NICE to Report Q4 Earnings: Will Strong Portfolio Aid Growth?

Nice NICE is set to release fourth-quarter 2023 results on Feb 22.

For the to-be-reported quarter, NICE projects non-GAAP revenues to be between $2.35 billion and $2.37 billion, indicating 9% growth at the midpoint. Non-GAAP earnings are estimated in the $8.58-$8.78 per share band.

The Zacks Consensus Estimate for revenues is pegged at $2.37 billion, indicating an increase of 8.62% from the year-ago quarter’s reported figure.

The consensus mark for earnings has been stable in the past 30 days at $2.26 per share. The figure suggests an increase of 10.78% from the prior-year quarter’s levels.

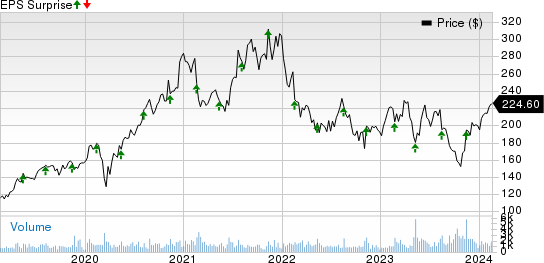

Nice Price and EPS Surprise

Nice price-eps-surprise | Nice Quote

NICE earnings beat the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 4.30%.

Let’s see how things have shaped up for NICE prior to this announcement.

Factors Likely to Influence Q4 Results

NICE’s fourth-quarter 2023 performance is likely to have benefited from the strong adoption of its solutions, with a significant focus on the high-end market and the expansion of CXone into a comprehensive digital engagement and the CX AI platform.

Growing momentum in customer engagement owing to its robust CXone solutions is expected to have benefited the top-line performance in the to-be-reported quarter.

Strong momentum across cloud solutions is likely to have acted as a tailwind for the company.

NICE is likely to have benefitted from the ongoing trend of digitalization across large enterprises on the back of its increasing focus on digital engagement and conversational AI.

NICE's fourth-quarter performance is anticipated to have reflected its ability to meet the demands of a dynamic market, with a focus on innovative solutions and a strategic approach to digital transformation.

What Our Model Says

Per the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

NICE has an Earnings ESP of -0.44% and carries a Zacks Rank #2. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are some companies worth considering, as our model shows that these have the right combination of elements to beat on earnings in their upcoming releases:

Inseego INSG has an Earnings ESP of +4.17% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Inseego shares have gained 54.2% year to date. INSG is set to report its fourth-quarter 2023 results on Feb 21.

Vertiv VRT has an Earnings ESP of +1.90% and a Zacks Rank of 2 at present.

Vertiv shares have gained 31.1% year to date. VRT is set to report its fourth-quarter 2023 results on Feb 21.

NVIDIA NVDA has an Earnings ESP of +3.67% and a Zacks Rank #2.

NVIDIA shares have gained 46.6% year to date. NVDA is set to report its fourth-quarter fiscal 2024 results on Feb 21.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Nice (NICE) : Free Stock Analysis Report

Inseego (INSG) : Free Stock Analysis Report

Vertiv Holdings Co. (VRT) : Free Stock Analysis Report