Is Nikola Stock a Buy?

Driving almost 24% lower since the start of the year, Nikola (NASDAQ: NKLA) has failed to keep pace with the S&P 500, which has risen almost 10%. Enthusiasm for the battery truck manufacturer has powered down considerably from where it was several years ago when the stock made its debut on the public markets.

The company encountered several bumps in the road, and the market has punished the stock recently, but that doesn't mean the shares can't reverse the trend and head higher. Many optimists believe now's a great time to add the electric-vehicle (EV) stock to their portfolios.

Let's take a closer look at both arguments to get a better sense of whether picking up shares now is a smart move.

Bears are balking at buying shares for several reasons

For pessimists, the company's flagging financial health is at the core of their concern. In 2023, Nikola reported revenue of $35.8 million, a 28% year-over-year decline. Towards the bottom of the income statement, Nikola reported earnings before interest, taxes, depreciation, and amortization (EBITDA) of negative $752.7 million, a steeper loss than the negative EBITDA of $698 million reported in 2022.

Critics will be quick to point out that Nikola's financials pale in comparison to the company's projection of where it would be at this time. In a 2020 investor presentation, Nikola forecast 2023 revenue and EBITDA of $1.4 billion and negative $66 million, respectively.

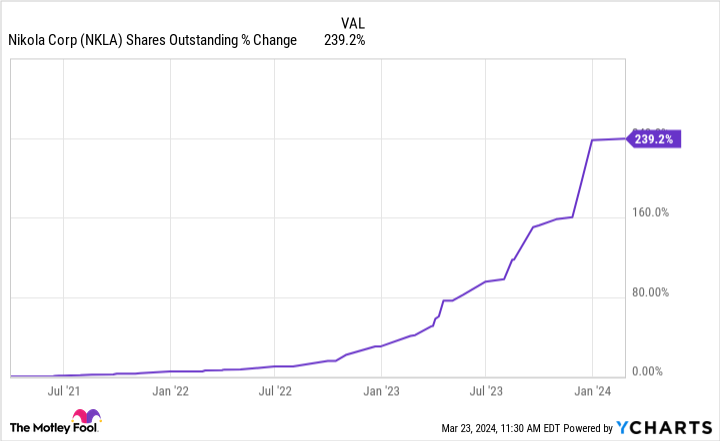

Further powering the bears' concerns is the prospect of shareholder dilution. Incurring steep losses over the past few years, Nikola has resorted to raising capital through the issuance of equity to help keep the lights on.

Besides the financials, bears are pumping the brakes on Nikola stock as competition continues to ramp up. While the company has floundered in achieving the growth it had imagined over the past few years, electric-trucking peers show no signs of slowing down.

Tesla represents a familiar and formidable foe with its Semi battery-electric truck. In Nevada, Tesla is developing a Gigafactory, which the company recognizes as its "first high-volume Semi factory."

Meanwhile, Daimler Truck also is challenging Nikola's progress. In 2023, it reported electric-truck deliveries of 3,443. Nikola, on the other hand, shipped 114 trucks to customers.

Bulls like Nikola's hydrogen prospects

Rather than dwell on Nikola's challenges, optimists are firm in their beliefs that the road ahead for the company is a lot smoother than its recent path. Bulls believe that the gap between the company's estimate of where it'd be now versus where it actually is now stems from the deceit of the company's founder, Trevor Milton, who was convicted of securities fraud in December.

Now at the helm is Steven Girsky, who had served in several leadership positions for General Motors, including vice chairman and president of GM Europe. Optimists have more faith that Girsky will be more adept at steering the company in the right direction.

Bulls are also enthusiastic about Nikola's projections for 2024. While the company's financial performance in 2023 left much to be desired, management's outlook for this year is encouraging.

At the top of the income statement, management estimates that truck sales will deliver revenue of $150 million to $170 million (significantly higher than in 2023). When it comes to profitability, management thinks the company's gross margin will narrow considerably, from negative 597% in 2023 to negative 100% to negative 80% in 2024.

Already, the company is off to some success in 2024, fueling the hopes of Nikola enthusiasts. In February, it announced the opening of its first hydrogen refueling station in Southern California. Nikola has high aspirations for these Hyla-branded refueling stations that will meet the demands of both its hydrogen fuel cell electric trucks, as well as drivers of other Class 8 hydrogen trucks.

By the end of 2024, Nikola hopes to have 14 refueling stations of this sort in operation.

What's an EV-focused investor to do now?

Both bulls and bears make valid arguments regarding the buy case for Nikola. Ultimately, investors will have to decide for themselves whether it's the right time to park Nikola stock in their portfolios. However, it's critical that prospective buyers know the considerable risks of an investment.

There's no guarantee that the company will achieve its 2024 projections. If it does, there's no assurance it will extend further growth in 2025. For the majority of investors, therefore, the most prudent course of action is to watch this story continue to evolve from the side of the road for the time being.

Should you invest $1,000 in Nikola right now?

Before you buy stock in Nikola, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nikola wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Scott Levine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool recommends General Motors and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.

Is Nikola Stock a Buy? was originally published by The Motley Fool