NL Industries Inc Reports Turnaround with Q4 Net Income of $7.6 Million

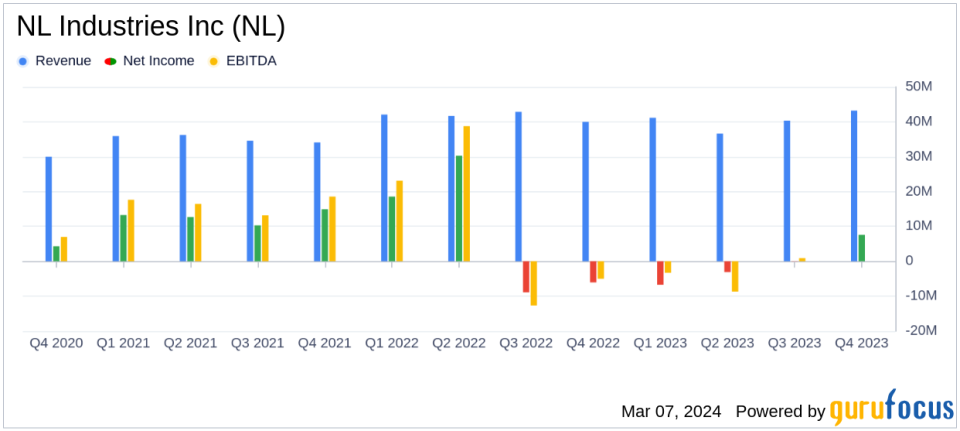

Net Income: NL Industries Inc (NYSE:NL) reported a net income of $7.6 million in Q4 2023, a significant improvement from a net loss of $6.1 million in Q4 2022.

Net Sales: Q4 net sales rose to $43.2 million, up from $40.0 million in the same quarter last year, driven by increased Security Products sales.

Full-Year Performance: Despite a positive Q4, NL faced a full-year net loss of $2.3 million in 2023, contrasting with a net income of $33.8 million in 2022.

Income from Operations: Income from operations attributable to CompX was $7.4 million in Q4 2023, up from $5.4 million in Q4 2022.

Kronos Worldwide Inc: Equity in losses of Kronos Worldwide Inc was $1.6 million in Q4 2023, improved from losses of $6.0 million in the same period of 2022.

On March 6, 2024, NL Industries Inc (NYSE:NL) released its 8-K filing, revealing a notable turnaround in its fourth-quarter performance with a net income of $7.6 million, or $0.16 per share. This marks a significant recovery from the net loss of $6.1 million, or $0.13 per share, in the fourth quarter of the previous year. The company's results for the quarter included an unrealized gain of $2.4 million related to marketable equity securities, contrasting with an unrealized loss in the same quarter of 2022.

NL Industries operates in the component products industry through its majority-owned subsidiary, CompX International Inc. The company manufactures engineered components for various industries, including recreational transportation, postal, office and institutional furniture, cabinetry, tool storage, healthcare, gas stations, and vending equipment. CompX has three production facilities in the United States and derives most of its revenue from Europe.

The fourth quarter saw an increase in net sales to $43.2 million, primarily due to higher Security Products sales related to a government security customer pilot project. However, the full-year net sales decreased to $161.3 million from $166.6 million in the previous year, mainly due to lower Marine Components sales to the towboat market. Income from operations attributable to CompX increased in the fourth quarter due to higher sales and improved gross margin percentage at Security Products, partially offset by lower Marine Components sales and gross margin percentage.

Financial Highlights and Challenges

Despite the positive fourth-quarter results, NL Industries faced challenges throughout 2023, ending the year with a net loss of $2.3 million, or $0.05 per share. This annual performance was impacted by an unrealized loss of $8.1 million related to marketable equity securities, consistent with the previous year. The company's subsidiary, Kronos Worldwide Inc, experienced fluctuations in its TiO2 business, with a 29% increase in sales volumes in Q4 but a 13% decrease for the full year. Kronos' average TiO2 selling prices were lower both quarterly and annually, contributing to a loss from operations of $56.0 million for the full year, a stark contrast to the income from operations of $159.6 million in 2022.

Corporate expenses decreased slightly due to lower litigation fees and administrative expenses, while interest and dividend income increased, benefiting from higher average interest rates. The full-year net loss per share includes a non-cash loss due to the termination of NL's U.K. pension plan.

Analysis of NL Industries' Performance

The company's recovery in the fourth quarter is a positive sign, especially in the Security Products segment. However, the overall annual performance indicates that NL Industries still faces significant challenges, particularly in its Marine Components sales and the performance of its equity investment in Kronos Worldwide Inc. The company's ability to navigate these challenges while capitalizing on its strengths in the Security Products market will be crucial for its future success.

Value investors may find NL Industries' turnaround in quarterly net income and improved income from operations as positive indicators, while the full-year results may warrant a cautious approach. The company's performance in the component products industry, along with its financial achievements and challenges, will continue to be closely monitored by investors and industry analysts alike.

For a detailed understanding of NL Industries Inc's financial position and future prospects, investors and potential GuruFocus.com members are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from NL Industries Inc for further details.

This article first appeared on GuruFocus.