nature, it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized. The Company further cautions investors Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability and further cautions investors the quantity and grade of the reported inferred Mineral Resources are uncertain in nature and there has been insufficient exploration to define these inferred Mineral Resources as indicated Mineral Resources.

The Company cautions investors it has yet to verify the historical data and further cautions investors grab samples are selective by nature and are unlikely to represent average grades of sampling on the entire property.

--

FOR FURTHER INFORMATION PLEASE CONTACT:

Jeremy Poirier

Chief Executive Officer

info@nexusuranium.com

This news release includes certain statements and information that may constitute "forward-looking information" within the meaning of applicable Canadian securities laws. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends" or "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "should", "would" or "occur". All statements in this news release, other than statements of historical facts, including statements regarding future estimates, plans, objectives, timing, assumptions or expectations of future performance are forward-looking statements and contain forward-looking information, including, but not limited to: the anticipated entry into the Option Agreement, the anticipated terms of the Option Agreement; the anticipated approval of the Option Agreement by the CSE; the anticipation that all Common Shares issued under the Option Agreement will be subject to an escrow agreement; the anticipated potential for discovery of high-grade unconformity-style uranium mineralization at the Project; the anticipation of leveraging the extensive historical dataset regarding the Project and the anticipation that this will expand the Company's understanding of the Project and will allow the Company to expedite its exploration plans to include geophysics and drilling this winter; and expectations regarding mineral reserves and mineral resources.

Forward-looking statements are based on certain material assumptions and analysis made by the Company and the opinions and estimates of management as of the date of this news release, including, but not limited to: the assumption that the Company will enter into the Option Agreement, the assumption that the terms of the Option Agreement will be as expected; the assumption that the CSE will approve the Option Agreement; the assumption that all Common Shares issued under the Option Agreement will be subject to an escrow agreement; the assumption that the Project has the potential for high-grade unconformity-style uranium mineralization; the assumption that the Company will be able to leverage the extensive historical dataset regarding the Project and the assumptions that this will expand the Company's understanding of the Project and will allow the Company to expedite its exploration plans to include geophysics and drilling this winter; and assumptions regarding mineral reserves and mineral resources. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking statements or forward-looking information, including, but not limited to: the risk that the Company will not enter into the Option Agreement, the risk that the terms of the Option Agreement will not be as expected; the risk that the CSE will not approve the Option Agreement; the risk that all Common Shares issued under the Option Agreement will not be subject to an escrow agreement; the risk that the Project will not have the potential for high-grade unconformity-style uranium mineralization; the risk that the Company will not be able to leverage the extensive historical dataset regarding the Project and the risk that that this will neither expand the Company's understanding of the Project nor will allow the Company to expedite its exploration plans to include geophysics and drilling this winter; and the risk that the Company's assumptions regarding mineral reserves and mineral resources are incorrect.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial outlook that are incorporated by reference herein, except in accordance with applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/195156