Nike Inc (NKE) Posts Mixed Q3 Fiscal 2024 Results Amid Restructuring Efforts

Revenue: Reported a slight increase to $12.4 billion, with a stable performance across most regions.

Gross Margin: Improved by 150 basis points to 44.8%, benefiting from strategic pricing and lower logistics costs.

Net Income: Decreased by 5% to $1.2 billion, affected by restructuring charges.

Diluted EPS: Declined by 3% to $0.77, including the impact of $0.21 from restructuring charges.

Shareholder Returns: Returned $1.4 billion to shareholders through dividends and share repurchases.

Inventories: Down by 13%, reflecting a decrease in units and efficient inventory management.

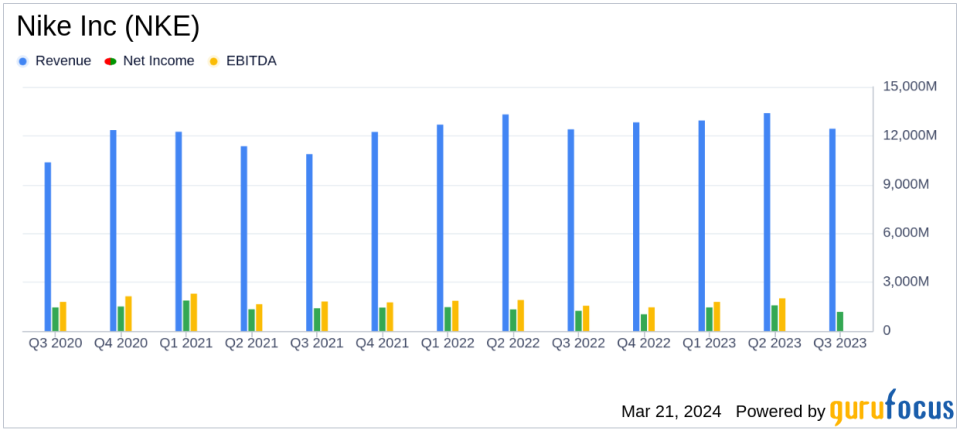

On March 21, 2024, Nike Inc (NYSE:NKE) released its 8-K filing, detailing its financial results for the third quarter of fiscal year 2024. The company, a global leader in athletic footwear and apparel, reported a slight increase in revenues to $12.4 billion, with gross margins improving to 44.8% due to strategic pricing actions and reduced logistics costs. However, net income saw a 5% decrease to $1.2 billion, and diluted earnings per share (EPS) dropped by 3% to $0.77, influenced by restructuring charges.

Nike Inc (NYSE:NKE) continues to navigate through a dynamic market environment, making adjustments to drive future growth. The company's performance is crucial as it reflects the health of the athletic footwear and apparel industry, where Nike holds a significant position. The reported challenges, including a decrease in digital sales and the impact of restructuring charges, may pose risks to the company's future performance.

Financial Performance Highlights

Nike's financial achievements, including a stable revenue and an improved gross margin, are significant indicators of the company's ability to manage costs and optimize pricing in a competitive market. The increase in gross margin is particularly noteworthy as it suggests that Nike is successfully navigating supply chain challenges and is able to leverage its brand strength to maintain pricing power.

Key details from the financial statements include:

Income Statement: The slight revenue increase was driven by growth in North America, Greater China, and APLA, offset by declines in EMEA. The gross margin improvement reflects Nike's strategic pricing and cost management efforts. Selling and administrative expenses rose by 7% to $4.2 billion, influenced by restructuring charges and increased marketing expenses.

Balance Sheet: Inventories were down 13%, indicating efficient inventory management. Cash and equivalents, along with short-term investments, totaled $10.6 billion, a slight decrease from the previous year.

Cash Flow Statement: Cash generated from operations was offset by share repurchases, dividends, capital expenditures, and bond repayments.

According to John Donahoe, President & CEO of Nike Inc (NYSE:NKE), "We are making the necessary adjustments to drive NIKEs next chapter of growth." Matthew Friend, Executive Vice President & Chief Financial Officer, added, "Our teams are focused on what matters most to return to strong growth. We are taking action to build a faster, more efficient NIKE and maximize the impact of our new innovation cycle."

Shareholder Returns and Future Outlook

Nike's commitment to shareholder returns is evident in its 22 consecutive years of increasing dividend payouts. In Q3, the company paid dividends of $562 million and repurchased $866 million worth of shares. These actions underscore Nike's confidence in its financial stability and future growth prospects.

While the company faces challenges, such as a dip in digital sales and the costs associated with restructuring, Nike's overall financial health remains robust. The company's focus on innovation, brand storytelling, and partnerships with wholesale retailers is expected to support its long-term growth trajectory.

For more detailed information on Nike Inc (NYSE:NKE)'s financial results, investors and stakeholders are encouraged to review the full earnings report and listen to the earnings call, which provides additional insights into the company's performance and strategic direction.

Explore the complete 8-K earnings release (here) from Nike Inc for further details.

This article first appeared on GuruFocus.