Nike Earnings: Buy this S&P 500 Stock Down 45% and Hold?

Nike (NKE) stock is down 45% from its highs heading into its Q3 FY24 earnings release on Thursday, March 21.

Wall Street has dumped Nike for numerous reasons. But the footwear and apparel company remains a heavyweight champ and it might be time to consider buying Nike with its back against the ropes.

The Setbacks

Relative newcomers Hoka and On are challenging Nike in the running shoe segment and forcing it to adapt quickly to regain its market share within key demographics. At the same time, Lululemon (LULU), Adidas, and tons of digital-focused upstarts are chipping away at its athleisure and streetwear segments.

Nike also got caught up in the broader consumer discretionary selloff. Higher rates and changing consumer shopping patterns after the pandemic boom have seen the Zacks Consumer Discretionary sector fall -37% over the last three years vs. the S&P 500’s +30% climb.

Image Source: Zacks Investment Research

Wall Street is growing more concerned about Nike’s pandemic-era pivot to go all-in on digital and direct-to-consumer. Some investors also question NKE’s direction under CEO John Donahoe, who took over from long-time boss Mark Parker in early 2020.

The company offered disappointing guidance last quarter, citing “increased macro headwinds, particularly in Greater China and EMEA… adjusted digital growth plans based on recent digital traffic softness and higher marketplace promotions, life cycle management of key product franchises and a stronger U.S. dollar…”

Near-Term Outlook

Nike made efforts last quarter to address some of its recent setbacks. Nike also kicked off a new effort to streamline its business to save up to $2 billion over the next three years by simplifying product assortment, improving supply chain efficiency, boosting automation, streamlining organizational structure and reducing management layers, and more.

Nike’s adjusted quarterly earnings are projected to fall 13% YoY on 0.9% lower revenue. Thankfully, Nike’s soon-to-be-reported quarter is projected to mark the near-term bottom for the business.

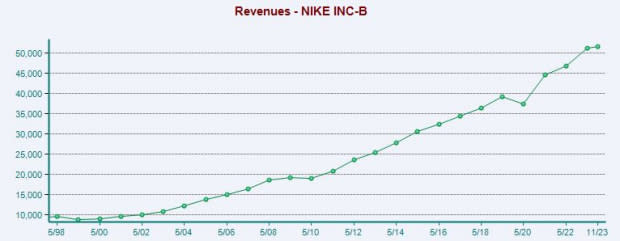

Image Source: Zacks Investment Research

Nike faces a top-line slowdown after 10% revenue growth in FY23, which followed 5% growth in FY22 and a whopping 19% jump in FY21—its largest YoY expansion in the last 25 years.

Still, NKE revenue is projected to climb 1% in FY24 and then jump 6% in FY25 to nearly $55 billion. Nike’s adjusted earnings are excepted to jump 10% in FY24 and 17% in FY25.

Price, Technical Levels, and Valuation

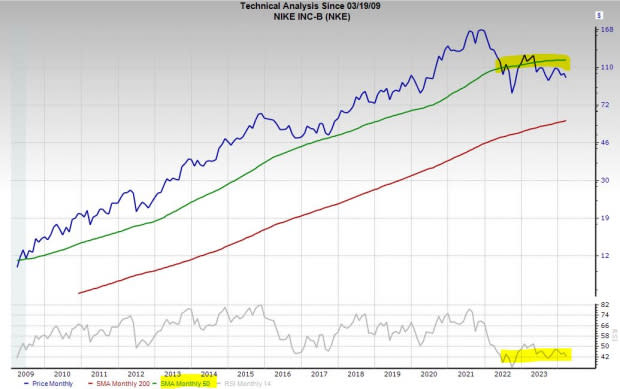

NKE has soared 750% in the last 15 years vs. the S&P 500’s 550%. The stock was crushing the benchmark until the last three years, down 28% vs. the index’s 30% gain. Meanwhile, Lululemon has soared 45% during the past 36 months.

Image Source: Zacks Investment Research

Nike trades 22% below its average Zacks price target and 45% below its all-time highs at around $99 per share.

NKE is under almost all of its widely tracked short-term and long-term technical levels. Nike is even below its 50-month moving average and at some of its most oversold RSI levels over the last 15 years.

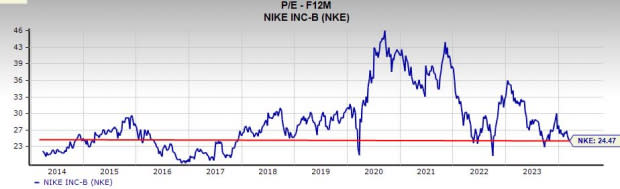

On the valuation side of the coin, Nike trades at a 10% discount to its 10-year median at 24.7X forward earnings.

Bottom Line

Nike currently lands a Zacks Rank #3 (Hold). Yet, its most accurate/recent EPS estimate for Q3 came in well below the current consensus, which isn’t a good sign.

The stock trades at a precarious technical level and Wall Street likely wants to see that a turnaround is right around the corner before it dives back in.

Still, investors with long-term outlooks might want to add Nike to their watchlists because it is a powerhouse in the global apparel and footwear market and it is hard to imagine NKE fades away without a fight.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NIKE, Inc. (NKE) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report