NII to Support Wells Fargo (WFC) Q4 Earnings, Mortgage to Hurt

Wells Fargo & Company WFC is scheduled to report fourth-quarter and full-year 2022 results on Jan 13, before the opening bell. The company’s quarterly earnings and revenues are expected to have declined year over year.

In the last reported quarter, the company’s earnings beat the Zacks Consensus Estimate on robust growth in net interest income and solid average loan growth. Yet, dismal non-interest income, higher provisions and muted mortgage business were the major undermining factors. Also, the rise in non-interest expenses acted as a headwind.

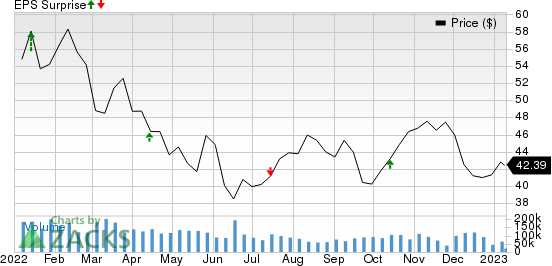

Over the trailing four quarters, Wells Fargo’s earnings surpassed the consensus estimate on three occasions and missed once, the surprise being 12.66%, on average.

Wells Fargo & Company Price and EPS Surprise

Wells Fargo & Company price-eps-surprise | Wells Fargo & Company Quote

Before we proceed further and check out the factors likely to have impacted the WFC’s quarterly performance, let’s discuss the latest enforcement action faced by it. In December 2022, the company was ordered by the CFPB to pay more than $2 billion in redress to consumers and a $1.7-billion civil penalty for the widespread mismanagement of auto loans, mortgages and deposit accounts. The company expects its operating losses expense, which is included in its non-interest expenses, will be roughly $3.5 billion for the to-be-reported quarter.

Now, let’s take a look at the other factors that are expected to have influenced Wells Fargo’s fourth-quarter earnings.

Loans and Net Interest Income (NII): While lending activity continued to improve in the fourth quarter, the pace of loan growth across most categories slowed as the quarter progressed. Per the Fed’s latest data, demand for commercial and industrial loans, real estate loans (specifically commercial real estate loans) and consumer loans accelerated in October and November.

Also, in the fourth quarter, the Fed hiked interest rates by 125 basis points, resulting in a policy rate of 4.25-4.50%, the highest level in the past 15 years. Driven by decent loan growth and interest rate hikes, Wells Fargo is expected to have witnessed a robust improvement in earning asset yields, margin and NII in the quarter.

Amid the considerations, the Zacks Consensus Estimate for Wells Fargo’s NII is pegged at $12.97 billion, suggesting a 7.2% rise from the prior quarter’s reported figure.

Management expects NII to be $12.9 billion in the fourth quarter. Moreover, NII is projected to grow 24% in 2022.

Mortgage Banking Revenues: Mortgage originations, both purchase and refinancing, continued the downtrend in the fourth quarter. Mortgage banking revenues have been facing tough comps from the prior year propelled by low mortgage rates.

Also, in the fourth quarter, mortgage rates continued to rise, with the rate on the 30-year fixed mortgage remaining above the 6% mark throughout the period. The climb in mortgage rates, which kept the home buyers on the sidelines, led to a smaller origination market. Hence, being one of the largest bank mortgage lenders in the United States, WFC is likely to have continued seeing declines in its home lending portfolio and mortgage banking income.

The Zacks Consensus Estimate for Wells Fargo’s mortgage banking revenues is pegged at $298 million for the fourth quarter, suggesting an 8% fall on a sequential basis.

Overall Non-Interest Revenues: Wells Fargo’s investment advisory and other asset-based fee revenues are likely to have borne the brunt of the lag effect from weaker equity and fixed-income market performance in the third quarter. A dip in market valuations and lower transactional activity are expected to have been headwinds too.

Further, the company is expected to have seen lower deposit-related fees, reflecting the implementation of overdraft policy changes and fee waivers. The consensus mark for the same is pegged at $1.25 billion, implying a sequential decrease of 3.3%.

Raging inflation, equity market rout and fears of recession resulted in disappointing equity market performance. Thus, the IPOs and follow-up equity issuances dried up. Also, bond issuances are likely to have been muted. While global deal-making hit a record low for the fourth consecutive quarter, Wells Fargo is expected to have fared decently on the M&A front. Accordingly, the consensus mark for investment banking fees is pegged at $376 million, implying a marginal sequential increase.

The Zacks Consensus Estimate for Wells Fargo’s total non-interest income is pegged at $6.97 billion, suggesting a 5.9% decline from the prior quarter’s reported number.

Expenses: Wells Fargo’s costs are expected to have continued to flare up in the fourth quarter, given its franchise investments in technology and digitalization efforts. Additionally, amid the rising inflation, salary expenses are anticipated to have led to elevated non-interest expenses.

Apart from these, the above-mentioned regulatory settlement is expected to have resulted in higher expenses during the to-be-reported quarter.

Asset Quality: With loan growth, expectations of a worsening macroeconomic outlook and growing recession risk, Wells Fargo is expected to have continued building reserves in the fourth quarter.

The Zacks Consensus Estimate for non-performing assets of $5.78 billion implies a 1.1% increase sequentially. Likewise, the consensus estimate for total non-accrual loans stands at $5.7 billion, reflecting a 2% rise.

What Our Model Predicts

Our proven model doesn’t conclusively predict an earnings beat for WFC this time around. This is because the company does not have the right combination of the two key ingredients — positive Earnings ESP and Zacks Rank #3 (Hold) or better — to increase the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Wells Fargo is 0.00%.

Zacks Rank: WFC currently carries a Zacks Rank of 3.

The Zacks Consensus Estimate for fourth-quarter earnings has been cut to half over the past month to 64 cents. Also, it suggests a year-over-year decline of 53.6%.

Also, the consensus estimate of $19.79 billion for quarterly revenues indicates a 5.1% fall from the prior-year quarter’s reported number.

Banks That Warrant a Look

Here are a couple of bank stocks that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this time around:

The Earnings ESP for The Bank of New York Mellon Corporation BK is +6.31% and it carries a Zacks Rank #3, at present. The company is slated to report fourth-quarter and full-year 2022 results on Jan 13.

Over the past seven days, BK’s Zacks Consensus Estimate for quarterly earnings has moved 3.5% north.

First Republic Bank FRC is scheduled to release fourth-quarter and full-year 2022 earnings on Jan 13. The company, which carries a Zacks Rank #3 at present, has an Earnings ESP of +0.25%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

FRC’s quarterly earnings estimates have moved marginally lower over the past week.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

The Bank of New York Mellon Corporation (BK) : Free Stock Analysis Report

First Republic Bank (FRC) : Free Stock Analysis Report